From June 2021 till the beginning of this year, AGNC Financial Investment ( NASDAQ: AGNC) had actually seen its supply decrease gradually. This year, AGNC’s supply rate is up a small 5%.

So why would certainly anybody forecast that this continuous underperformer will exceed the marketplace over the following year? Allow’s look into why I assume AGNC’s overall return will certainly exceed the marketplace over the following year. Yet initially, allow’s additionally check out why it has actually been underperforming the marketplace.

Years of underperformance

To comprehend why AGNC has actually been underperforming over the previous couple of years, you initially need to comprehend what it in fact does. AGNC is a real estate investment trust (REIT) that purchases mortgage-backed protections (MEGABYTESES) that are backed by government-sponsored companies. Essentially, it’s a fund that has home mortgages.

Significantly, its financial investments lug basically no debt threat, since they are basically back-stopped by the united state federal government via Fannie Mae and Freddie Mac. Nonetheless, that does not suggest these home loan financial investments are safe. When home loan prices increase, today worth of these home loan financial investments decreases. This is usually described as interest rate risk.

Why it functions in this manner is basic. If I possessed a megabytes safety and security that paid a price of 3%, you would not provide me amount of the safety and security if you can obtain a recently provided megabytes safety and security paying 6%. Rather, if I required to offer that safety and security, I would certainly need to offer it at a discount rate to its stated value.

This is among the reasons that AGNC’s supply has actually substantially underperformed in the previous couple of years. As the Fed started elevating rate of interest after years of really reduced prices, home loan prices additionally enhanced. This left the worth of AGNC’s profile of reduced promo code MBS protections worth much less.

Maybe an also larger problem, however, was that the spread in between safe Treasury returns and home loan returns additionally broadened, which simply intensified the decreases that AGNC saw in its MBS profile.

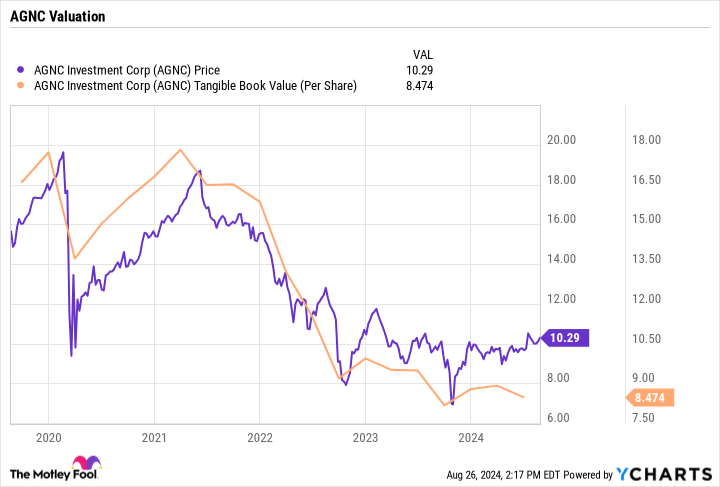

The worth of AGNC’s profile is stood for by its substantial web publication (TBV) worth. On that particular front, the REIT’s TBV per share sank 45% from completion of 2021 till completion of 2023, going from $15.75 per share to $8.70 per share.

Reduced prices in advance

After a number of years of Fed price walkings and greater home loan prices, Federal Book Chairman Jerome Powell suggested at the Fed’s yearly resort in Jackson Opening, Wyoming that rate of interest cuts are coming. Powell stated that while information and its expectation will certainly affect the timing and rate of price cuts, the instructions is clear.

At the same time, according to the current Fed Dot Story graph (this is a graph revealing where each participant of the Fed policymaking board assumes prices are headed), Fed participants are anticipating the Fed Finances price to be up to about 4% to 4.25% by the end of 2025 and to around 3.00% to 3.25% by the end of 2026. Prices presently rest at in between 5.25% to 5.50%.

With reduced rate of interest, home loan prices must most likely head reduced also. And comparable to exactly how AGNC’s profile decreased in worth as home loan prices climbed, its profile worth must increase in worth as home loan prices drop.

Eventually, AGNC’s supply rate normally tracks its TBV per share, which is based upon the worth of its MBS profile.

Goldilocks atmosphere

One threat home loan REITs deal with when prices start to decrease is early repayment threat, where individuals progressively re-finance their home mortgages or offer their homes at greater prices than anticipated. When they do this, REITs require to change their financial investments with megabytes that usually would have a reduced return.

Home mortgage prices have actually currently started to drop in expectancy of a Fed cut and currently rest at around 6.5%. Nonetheless, regarding 80% of AGNC’s profile remains in megabytes with vouchers of 6% or under, reducing this early repayment threat.

This establishes the firm up well to see a boosting advantage in substantial publication worth without much early repayment threat.

At the same time, home loan REITs have a tendency to do quite possibly throughout regular price reducing cycles (not associated with a real estate situation). While AGNC has actually not been around for a lot of them, fellow home loan REIT Annaly Resources Monitoring ( NYSE: NLY) has. Its supply saw a large rally throughout the Fed price reduced cycle beginning in 2001 after the dotcom bubble ruptured.

The mix of a Fed price reducing cycle, AGNC’s profile structure, and the supply’s $0.12 month-to-month returns established AGNC approximately exceed the marketplace over the following year. With a return of 14%, the supply additionally does not require a great deal of rate gratitude to exceed and can conveniently see a 20% to 25% overall return over the following year.

Nonetheless, if megabytes spreads tighten up as prices decrease, AGNC’s TBV can leap dramatically, as would certainly its shares. This can occur if financial institutions begin to reenter the megabytes market as prices relieve, assuming they are currently beneficial financial investments. This would certainly after that boost need in the area and possibly tighten up spreads that have actually broadened bent on traditionally high degrees. This would certainly bring about a lot bigger returns for the supply.

That is the best-case situation, yet also without that occurring, the supply is still readied to exceed over the following year as the Fed systematically reduces prices.

Should you spend $1,000 in AGNC Financial investment Corp. now?

Prior to you purchase supply in AGNC Financial investment Corp., consider this:

The Supply Consultant expert group simply determined what they think are the 10 best stocks for financiers to purchase currently … and AGNC Financial investment Corp. had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Take Into Consideration when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $720,542! *

Supply Consultant supplies financiers with an easy-to-follow plan for success, consisting of assistance on developing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Supply Consultant solution has greater than quadrupled the return of S&P 500 because 2002 *.

* Supply Consultant returns since August 26, 2024

Geoffrey Seiler has settings in Annaly Resources Monitoring. The has no placement in any one of the supplies stated. The has a disclosure policy.

Prediction: AGNC Investment Will Outperform the Market Over the Next Year was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.