Binance, the globe’s biggest crypto exchange by trading quantity, is preparing to release a fluid laying token (LST) on the Solana blockchain, together with various other exchanges.

This relocation comes as Solana’s fluid laying ecological community remains to expand, drawing in passion from significant market gamers.

Exchanges Foray right into SOL Fluid Betting

On Thursday, Binance, Bybit, and Bitget meant strategies to release brand-new fluid laying symbols (LSTs) on the Solana blockchain withcryptic messages Bybit’s fluid laying token will certainly lug the ticker BBSOL, while Bitget’s will certainly be BGSOL. Binance will certainly utilize BNSOL as the sign for its LST.

These symbols will certainly allow owners to gain return on their Solana (SOL) holdings while taking part in decentralized financing (DeFi) tasks such as borrowing and loaning. In addition, they will certainly assist safeguard the blockchain with laying. Sanctum, a fluid laying layer on Solana, has suggested that these LSTs will certainly be improved its method.

” BBSOL will certainly act as a bridge in between Bybit’s central exchange (CEX) and Web3 systems, giving customers with regular and reputable benefits. By laying Solana (SOL) on Bybit Web3, customers obtain BBSOL symbols, opening a wide range of gaining possibilities throughout Bybit’s CEX and Web3 items,” Bybit shown BeInCrypto

Learn More: What Is Fluid Betting in Crypto?

In the middle of this information, Sanctum’s CLOUD token has actually risen by 47%, trading at $0.2629 at the time of composing. Jae Sik Choi, elderly partner at Greythorn Property Administration, defined the advancement as favorable for Sanctum, forecasting that approximately $3 billion well worth of Solana can be included in the laying layer’s overall worth secured (TVL).

” BNSOL– Binance’s LST, possibly includes $3 billion well worth of SOL in Sanctum laying layer TVL. That will certainly bring possibly a 55.48% rise in TVL, as soon as indigenous laid are transformed to LSTs,” he wrote.

Sik Choi recommends that Binance, Bitget, and Bybit might have started a central exchange (CEX) LST period, which can improve Sanctum’s worth. Along with Sanctum, various other laying layers on Solana, such as Jito, Sauce, Jupiter, and Blaze, are adding to the development of Solana’s fluid laying market.

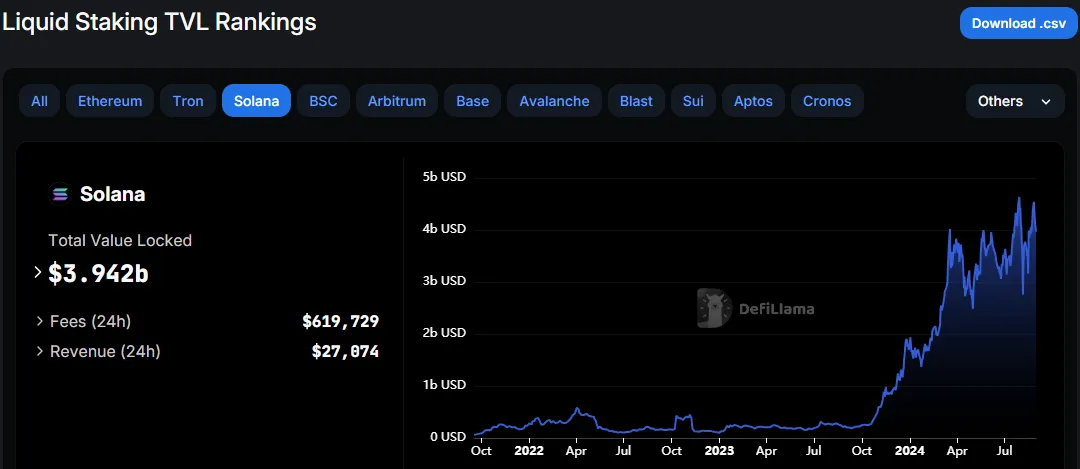

Solana Fluid Staking Market Doubles in 2024

According to DefiLlama information, Solana’s fluid laying overall worth secured (TVL) has actually greater than increased in 2024, enhancing from $1.9 billion to $3.94 billion. Given that its beginning in 2021, the industry has actually seen an outstanding development, drawing in a a great deal of individuals.

Nevertheless, the $3.9 billion TVL make up simply 9.6% of the $42.5 billion secured throughout all fluid laying procedures. Ethereum still controls the industry, holding 83% of the overall market share.

Fluid laying procedures are acquiring appeal since they incorporate protection payments to network agreement with economic versatility, making them an eye-catching choice for smart financiers intending to optimize earnings.

For exchanges, presenting LSTs includes a brand-new income stream, as these symbols broaden their item offerings. Stakers gain benefits, while exchanges gather charges. As an example, Binance, which supplies BETH– the third-largest LST by market capitalization– bills a 10% charge on Ethereum (ETH) laying benefits.

Learn More: Leading 8 High-Yield Fluid Betting Systems To View in 2024

According to Binance’s assistance web page, this 10% charge covers functional expenses, consisting of equipment and network upkeep for validator nodes. In addition, LSTs like BNSOL, BBSOL, and BGSOL will certainly permit exchanges keep Solana equilibriums on their systems.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to offer precise, prompt info. Nevertheless, viewers are suggested to validate realities separately and seek advice from an expert prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.