-

The West’s assents are pressing Russia to create alternate repayment systems with its profession companions.

-

Russia’s SPFS and Mir systems, China’s CIPS, and India’s UPI assistance intend to test SWIFT’s prominence.

-

Reserve bank electronic money and cryptocurrencies are additionally being discovered to promote profession.

The West’s tightening up assents are driving Russia almost up versus the wall surface– however Moscow keeps finding ways to maintain the nation’s economic situation going.

Russia’s profession companions, also, are searching for methods to proceed working with the nation through alternate systems to match the Western-led, United States dollar-dominated worldwide economic order.

Conversations concerning de-dollarization have actually been obtaining grip over the last few years as Western-led assents versus Russia pertaining to its intrusion of Ukraine are making various other nations cautious of the prospective repercussions of going across Washington.

There’s been some success, with profession in between Russia and China, in addition to Russia and India, downing along up until just recently. Currently, also Chinese banks— giving in the stress of tightening up United States assents– are pressing back on handling deals for Russian business.

Yet Russia and its companions have actually been considering various other methods to do company outside the Western-led order, partly since innovation is making it much easier to refine settlements and navigate the US-dollar-dominated worldwide economic order.

As Brookings researchers Sam Boocker and David Wessel described in an August article, “developments in repayment innovation can minimize the buck’s duty in the worldwide economic situation.”

To ensure, king dollar is lodged on the planet’s economic system, so it’s not likely to be uncrowned, a lot of professionals claim. Nevertheless, brand-new systems are showing up that can try its prominence.

These are several of the alternate trading and repayment systems that are attempting to fracture the US-led profession and settlements order:

Russia established SPFS and Mir years earlier, pointing out ‘dangers’

Russia got ready for much more assents years earlier, adhering to profession constraints after it linked Crimea in 2014.

” There are dangers in operation the worldwide economic networks,” Elvira Nabiullina, guv of Russia’s reserve bank, informed CNBC in 2018. “As a result, because back in 2014, we have actually been establishing our very own systems.”

Some Russian financial institutions were outlawed from the SWIFT messaging system for financial deals adhering to Russia’s major intrusion of Ukraine. Moscow has actually been promoting its domestic ruble-based repayment system– the System for Transfer of Financial Messages, or SPFS– that was established in 2014.

At the end of 2023, customers of SPFS consisted of 556 companies from 20 nations. Of these, 159– concerning a quarter of overall individuals– were international and their use the messaging system greater than increased from 2022, according to Russia’s reserve bank, per Interfax.

In July, Russia and Iran– an additional heavily-sanctioned nation– settled information to link the financial systems of both nations, Iran’s Mehr news agency reported.

This indicates that Russia’s Mir repayment system would certainly collaborate with Iran’s Shetab financial system, permitting both pariah mentions to trade even more efficiently.

China’s CIPS is expanding swiftly

China’s Cross-Border Interbank Repayment System, or CIPS, is a different system that refines settlements in Chinese yuan.

Introduced in 2015, CIPS has around 2,000 participants as of July, contrasted to 11,000 for SWIFT.

CIPS “has actually been proliferating over the last few years,” the Brookings scientists created.

In 2023, CIPS refined over 6.6 million deals, completing 123 trillion Chinese yuan, or $17.3 trillion– up almost 30% by worth from a year earlier, according to China’s central bank.

India’s UPI is currently made use of thoroughly

India– currently a vital trading component of Russia– additionally has its very own system.

The nation’s Unified Payments Interface, or UPI, was established in 2016 and is used extensively in India today, also amongst day-to-day customers.

The repayment system has actually obtained so large that it’s not simply restricted to India. The National Settlements Firm of India, which runs the system, has actually partnered with banks in various other nations, consisting of France, the United Arab Emirates, and Singapore.

If the UPI’s impact broadens to extra nations, maybe a method to bypass the quick financial system, created Evan Freidin, a worldwide connections expert, for the Lowy Institute, an Australian brain trust.

” It is substantial that UPI can additionally be made use of to bypass the quick financial system, allowing settlements with approved nations such as Russia, therefore deteriorating United States economic hegemony,” Freidin created in July.

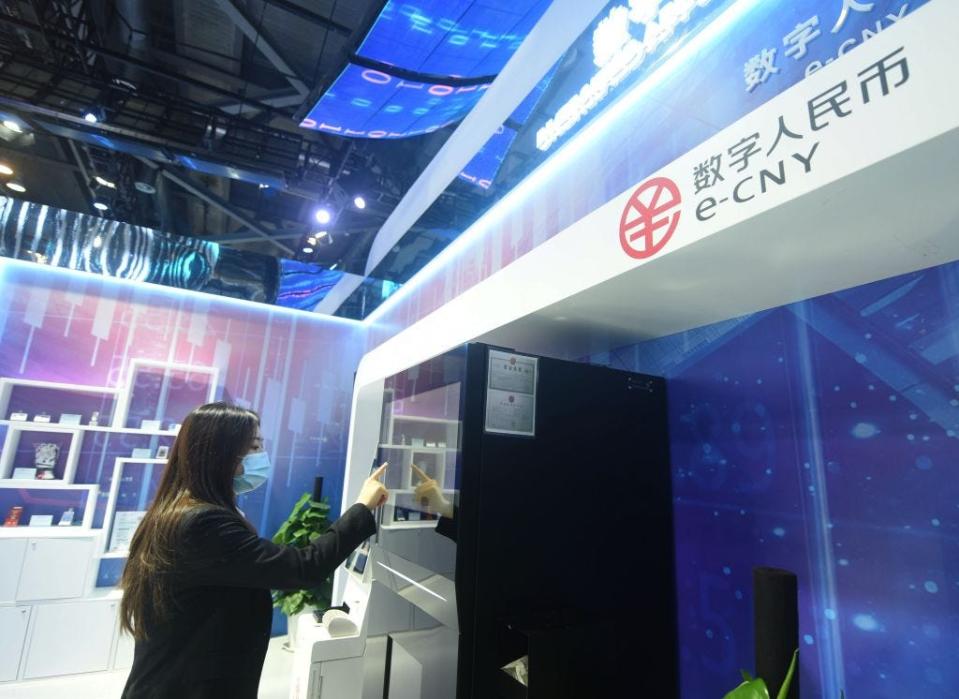

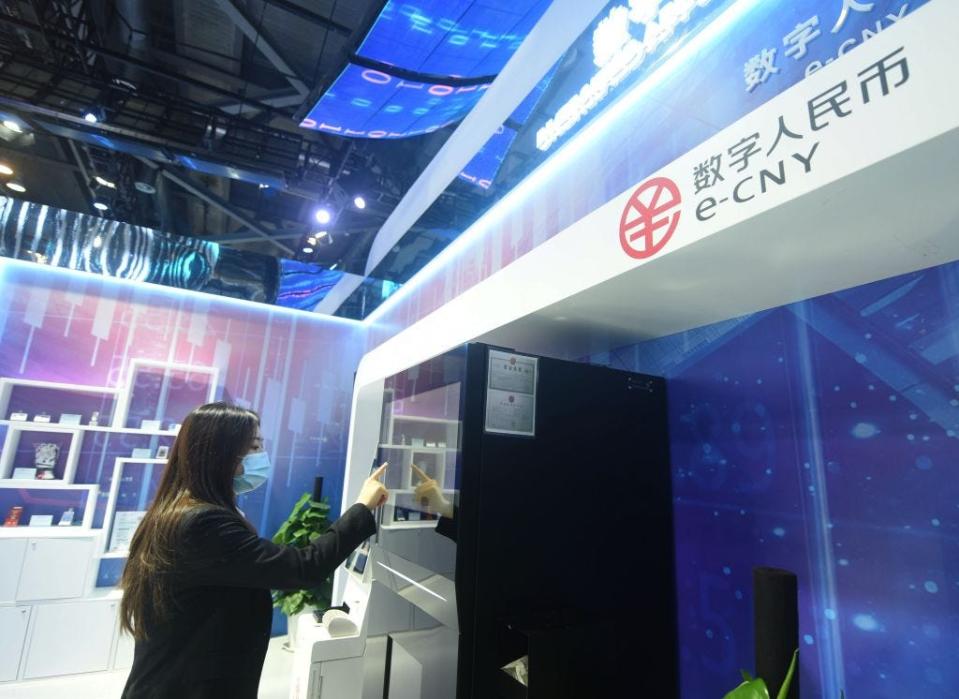

Reserve banks are considering electronic money

Nations are additionally progressively seeking to develop reserve bank electronic money, or CBDCs. These money resemble cryptocurrencies however are issued and backed by central banks.

The Bank for International Settlements, a company of reserve banks, is looking after the test of a CBDC system for wholesale cross-border repayment.

Individuals of the job, called mBridge, consist of China, Hong Kong, Thailand, the United Arab Emirates, and Saudi Arabia. It’s controlled by Beijing, which has actually currently presented the electronic Chinese yuan.

The Brookings scientists created that these CBDCs can “overthrow the buck’s duty as a money ‘intermediary’ by decreasing negotiation times, making it more affordable and much easier to trade non-dollar money.”

The CBDCs incorporate messaging and settlements, unlike existing systems like SWIFT and significant United States buck removing system CHIPS.

Russia hurries right into crypto

As doors to negotiate in fiat cash close, Russia is currently seeking to sell cryptocurrencies.

It remains in such a thrill to obtain the system up and running that it prepares to begin crypto exchange tests as quickly as September 1, confidential resources informed Bloomberg in late August.

Producing this setting of repayment has actually obtained extra important since also banks from China are turning down most deals with Russian entities.

Russian President Vladimir Putin himself claimed in July that Russia needed to “seize the moment” to produce a lawful structure for electronic possessions, as they are being progressively made use of to resolve worldwide settlements.

Returning to barter profession

If all else stops working, there’s additionally the olden approach of barter profession.

In August, Reuters reported that Russia and China are intending to restore the method of barter trade to navigate Western assents.

The bargains can entail farming and can come as quickly as this autumn, the information company reported, pointing out confidential profession and settlements resources.

Both nations are familiar with trade.

It was exercised throughout the Soviet era and in the years following the bloc’s collapse. At the time, China was a vital trading companion.

In August 2022, the Taliban regime in Afghanistan additionally went over barter profession with Russia that can entail trading Russian petroleum items for raisins, minerals, and medical natural herbs, according to RIA Novosti, a Russian state-owned information company.

In 2015, cash-strapped Pakistan licensed the barter profession of details products with Russia.

In 2019, China traded $150 million worth of palm oil from Malaysia for a variety of product or services, consisting of natural deposits and protection devices.

Review the initial post on Business Insider

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.