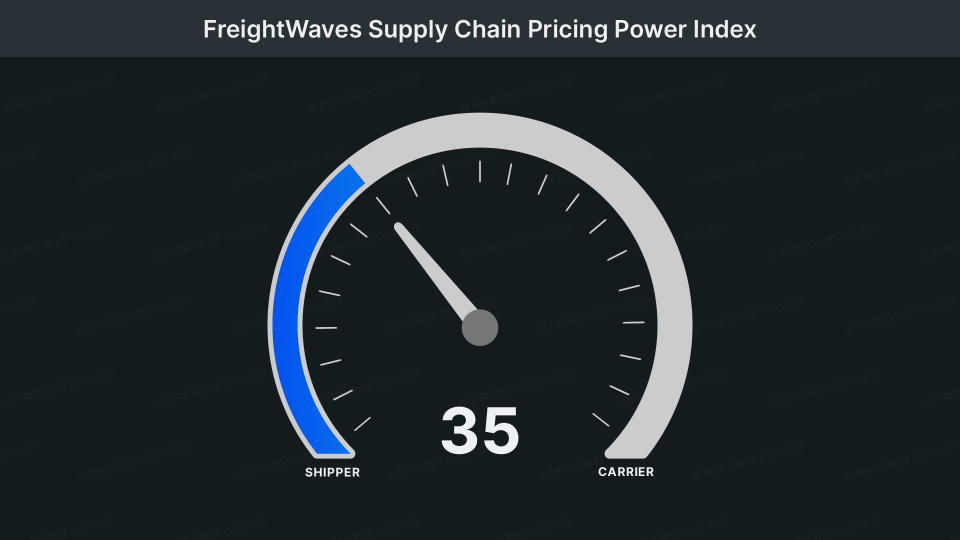

Today’s FreightWaves Supply Chain Prices Power Index: 35 (Carriers)

Recently’s FreightWaves Supply Chain Prices Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Prices Power Index Overview: 35 (Carriers)

The FreightWaves Supply Chain Prices Power Index makes use of the analytics and information in FreightWaves FINDER to assess the marketplace and approximate the working out power for prices in between carriers and providers.

Today’s Prices Power Index is based upon the adhering to indications:

Tender quantities close August more than where they started

After the slow-moving beginning to August, tender quantities have actually been trending greater throughout the month. August will certainly adhere to a pattern comparable to in 2014 when tender quantities will certainly shut the month more than they started the month. With import degrees still being incredibly raised, at some point the products will certainly relocate to the truckload market, it is extra an issue of timing of when that takes place.

To read more concerning FreightWaves Finder, click here.

The Outbound Tender Quantity Index, a step of nationwide products need that tracks carriers’ ask for trucking ability, is 1.87% greater week over week, the biggest boost because the influences of 4th of July. The space with year-ago degrees recoiled over the previous week as quantities remained to inch greater. Quantities are presently 3.13% greater year over year.

To read more concerning FreightWaves Finder, click here.

Agreement Lots Accepted Quantity (CLAV) is an index that determines approved tons quantities relocating under acquired arrangements. Simply put, it resembles OTVI however without the denied tenders. Checking out approved tender quantities, we see a boost of 1.39% w/w, a somewhat smaller sized boost than OTVI as tender denial prices relocated higher over the previous week. Accepted tender quantities are up 1.41% y/y.

Profits records in the retail area have actually remained to reveal that compensation sales stay tested, however merchants have actually had the ability to regulate prices incredibly well. An archetype of this went to Finest Buy, a firm that requires solid optional investing for digital acquisitions. In the business’s 2nd quarter profits launch, similar sales decreased by 2.3%, however the business’s non-GAAP watered down EPS was 9.8% greater y/y.

With the boost in imports, it shows up that merchants, specifically large box merchants, are anticipating a solid 4th quarter from a customer investing point of view.

To read more concerning FreightWaves Finder, click here.

Quantity enhances held throughout most of the nation as 74 of the 135 products markets tracked within FreightWaves finder revealed week-over-week rises in quantities.

Despite the uptick in quantities over the previous week, the biggest products markets in the nation experienced tender quantities decrease. Tender quantities in Ontario, The golden state dropped by 0.69% w/w. Relocating eastern right into Dallas, tender quantities were 1.37% reduced w/w. In the southeast, the decrease was a lot more serious as tender quantities in Atlanta dropped by 4.04% w/w.

To read more concerning FreightWaves Finder, click here.

By setting: Dry quantities are currently practically as much as 4th of July quantities, which is a favorable as August ends. The Van Outbound Tender Quantity Index raised by 2.76% w/w. Dry van quantities are 3.93% greater y/y, as the space with 2023 degrees remains to broaden after can be found in line with 2023 degrees in very early August.

The reefer market remains to reveal that it is trending greater, however with even more missteps along the road. Over the previous week, the Reefer Outbound Tender Quantity Index raised by 2.31%. Regardless of the once a week boost, reefer quantities are still down 3.82% y/y.

Denial prices inch greater for Labor Day weekend break

Tender denial prices have actually responded to the Labor Day vacation weekend break, however the response has actually been relatively soft in contrast to the 4th of July vacation week. Tender denial prices relocated higher over the previous week, coming close to 5%, however that mores than 200 basis factors less than the 4th of July top.

To read more concerning FreightWaves Finder, click here.

Within the previous week, the Outbound Tender Reject Index (OTRI), which determines family member ability on the market, raised by 45 basis indicate 4.86%. The boost was the biggest once a week boost because the 4th of July vacation and extremely comparable to the boost introducing Labor Day in 2014. Tender denial prices remain to run a little more than they were this time around in 2014, presently 47 basis factors greater y/y. Contrasted to 2019, the year in which the existing instructions straightens with one of the most, tender denial prices are presently 18 bps greater.

To read more concerning FreightWaves Finder, click here.

The map over reveals the Outbound Tender Reject Index– Weekly Adjustment for the 135 markets throughout the nation. Markets shaded in blue are those where tender denial prices have actually raised over the previous week, while those in red have actually seen denial prices decrease. The bolder the shade, the extra considerable the modification.

Of the 135 markets, 96 reported greater denial prices over the previous week, a boost from 76 in recently’s record.

The Detroit, Michigan market experienced the biggest boost in tender denial prices of the biggest products markets. Tender denial prices in Detroit raised by 169 bps w/w.

The Pacific Northwest is seeing denial prices boost over the previous week, consisting of Seattle where denial prices were 204 bps greater w/w.

To read more concerning FreightWaves Finder, click here.

By setting: Dry van denial prices did relocate greater over the previous week, however have not overshadowed the degrees experienced previously in August. Over the previous week, the Van Outbound Tender Reject Index climbed by 18 bps to 4.47%. Dry van denial prices are 62 bps more than they were this time around in 2014.

The reefer market is being even more unpredictable than the completely dry van market as reefer denial prices get on the increase. The Reefer Outbound Tender Reject Index has actually raised by 230 basis indicate 10.73%. Reefer denial prices are 57 basis factors more than they were this time around in 2014.

Flat bed denial prices remain to be under stress, greatly because of the greater rate of interest atmosphere. With rate of interest cuts coming up, it is most likely that the last 4 months of the year will certainly see some soft task up until commercial and production firms release funding that has actually gotten on the sidelines. Over the previous week, the Flat bed Outbound Tender Reject Index dropped by 87 basis indicate 6%. Flatbed tender denial prices are 68 basis factors reduced y/y, as the greater rate of interest atmosphere had a delayed effect to the marketplace.

Place prices have actually restricted activity right into Labor Day

Place prices have actually leveled out at Memorial Day vacation degrees, which is a favorable indication for the marketplace relocating right into the last verse of the year. At the very same time, agreement prices have actually been relocating greater because late June, which indicates that considerable price financial savings have actually currently been understood.

To read more concerning FreightWaves Finder, click here.

Today, the National Truckload Index (NTI)– that includes gas additional charge and different accessorials– was unmodified over the previous week at $2.27 per mile. Contrasted to this time around in 2014, the NTI is up 1 cent per mile. The linehaul variation of the NTI (NTIL)– which leaves out gas additional charges and various other accessorials– was up 1 cent per mile today at $1.70. The NTIL is 12 cents per mile more than it went to this time around in 2014. The disparity in the NTIL and NTI is only the adjustments in gas, which was even more pricey in 2023 than presently. The typical diesel vehicle place rate per gallon is 73 cents per gallon, or 16.4%, less than it was in 2014.

Originally reported completely dry van agreement prices stay in a rather limited variety, raised by 5 cents per mile over the previous week at $2.33. Throughout 2024, agreement prices have actually remained in a limited variety, an indicator that the severe price financial savings remain in the rearview mirror and solution is currently pertaining to the leading edge. Originally reported agreement prices are down 5 cents per mile from this time around in 2014, concerning a 2% decrease.

The graph above reveals the spread in between the NTIL and completely dry van agreement prices is trending back to pre-pandemic degrees. The spread broadened over the previous week as van agreement prices raised while place prices were relatively steady. If place prices relocate greater over the following week as any type of interruption from the Labor Day vacation functions itself out, it will certainly tighten the spread.

To read more concerning FreightWaves TRAC, click here.

The FreightWaves Relied On Price Evaluation Consortium place price from Los Angeles to Dallas dropped by 2 cents per mile over the previous week to $2.22 per mile.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.