The Bitcoin (BTC) market has actually just recently seen a significant change in the task of its lasting owners.

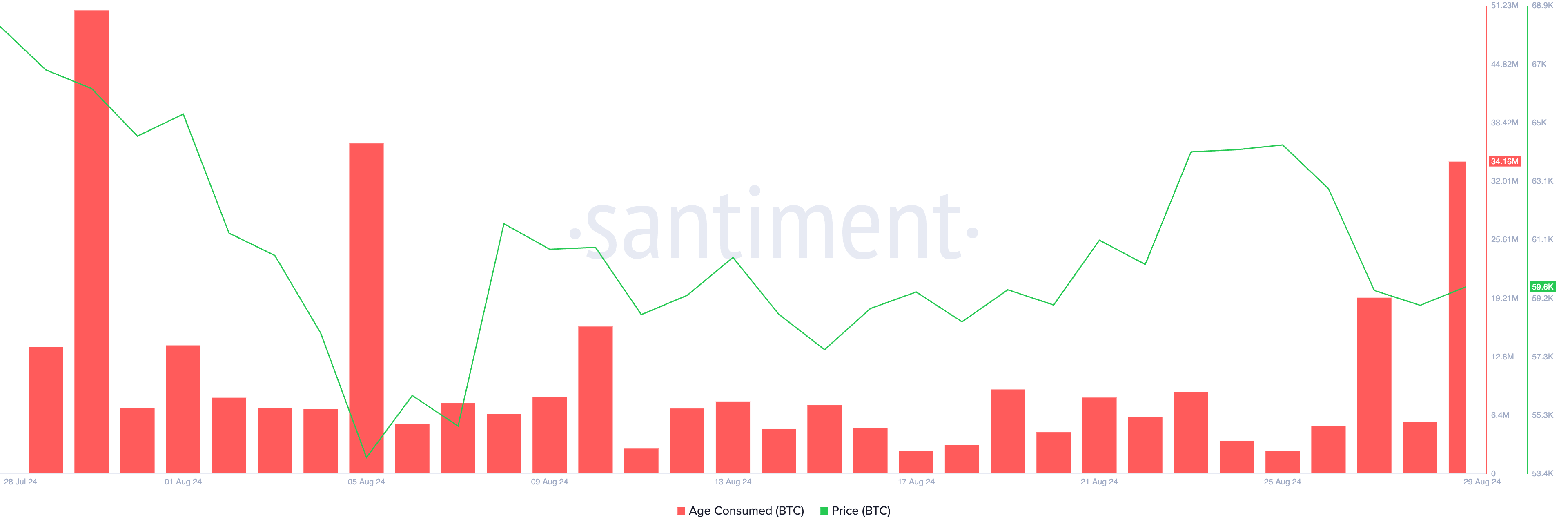

On Thursday early morning, there was a significant rise in the “age taken in” statistics, showing that financiers that have actually held their coins for an extensive duration are currently coming to be energetic once more.

Bitco in Long-Term Owners Are on the Relocate

According to Santiment, Bitcoin’s “age taken in” statistics increased to 34.16 million on Thursday early morning, noting the highest possible single-day degree considering that August 5, when a wider market slump caused over $1 billion in liquidations. The age taken in statistics tracks the activity of inactive coins by computing the moment they have actually been held prior to being relocated, increased by the variety of coins relocated.

Usually, lasting owners do not regularly relocate their coins, so a spike in this metric can frequently signify an upcoming change in market patterns.

Following this enter age taken in, Bitcoin experienced a 1% boost over the previous 24 hr. When a rate spike comes with a rise in age taken in, it can show that a neighborhood base. Nevertheless, the current 1% development isn’t adequate to verify this thesis.

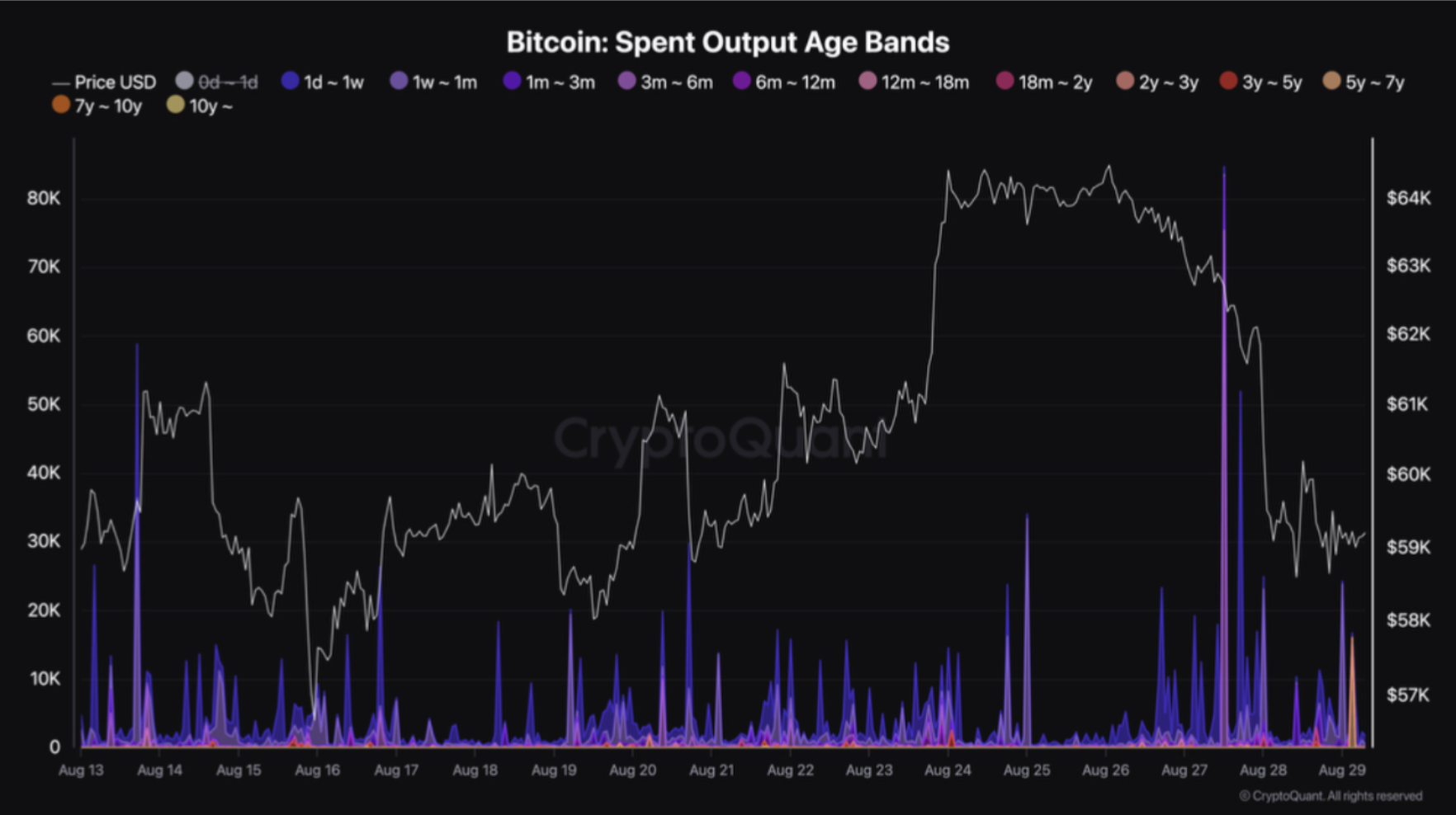

Additional evaluation of Bitcoin’s used result age bands discloses extensive circulation of coins by numerous owner associates over the previous couple of days. A report from Cryptoquant expert XBTManager highlighted substantial transfers, consisting of 7,788 coins aged 1 to 3 months and 75,228 coins aged 3 to 6 months on August 27.

The adhering to day, the marketplace saw the transfer of 19,067 coins aged one week to one month, in addition to smaller sized quantities of coins matured as much as 2 years. Today, investors have actually relocated 23,345 coins aged one week to one month, 1,220 coins aged 6 to twelve month, and 16,003 coins aged 5 to 7 years.

Find Out More: What Occurred at the Last Bitcoin Halving? Forecasts for 2024

” These transfers require to quit; or else, they will certainly remain to add to the decrease. When bitcoins that have actually stayed inactive for a very long time are relocated, it’s generally to prepare for something, and you might see them utilized for marketing. Transfers that take place at the correct time and area often tend to have an unfavorable influence on Bitcoin,” he kept in mind.

BTC Cost Forecast: A Rally Over $60,000 Is Feasible

At press time, Bitcoin is trading listed below its 20-day rapid relocating standard (EMA) at $59,640. This relocating standard, which tracks the coin’s typical rate over the previous 20 days, is a crucial indication of market belief.

When a property’s rate drops listed below its 20-day EMA, it commonly indicates a boost in offering stress.

Find Out More: Bitcoin Halving Background: Every Little Thing You Required To Know

If this marketing stress magnifies, Bitcoin threats shedding its gains from the previous 24 hr and might go down to $58,790. Nevertheless, if the coin takes care of to damage over its 20-day EMA, the restored acquiring energy might press its rate back over the $60,000 mark.

Please Note

In accordance with the Trust fund Job standards, this rate evaluation short article is for educational functions just and need to not be taken into consideration monetary or financial investment guidance. BeInCrypto is devoted to exact, honest coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and speak with a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.