IT occurrence action system PagerDuty (NYSE: PD) will certainly be introducing profits outcomes tomorrow after the bell. Below’s what to search for.

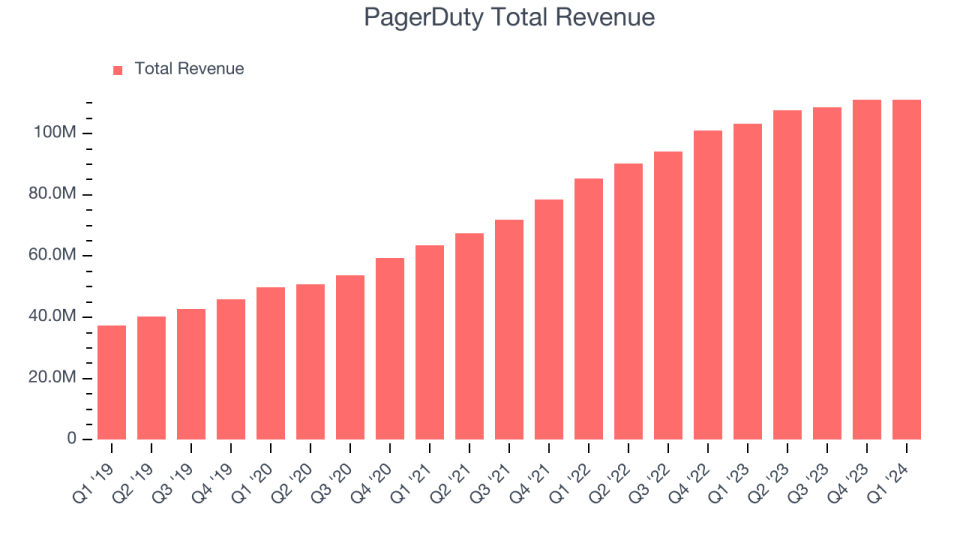

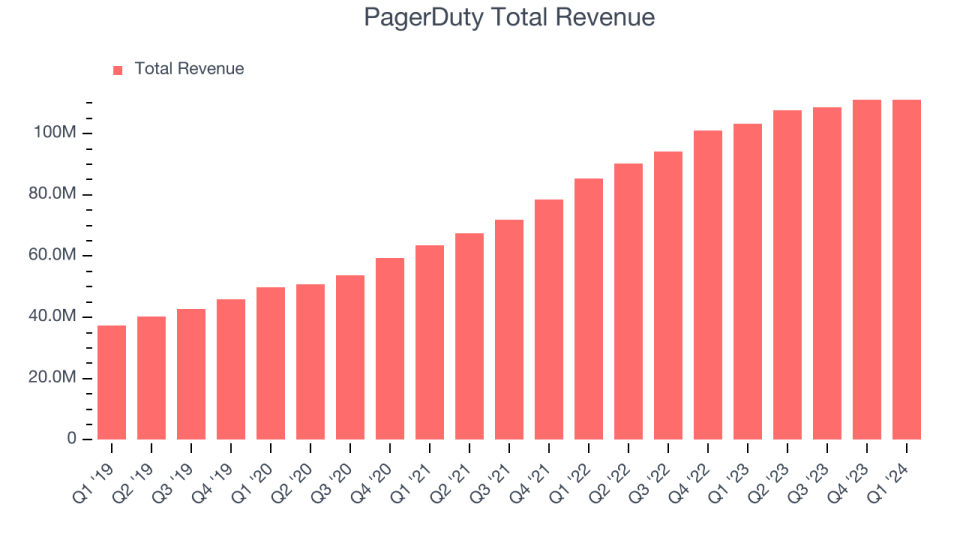

PagerDuty satisfied experts’ profits assumptions last quarter, reporting profits of $111.2 million, up 7.7% year on year. It was a strong quarter for the firm, with increasing client development and a respectable beat of experts’ payments quotes. It included 81 consumers to get to a total amount of 15,120.

Is PagerDuty a buy or offer entering into profits? Read our full analysis here, it’s free.

This quarter, experts are anticipating PagerDuty’s profits to expand 8.2% year on year to $116.5 million, reducing from the 19.2% boost it taped in the exact same quarter in 2014. Readjusted profits are anticipated ahead in at $0.17 per share.

Most of experts covering the firm have actually reconfirmed their quotes over the last thirty days, recommending they expect business to persevere heading right into profits. PagerDuty has actually just missed out on Wall surface Road’s profits approximates twice the last 2 years, going beyond top-line assumptions by 1.3% generally.

Checking out PagerDuty’s peers in the software program advancement sector, some have actually currently reported their Q2 results, providing us a tip regarding what we can anticipate. Datadog provided year-on-year profits development of 26.7%, defeating experts’ assumptions by 3.2%, and Dynatrace reported profits up 19.9%, covering quotes by 1.8%. Datadog traded up 3.9% complying with the outcomes while Dynatrace was likewise up 16.8%.

Review our complete evaluation of Datadog’s results here and Dynatrace’s results here.

There has actually declared view amongst capitalists in the software program advancement sector, with share rates up 10.2% generally over the last month. PagerDuty is up 5.7% throughout the exact same time and is heading right into profits with a typical expert rate target of $25.5 (contrasted to the existing share rate of $19.78).

Below at StockStory, we absolutely recognize the possibility of thematic investing. Varied champions from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Beast Drink (MNST) might all have actually been recognized as encouraging development tales with a megatrend driving the development. So, because spirit, we have actually recognized a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.