Chainlink’s (WEB LINK) cost is not getting on also well owing to unsure market problems, which have actually led to losses for financiers.

While there is wish for healing, it might not be the course established for web link as the more comprehensive market remains to prevent a rally.

Chainlink May Required to Wait

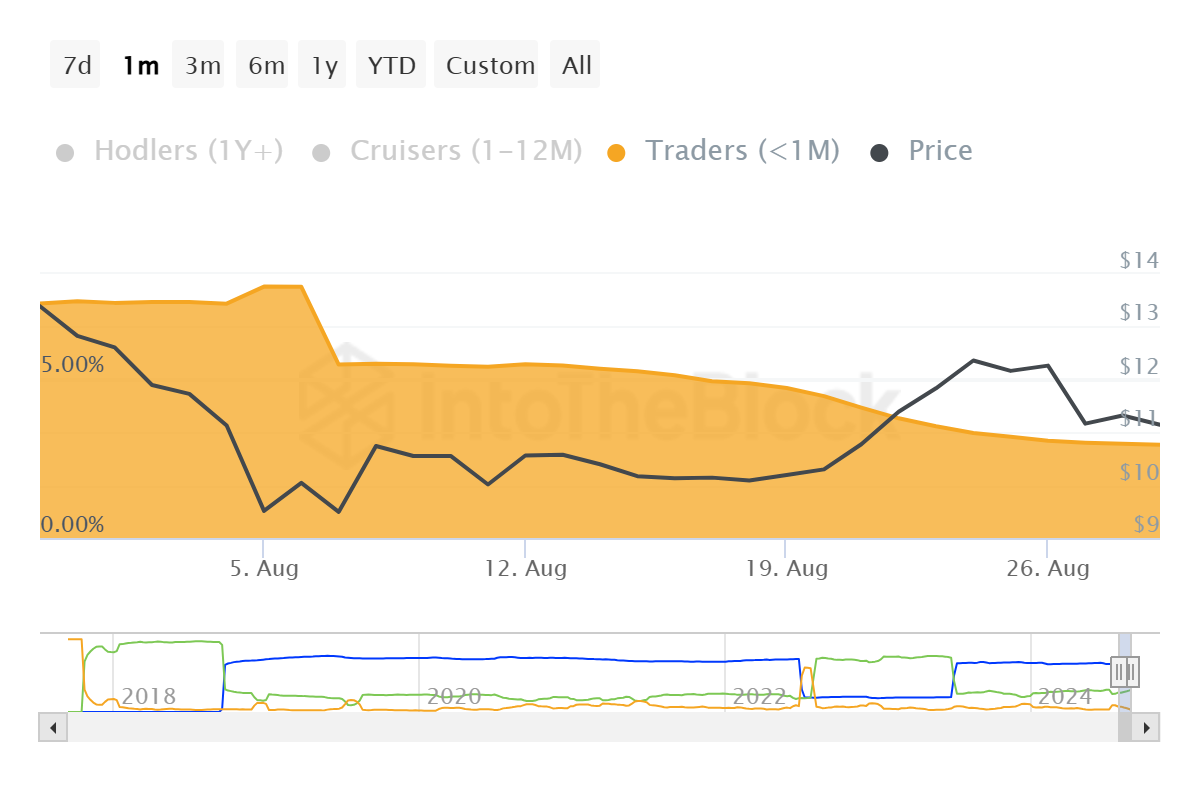

Chainlink’s cost is presently encountering bearish stress regardless of an essential team of financiers shedding their power over the altcoin. These are the temporary owners, that commonly hold for much less than a month. This makes them most likely to offer promptly, however the marketplace has actually seen their supremacy decrease considerably.

Their dominance has actually gone down from 7.37% to simply 2.9% over the previous 4 weeks. This decrease is normally considered as a favorable indication, recommending much less prompt marketing stress in the marketplace.

The decrease likewise shows an extra steady base of lasting financiers, which could sustain web link’s cost security in the short-term. With less short-term financiers in the mix, there’s a reduced danger of sudden sell-offs, possibly supplying an extra strong structure for cost development.

Find Out More: Just How To Acquire Chainlink (WEB LINK) and Whatever You Required To Know

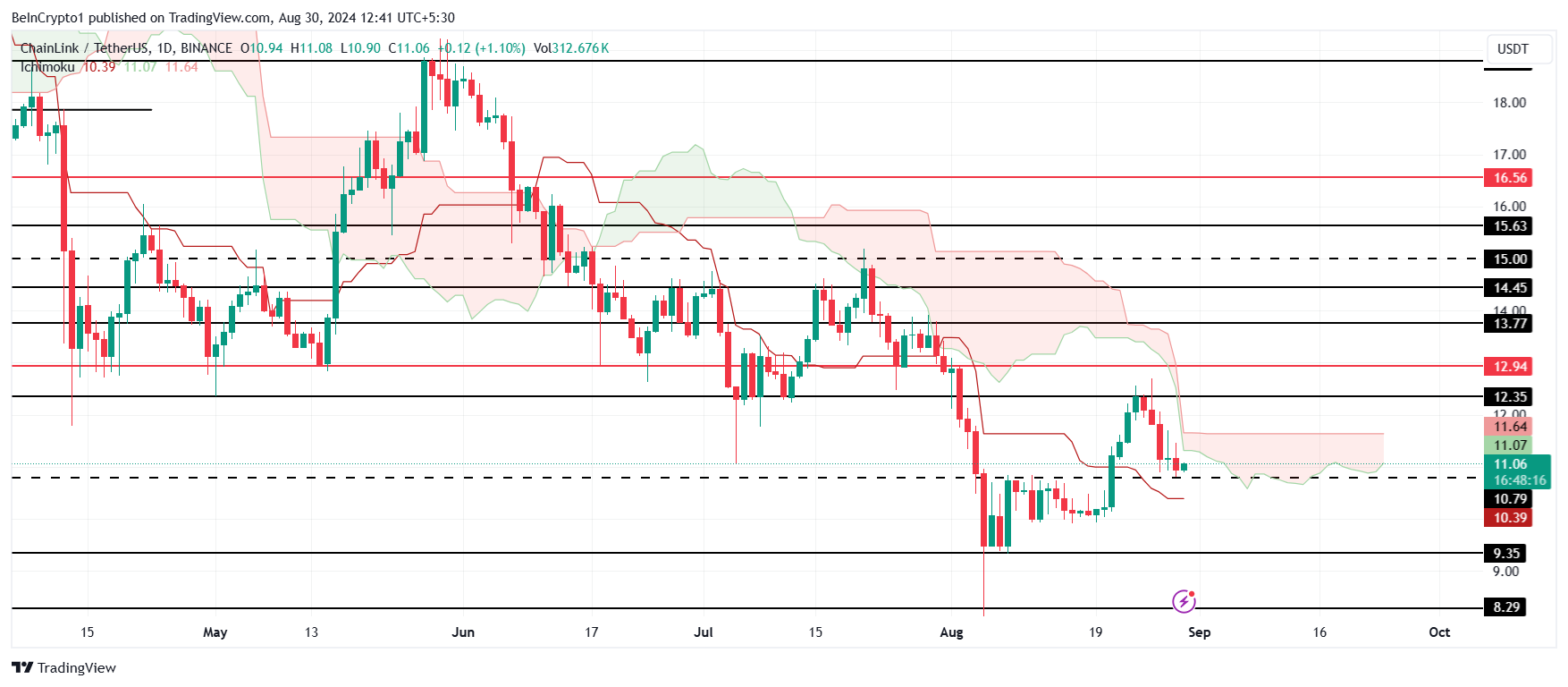

In spite of this motivating advancement, the Ichimoku Cloud evaluation provides a bearish expectation for web link. The cloud stays located over the candle holders, showing possible prolonged bearish problems. This technological signal recommends that web link might deal with ongoing descending stress in the close to term.

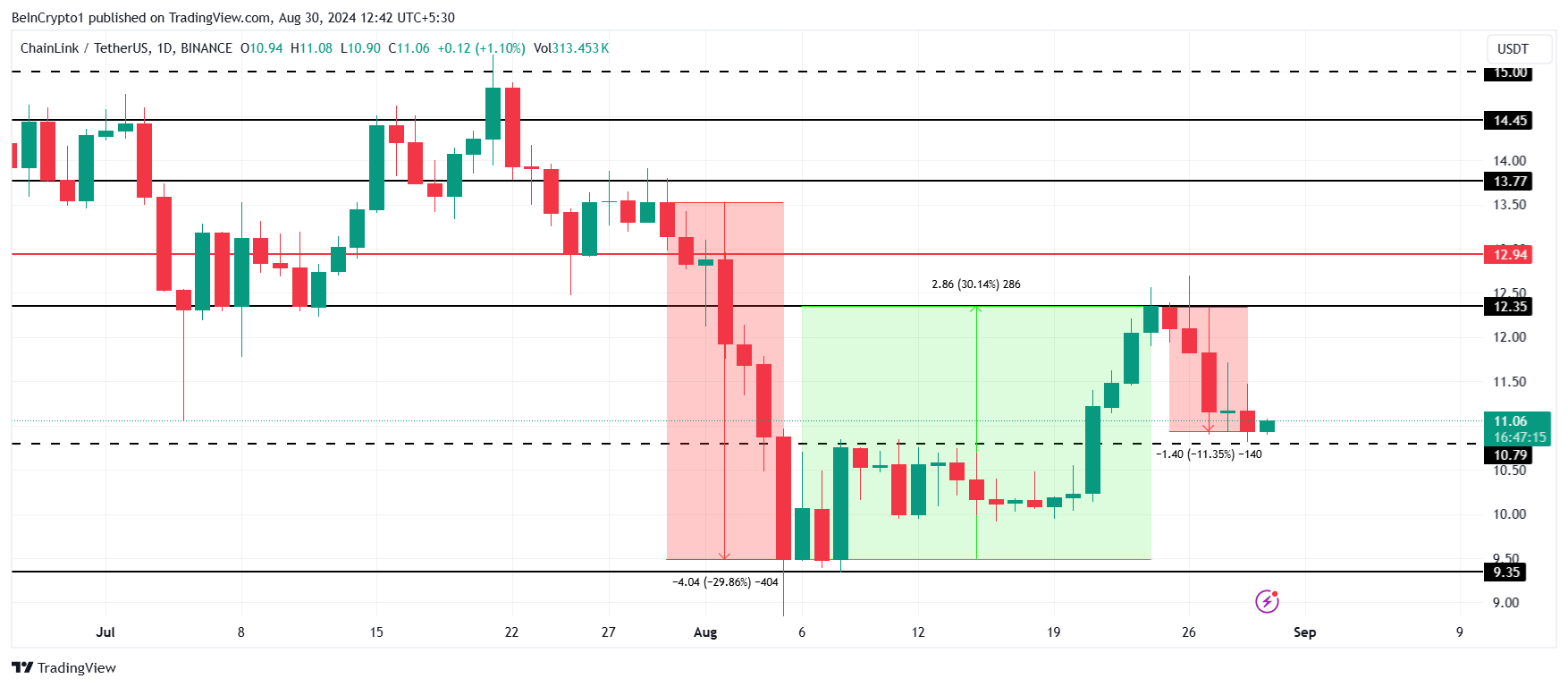

Current cost activity revealed a quick 30% rise in web link’s worth, which practically caused a favorable signal. Nonetheless, this favorable energy was short-term, and the cost quickly dropped back, stopping the sign from transforming favorable.

Web Link Cost Forecast: Seeing Laterally

Chainlink’s cost, from the appearances of it, might proceed relocating laterally after the 11% decrease in the last 4 days. Presently trading under the resistance of $12.35 and over the assistance of $10.79, the altcoin is altering hands at $11.06. Although this array has actually not been checked as loan consolidation in the past, the abovementioned elements indicate this future.

On the occasion that Chainlink’s cost fails the assistance of $10.79, a decline to $9.35 is feasible. This cost is the existing essential assistance flooring, and a decrease in it would certainly eliminate the current 30% gains.

Find Out More: Chainlink (WEB LINK) Cost Forecast 2024/2025/2030

Nonetheless, for Chainlink to recoup the 30% losses from the July accident, the resistance of $12.35 needs to be breached. This will certainly allow a surge towards $13.00, and turning this degree right into assistance would certainly press web link to $13.77, revoking the bearish-neutral thesis.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation short article is for educational functions just and need to not be taken into consideration monetary or financial investment guidance. BeInCrypto is dedicated to exact, honest coverage, however market problems go through alter without notification. Constantly perform your very own study and seek advice from a specialist prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.