The crypto market will certainly witness $5.01 billion in Bitcoin and Ethereum alternatives agreements end today. This large expiry can influence temporary cost activity, particularly as both possessions have actually lately decreased.

With Bitcoin alternatives valued at $3.67 billion and Ethereum at $1.36 billion, investors are supporting for prospective volatility.

High-Stakes Crypto Options Expirations: What Investors Must See Today

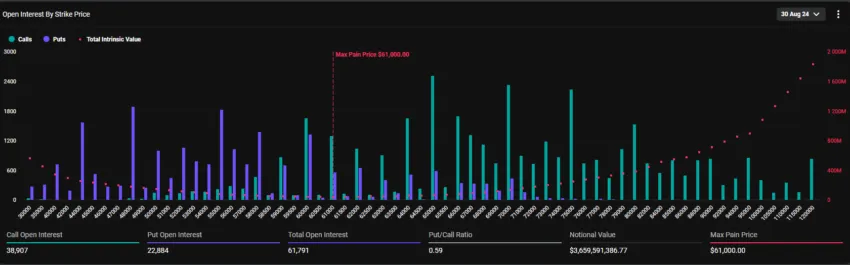

Today’s ending alternatives mark a substantial rise from recently. According to Deribit information, Bitcoin alternatives expiry entails 61,793 agreements, contrasted to 18,440 agreements recently. Likewise, Ethereum’s ending alternatives complete 538,872 agreements, up from 141,410 agreements the previous week.

Find Out More: An Intro to Crypto Options Trading

These ending Bitcoin alternatives have an optimum discomfort cost of $61,000 and a put-to-call proportion of 0.59. This suggests an usually favorable belief in spite of the property’s current pullback. In contrast, their Ethereum equivalents have an optimum discomfort cost of $2,800 and a put-to-call proportion of 0.49, showing a comparable market overview.

The optimum discomfort factor is an important metric that usually overviews market habits. It stands for the cost degree at which most alternatives end pointless. In addition, the put-to-call proportions listed below 1 for both Bitcoin and Ethereum recommend positive outlook on the market, with even more investors banking on cost boosts.

According to Greeks.live experts, current cost decreases and outside elements, such as Nvidia’s revenues, have actually resulted in a small uptick in indicated volatility (IV). Nevertheless, they note that IV has actually typically lowered gradually, showing a pullback fad.

” Alternatives information reveals that [realized volatility] recreational vehicle has actually dropped from a high of 100% on August 9 to 40% presently, with BTC’s real volatility degrees going down considerably, which is additionally a substantial element driving IV down,” the experts added.

Greeks.live experts additionally observed a boost in lengthy placements in block alternatives trading. This problem suggests that some large investors are getting ready for future cost increases.

The most recent information programs that Bitcoin’s trading worth has actually stopped by 3.26% to $59,157 from the $61,150 mark on August 29. Likewise, Ethereum has actually dropped by 2.55%, currently trading at $2,525, below the previous $2,592 throughout the very same duration.

Find Out More: 9 Finest Crypto Options Trading Operatings Systems

Options expiries usually create temporary cost variations, producing market unpredictability. Nevertheless, markets typically maintain not long after as investors adjust to the brand-new cost atmosphere. With today’s high-volume expiry, investors and financiers can anticipate a comparable result, possibly affecting future crypto market patterns.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to offer precise, prompt details. Nevertheless, viewers are encouraged to validate truths individually and talk to a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.