TOKYO (AP)– Eastern shares primarily dropped Thursday as market interest transformed to upcoming information on the united state economic climate after Nvidia reported its financial results.

Nvidia, among numerous firms that have actually ridden a wave of interest over expert system advancements, reported revenues Wednesday.

The outcomes revealed a solid revenue, yet Nvidia supply dropped 2.1%, though it is up 153% for the year. The business is just one of one of the most significant supplies on Wall surface Road, with an overall market price covering $3 trillion.

Japan’s benchmark Nikkei 225 slid 0.4% to 38,220.34. Australia’s S&P/ ASX 200 decreased 0.4% to 8,042.10. South Korea’s Kospi dipped 0.8% to 2,667.65. Hong Kong’s Hang Seng dropped 0.5% to 17,608.50, while the Shanghai Compound went down 0.5% to 2,824.62.

Beliefs stayed careful also after the White House said Beijing and Washington will certainly prepare for a telephone call in the coming weeks in between Chinese Head of state Xi Jinping and United State Head Of State Joe Biden.

The White Home declaration claimed both sides would certainly maintain lines of interaction open. Fears are expanding recently concerning stress over Taiwan.

Financiers are expecting Friday, when the united state federal government launches its newest information on rising cost of living with the PCE, or individual intake and expenditures record, for July.

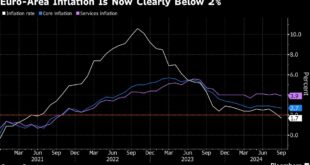

Economic experts anticipate the PCE, which is the Federal Get’s favored step of rising cost of living, to reveal that rising cost of living bordered as much as 2.6% in July from 2.5% in June. It was as high as 7.1% in the center of 2022. The price of rising cost of living has actually been alleviating progressively back towards the reserve bank’s target of 2% ever since, adhering to the Fed’s hostile rates of interest walks.

Wall Surface Road and the Fed are attempting to evaluate the resiliency of united state customers amidst the capture from rising cost of living and high interest rate. The reserve bank is anticipated to start cutting its benchmark rates of interest back from a two-decade high at its following conference in September.

Supplies on Wall surface Road shut reduced, as a pullback in huge modern technology firms exceeded gains somewhere else on the market. The S&P 500 dropped 0.6%, bore down by decrease in Nvidia, Apple, Microsoft and Amazon.

The Dow Jones Industrial Standard, which was coming off 2 successive all-time highs, dropped 0.4%. The Nasdaq compound, which is greatly heavy with modern technology supplies, shut 1.1% reduced.

All informed, the S&P 500 dropped 33.62 indicate 5,592.18. The Dow dropped 159.08 indicate 41,091.42. The Nasdaq dropped 198.79 indicate 17,556.03.

Treasury returns were blended in the bond market. The return on the 10-year Treasury climbed to 3.84% from 3.83% on Tuesday.

In power trading, benchmark united state crude climbed 16 cents to $74.68 a barrel. Brent crude, the global requirement, got 12 cents to $78.77 a barrel.

In money trading, the united state buck climbed to 144.52 Japanese yen from 144.44 yen. The euro price $1.1133, up from $1.1122.

___

AP Service Writers Damian J. Troise and Alex Veiga added. Yuri Kageyama gets on X:

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.