Leading altcoin Ethereum has actually seen a substantial cost decrease. Presently trading at $2,551, ETH has actually visited over 20% in the previous month.

This slump has actually led Ethereum whales to slowly minimize their settings in the previous couple of weeks.

Ethereum Big Owners Excercise Care

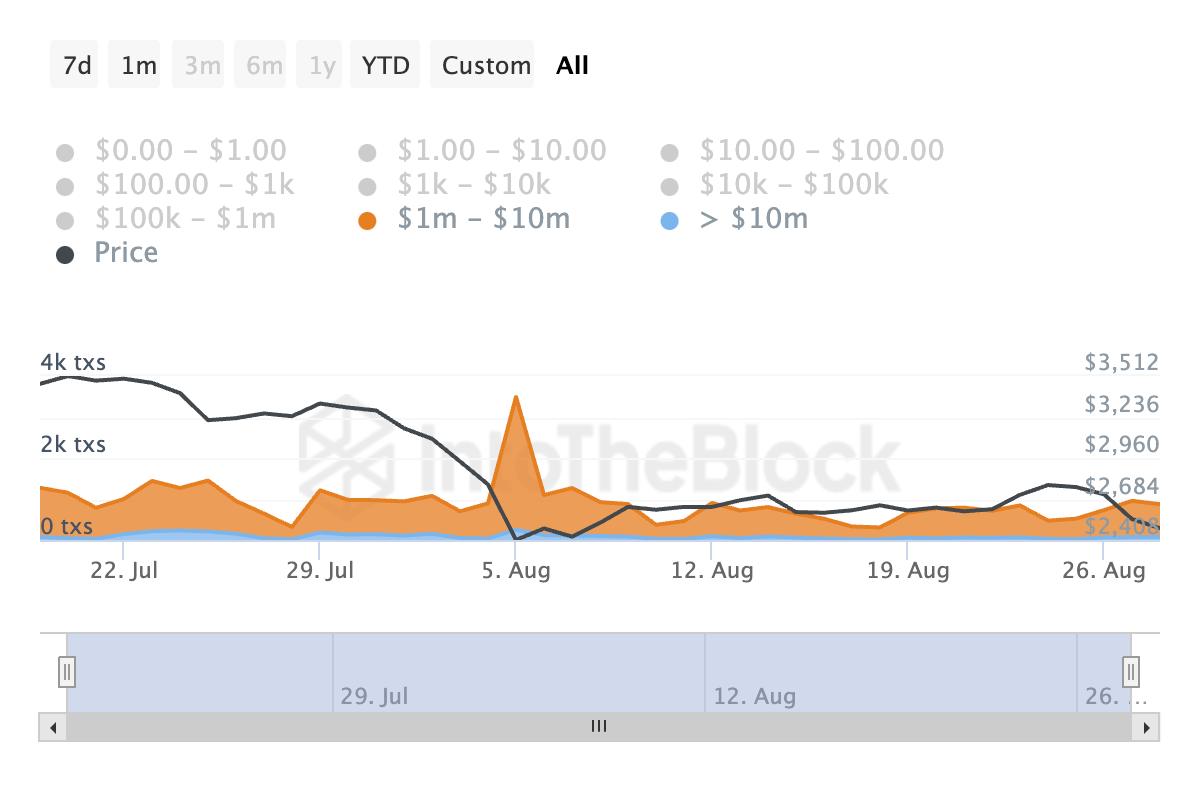

As a result of ETH’s double-digit cost decrease, ETH whales have actually lowered their trading task over the previous month. This can be obtained from the decrease in the coin’s big deal matter in the previous 1 month.

According to IntoTheBlock’s information, the everyday matter of ETH purchases worth in between $1 million and $10 million has actually visited 5% throughout this duration. At the exact same time, the everyday matter of bigger purchases valued over $10 million has actually dropped by 45%.

In addition, the netflow of big owners for Ethereum (ETH) has actually dropped by 77%. Big owners, or whales, are those that have over 0.1% of the possession’s flowing supply.

The big owners’ netflow determines the distinction in between the quantity of ETH that these whales get and the quantity they offer over a details duration.

Find Out More: Just How To Purchase Ethereum (ETH) With a Charge Card: A Step-by-Step Overview

When the big owners’ netflow statistics declines, it suggests whale circulation, which is commonly a bearish signal. This generally comes before additional cost decreases, as lowered whale task can adversely influence market view.

ETH Cost Forecast: Cost Eyes August 5 Lows

The bearish expectation for Ethereum (ETH) is strengthened by the configuration of its Allegorical Quit and Opposite (SAR) sign on the one-day graph. Presently, the sign’s dots are placed over the coin’s cost, indicating a sag.

The Allegorical SAR is a device made use of to determine prospective pattern instructions and turnarounds. When the dots show up over a possession’s cost, it suggests that the marketplace remains in a decrease which the possession’s cost might remain to drop.

In addition, Ethereum’s Relocating Typical Merging Aberration (MACD) is revealing bearish indications, with the MACD line (blue) nearing a cross listed below the signal line (orange). This crossover generally recommends a reinforcing drop, commonly analyzed by investors as a signal to think about offering or taking revenues.

Find Out More: Ethereum ETF Discussed: What It Is and Just How It Functions

If offering stress increases, ETH’s cost might go down towards its August 5 reduced of $2,112. Nonetheless, if the marketplace pattern changes and acquiring task grabs, the cost might possibly rally to $2,867.

Please Note

In accordance with the Depend on Task standards, this cost evaluation short article is for informative functions just and must not be taken into consideration economic or financial investment recommendations. BeInCrypto is devoted to precise, objective coverage, however market problems go through alter without notification. Constantly perform your very own study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.