Surge’s indigenous token, XRP, has actually kept a reasonably secure trading pattern over the previous month, relocating within a slim rate array. Although it dipped listed below its straight network throughout the marketplace decrease on August 5, XRP took care of to recuperate and resume its sideways activity.

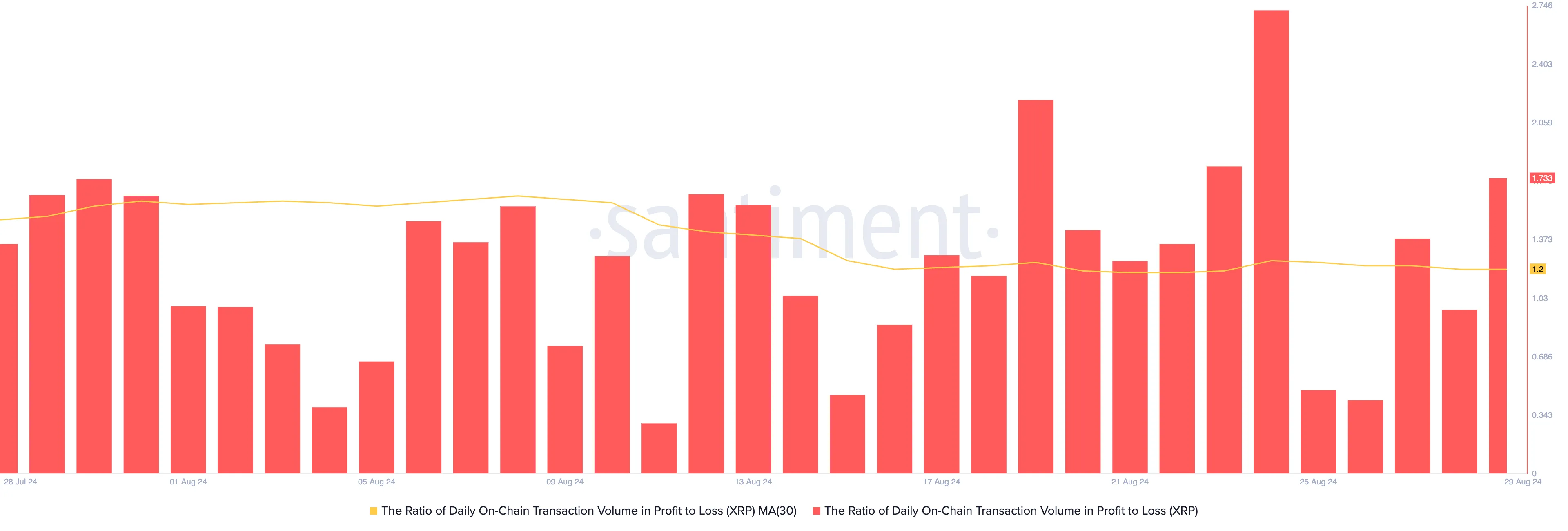

Regardless of the minimal rate changes, the majority of day-to-day purchases including XRP have actually been a lot more lucrative than not, showing a durability in its trading actions.

Surge Owners Grin to the Financial Institution

The day-to-day proportion of XRP’s deal quantity in earnings to loss, examined utilizing a 30-day relocating standard, reveals that even more purchases have actually paid than those causing a loss over the previous month. Since this writing, this stands at 1.2, recommending that for every single XRP deal that finishes in a loss, 1.2 purchases lead to an earnings.

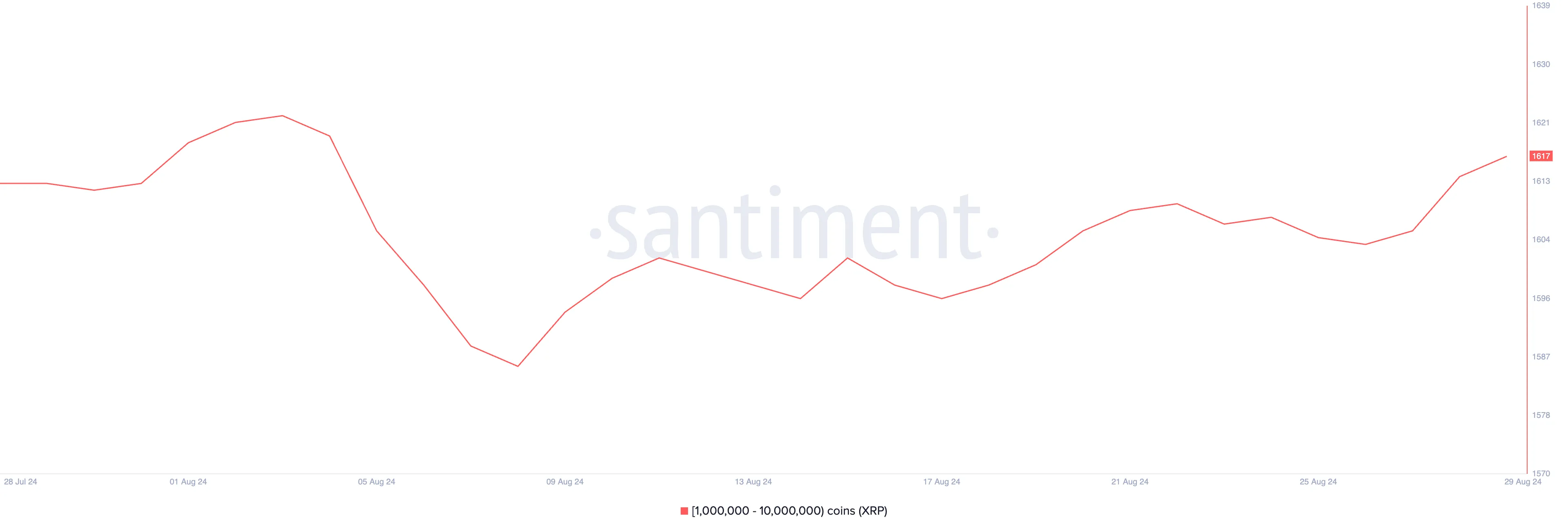

Within the evaluation duration, XRP whales have actually raised their trading task. Santiment’s information reveals a spike in the variety of XRP whale addresses that hold in between 1,000,000 and 10,000,000 XRP symbols. At press time, this accomplice is consisted of 1617 addresses, with its matter rising by 2% considering that August 9.

Learn More: XRP ETF Clarified: What It Is and Just How It Functions

The increase in the variety of whales holding a possession is a favorable signal. It shows a solid need for the possession and might increase the self-confidence of retail investors, bring about even more acquiring task, which might occasion a possession’s rate rally.

XRP Cost Forecast: Difficulty Exists Ahead

Already, XRP is trading at $0.57 and has actually been relocating within a straight network considering that July 17. When the possession’s rate changes within a details array, it develops a network that shows an equilibrium in between trading stress, protecting against the rate from making a solid relocate either instructions.

In this situation, the top limit of the network serves as resistance, while the reduced limit functions as assistance. XRP has actually run into resistance at $0.63 and discovered assistance at $0.54.

Presently, a bearish predisposition appears, with marketing stress surpassing acquiring task. This is shown in the decreasing Chaikin Cash Circulation (CMF) for XRP, which is trending downward and presently rests at -0.08. The CMF indication determines the circulation of cash right into and out of a possession. Its adverse worth recommends market weak point, showing that marketing stress is high.

Learn More: Surge (XRP) Cost Forecast 2024/2025/2030

If this fad proceeds, XRP’s rate might approach the assistance line of its straight network. Need to the bulls stop working to safeguard this degree, the sag can press the token’s rate to $0.50.

On the various other hand, if the bulls reclaim control, XRP can climb up in the direction of the resistance degree and effort to appear it. Success in breaching resistance may see XRP trading at $0.66.

Please Note

In accordance with the Trust fund Job standards, this rate evaluation post is for informative objectives just and ought to not be thought about monetary or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, however market problems go through alter without notification. Constantly perform your very own study and seek advice from a specialist prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.