Ethereum’s (ETH) cost throughout August has actually left financiers stressed owing to the extreme volatility.

The hope of healing from September is high, yet BeInCrypto’s evaluation recommends a various instructions.

Ethereum Might Not See an Increase Over $3,000

Ethereum’s cost floating under $2,800 might remain to do so for the near future. It may also recuperate to $2,900, yet this might be the degree of the altcoin leader’s surge in September.

This is due to the fact that professionals are keeping in mind a reasonably bearish-neutral result for ETH. According to Alvin Kan, the COO at Bitget Pocketbook, there is an opportunity that ETH owners might transfer to unload their holdings.

” Lately, the ETH Structure moved 35,000 ETH to Sea serpent as component of its 2024 budget plan, possibly signifying a sell-off valued at around $94 million. This relocation has actually increased alarm systems amongst whale financiers, that might pick to market ahead of time,” Kan informed BeInCrypto.

This marketing would certainly arise from FUD or panic produced by the relocation. Furthermore, Julio Moreno, Head of Study at Cryptoquant, highlighted a larger problem in an unique declaration to BeInCrypto.

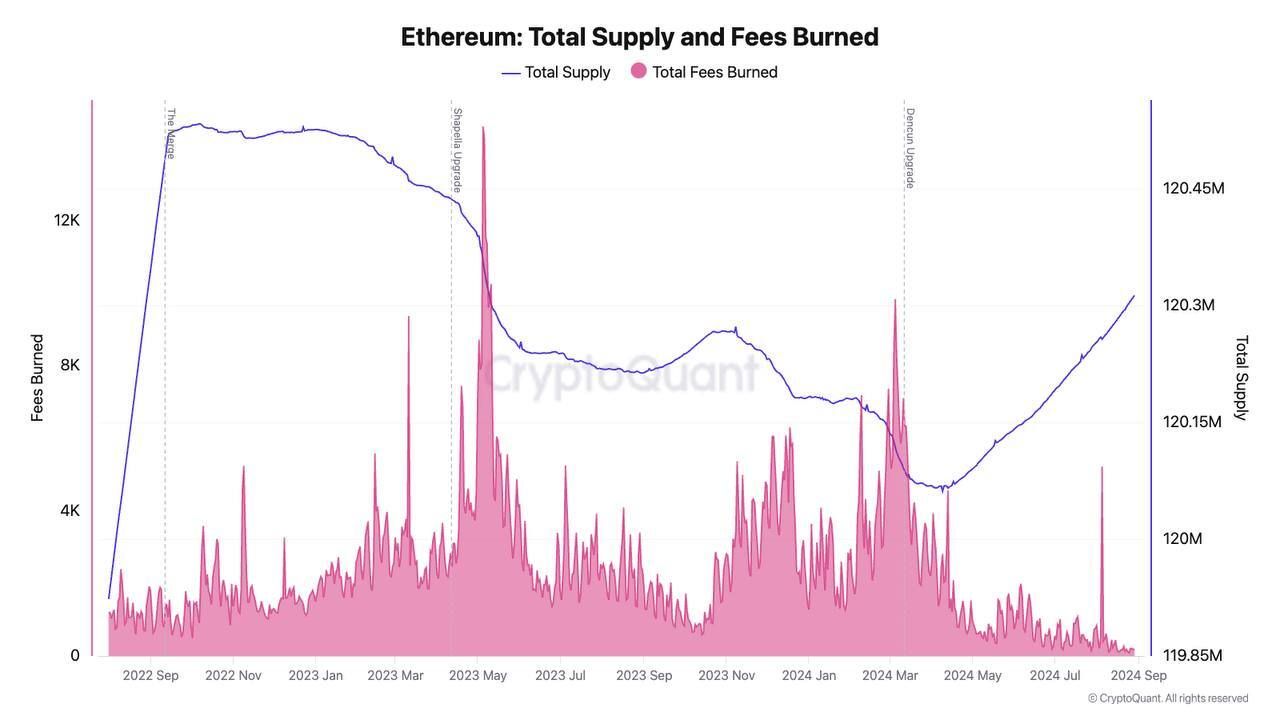

” Something that we are focusing on is the advancement of ETH’s complete supply and its partnership with network costs. The complete supply of ETH has actually been regularly expanding considering that very early April, quickly after the Dencun upgrade. The complete supply is currently at 120.313 million ETH, the highest possible considering that Might 2023. This rise in supply stands for 53% of the decrease in ETH supply considering that The Merge in September 2022. At this rate, ETH supply would recuperate its pre-Merge degree in roughly 3 months,” specified Moreno.

Find Out More: Just how to Buy Ethereum ETFs?

Moreno pointed out the Dencun upgrade as the reason behind this rise in supply, which is making ETH inflationary once more. Given that the upgrade, it has considerably reduced deal costs and decreased the ETH cost burning price. Because of this, the supply is boosting at a rapid price, relieving bearish problems.

ETH Rate Forecast: A Soft Touchdown or Release Off?

Over the coming couple of weeks, Ethereum’s cost might witness a mix of drawdown and recuperate. Currently, ETH is transforming hands at $2,471, and the macro cost activity, in addition to the previously mentioned aspects, recommends a decrease to the reduced pattern line at $2,300.

A bounce off this line might start an uptrend for Ethereum’s cost, bringing it over $2,681. Assumptions are turning this degree right into assistance, as it might establish ETH up for a rally in October.

Find Out More: Ethereum (ETH) Rate Forecast 2024/2025/2030

On the various other hand, if the expectancy for Q4 constructs the favorable energy previously, ETH might climb additionally. Breaching the resistance of $2,930 would certainly additionally cause an outbreak from the coming down wedge. This would certainly revoke the bearish-neutral thesis, preparing ETH for a surge past $3,000.

Please Note

In accordance with the Count on Job standards, this cost evaluation post is for educational objectives just and ought to not be taken into consideration economic or financial investment guidance. BeInCrypto is devoted to precise, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and speak with an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.