Over the previous couple of months, there has actually been an assumption that Bitcoin (BTC) would certainly drag altcoins in regards to efficiency. Nonetheless, this hasn’t emerged, as just 6 out of the leading 50 altcoins have actually exceeded BTC over the last 90 days.

Presently, Bitcoin’s prominence stands at 57.18%, suggesting that its market capitalization has actually been expanding much faster than that of the typical altcoin. In spite of this solid efficiency, BeInCrypto recognizes 3 altcoins that are anticipated to outmatch BTC in the future, supplying in-depth evaluation and thinking for this projection.

Tron (TRX)

Tron (TRX), the cryptocurrency connected to debatable blockchain billionaire Justin Sunlight, just recently struck a three-year high of $0.17. This landmark aided TRX get into the leading 10 cryptocurrencies by market capitalization, surpassing Cardano (ADA). Over the last thirty days, TRX’s rate has actually boosted by 15%, outshining Bitcoin (BTC) throughout the exact same duration.

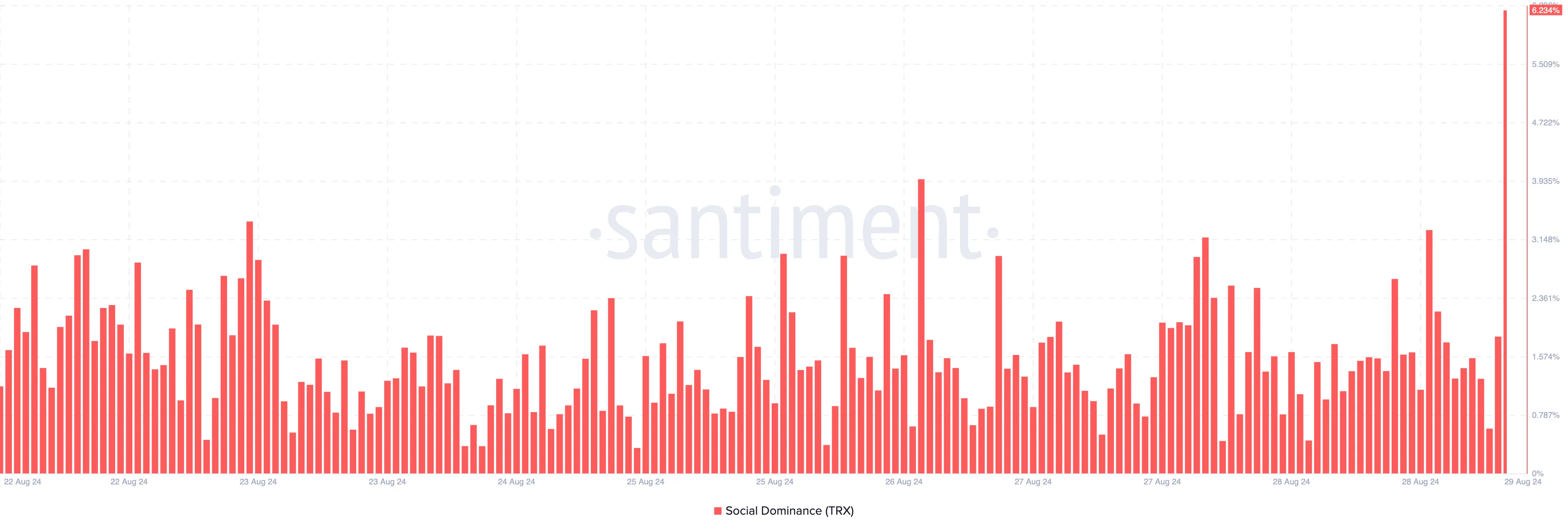

This rate rise is mainly as a result of the launch of the meme coin generator SunPump in August, which has actually increased need for TRX. The altcoin’s climbing social prominence, currently at 6.23%, shows expanding focus towards the job.

From a technological viewpoint, Tron’s On Equilibrium Quantity (OBV) line has actually been raising on the day-to-day graph, suggesting solid purchasing stress. A greater OBV mirrors even more purchasing task, which is commonly a forerunner to additional rate rises.

If the buildup of TRX proceeds, the rate can possibly go down to $0.14 prior to recovering to its current high of $0.17, and potentially also getting to $0.19 in September.

Find Out More: That Has one of the most Bitcoin in 2024?

Nonetheless, this hopeful overview can be tested if Bitcoin surpasses leading altcoins following month. Because instance, TRX’s higher energy may deal with resistance, and the anticipated rate targets can be tougher to attain.

Aave (AAVE)

Over the previous thirty days, AAVE’s rate has actually increased by 18.68%. This cryptocurrency, which functions as the administration token for the decentralized money (DeFi) method Aave, has actually just recently drawn in considerable rate of interest from whales. This rise in rate of interest locations AAVE amongst the favorable altcoins that can possibly outmatch Bitcoin (BTC) in September.

Aave has actually likewise recommended raising its participation with the Real life Properties (RWA) market by incorporating BlackRock’s BUIDL framework. If this proposition is accepted quickly, it can result in a spike sought after for AAVE.

On August 5, AAVE’s rate went down listed below $80. Nonetheless, the altcoin started developing Greater Lows (HL), ultimately getting to $146.49 on August 24. At this degree, the Loved one Toughness Index (RSI) showed that the token was overbought.

The RSI gauges energy; an analysis of 30.00 or listed below signals that a possession is oversold, while an analysis of 70.00 or over shows that it is overbought. As revealed, the RSI struck the overbought area last Saturday.

Following this, AAVE’s rate went down to $118. The RSI has actually considering that continued to be over the 50.00 neutral line, recommending that a favorable turnaround can be feasible. For this to occur, bulls require to protect the $118.01 assistance degree and break past the resistance at $129.64.

If effective, AAVE can turn into one of the altcoins to outmatch Bitcoin in September. Nonetheless, if the assistance at $118.01 falls short, the altcoin’s rate may deal with a substantial decrease.

Cardano (ADA)

Cardano’s setting in this checklist is mainly affected by its upcoming significant upgrade on September 1, called the Chang difficult fork. This upgrade will certainly present on-chain administration to the Cardano blockchain for the very first time, noting the preliminary stage towards the job’s best objective, Voltaire.

ADA owners have actually revealed considerable optimism leading up to the occasion. In 2021, a comparable difficult fork on the Cardano network brought about a 130% rate rise within a month. If background repeats itself, ADA can see extraordinary rate efficiency in September. Presently, ADA is trading at $0.35, below $0.40 simply 3 days earlier.

The Relocating Typical Merging Aberration (MACD) indication recommends that this current rate dip can be a purchasing chance for market individuals. The MACD is made use of to evaluate energy and assists investors recognize possible access and departure factors.

A favorable MACD analysis shows favorable energy, signifying a great time to get, particularly after a sag. An adverse analysis, alternatively, indicate bearish energy and a possible time to market.

Find Out More: 10 Ideal Altcoin Exchanges In 2024

For ADA, the MACD presently shows favorable energy. If this fad proceeds, the rate can rebound to $0.40 quickly, and if purchasing stress increases, it may also get to $0.44.

Nonetheless, there is a danger of invalidation if the difficult fork ends up being a “market the information” occasion, where the rate goes down complying with the expected occasion. Because instance, ADA’s rate can decrease to $0.32.

Please Note

According to the Trust fund Job standards, this rate evaluation short article is for educational functions just and must not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, yet market problems go through alter without notification. Constantly perform your very own study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.