Ethereum investors stay confident concerning a rate recuperation regardless of the altcoin’s numerous incorrect outbreaks. Their proceeded self-confidence shows that, no matter ETH’s current rate activity, the wider market prepares for the crypto will certainly recoup some losses.

On August 24, ETH’s rate got to $2,800 yet dealt with being rejected at that degree. Will the rate relocate investors’ support?

Ethereum Bulls Remain Undeterred

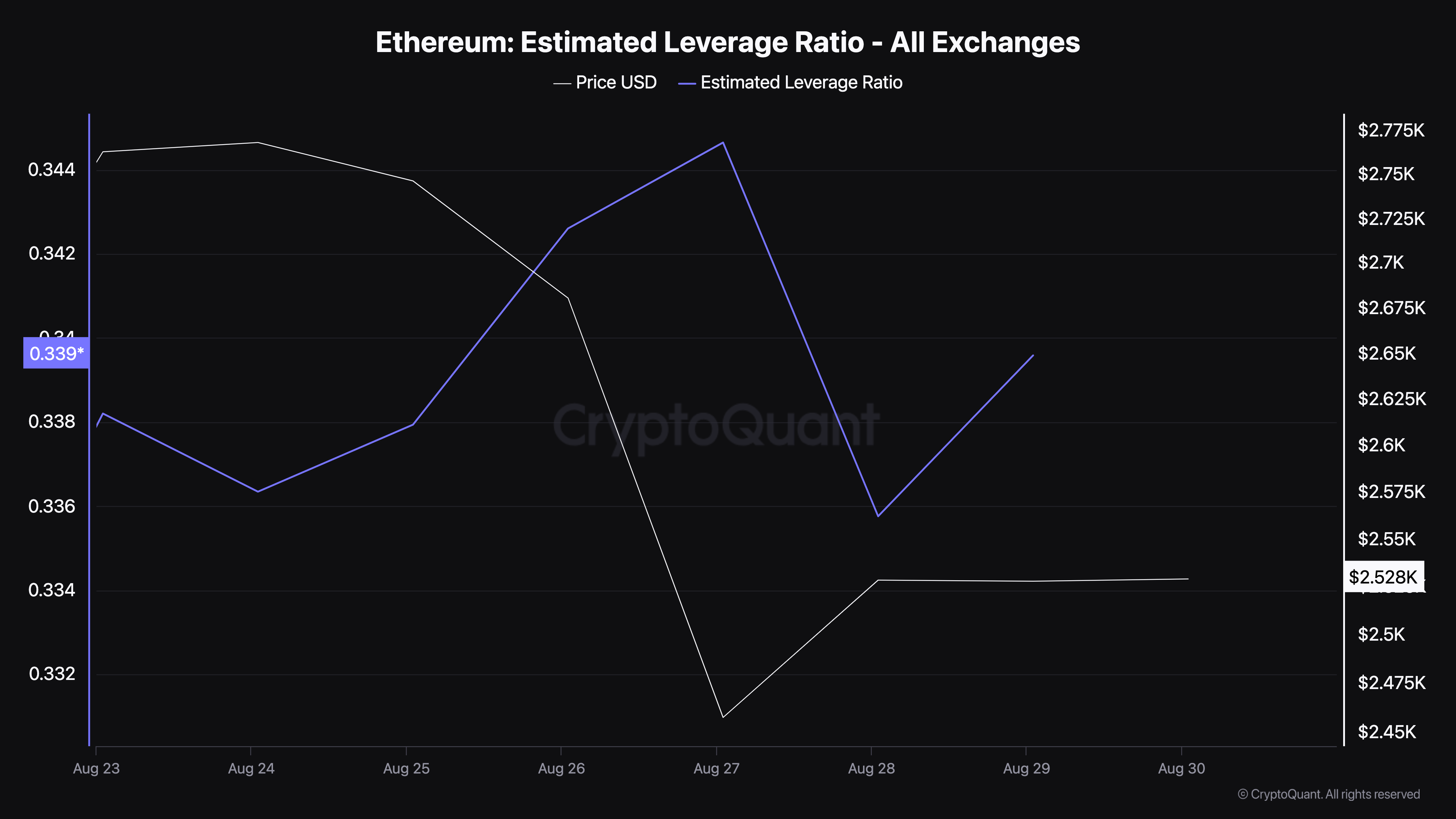

According to CryptoQuant, Ethereum’s Approximated Take advantage of Proportion (ELR) has actually just recently increased, suggesting that financiers are significantly taking high-leverage wagers in the by-products market. This recommends expanding self-confidence in a substantial rate activity.

Generally, a decreasing ELR indicate mindful belief, with investors preferring low-risk wagers. On the other hand, an increasing ELR signals that investors anticipate the rate to relocate emphatically.

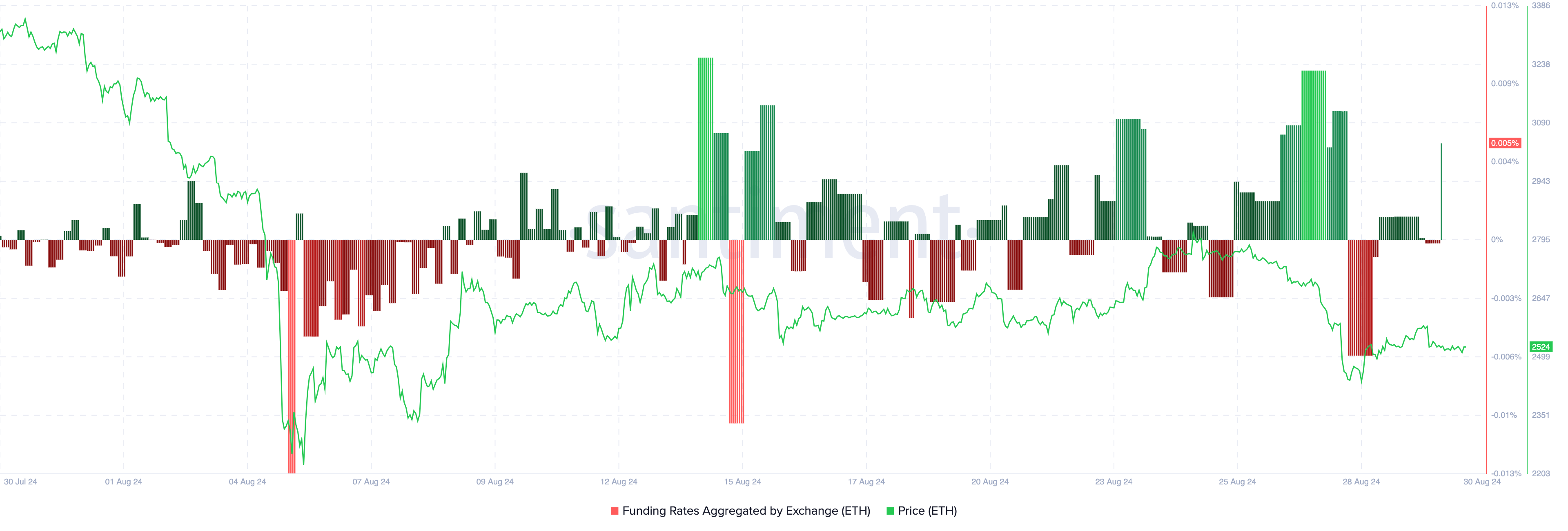

Sustaining this expectation, on-chain information from Santiment reveals an abrupt spike in Ethereum’s Financing Price, the expense of holding an employment opportunity in the continuous market.

When the Financing Price declares, the continuous futures rate professions at a costs to the area rate, suggesting favorable belief. Alternatively, adverse financing recommends the cryptocurrency is trading at a discount rate, with a lot of investors going with brief placements.

Find Out More: Solana vs. Ethereum: An Ultimate Contrast

It is necessary to keep in mind that the Financing Price can additionally affect rate activities. If financing is extremely adverse while the rate is increasing, it recommends hostile shorting, which can be a favorable sign. Nonetheless, the current spike in financing, paired with the rate boost, recommends that Ethereum could experience one more bearish round prior to possibly recoiling.

ETH Cost Forecast: Bears Are Not Off The Beaten Track

On the everyday graph, Ethereum (ETH) have to stay clear of damaging listed below the $2,414 degree to keep the opportunity of retesting the above resistance at $2,726. Efficiently holding this assistance can lead the way for a relocation higher, possibly getting to $3,014.

The Relocating Ordinary Merging Aberration (MACD) sign on the graph reveals a favorable analysis, recommending favorable energy. The MACD, which determines energy by contrasting the 12 and 26 Exponential Relocating Standards (EMAs), shows that as lengthy as the energy remains favorable, ETH’s rate can remain to climb.

Find Out More: Ethereum (ETH) Cost Forecast 2024/2025/2030

Nonetheless, ETH requires to damage over the coming down trendline to target $2,800. Failing to do so might cause being rejected, possibly triggering ETH to relapse towards $2,400.

Please Note

According to the Count on Task standards, this rate evaluation write-up is for educational functions just and need to not be thought about monetary or financial investment guidance. BeInCrypto is devoted to exact, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own study and seek advice from a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.