Bitcoin’s (BTC) cost led the crypto market’s collision over the last two days, and actually, the factor was the favorable view.

Nonetheless, when it concerns crypto, there is never ever simply one factor behind any type of case, and such holds true with BTC.

Bitcoin Financiers Are Hesitant yet Confident

Bitcoin’s cost touched the ground listed below the assistance of $60,000 after the marketplace transformed overtly favorable recently. According to Santiment, BTC kept in mind that hefty, lengthy agreements were opened up on dYdX on August 25, which is an indication that investors are demanding/expecting a rate surge.

Nonetheless, as kept in mind traditionally, huge lengthy or brief agreements usually prefer Bitcoin’s cost, taking the contrary course than what the investors desire. This is what occurred with BTC too, and the marketplace dropped by 7.5% in the adhering to two days.

Find Out More: What Occurred at the Last Bitcoin Halving? Forecasts for 2024

While this is one side of the coin, the various other is the anxiety of macro bearishness, which has actually developed from the current FOMC mins. In a special record shown to BeInCrypto, a 10X Study expert clarified the influence of Powell’s speech.

” Powell’s speech highlighted weak points in the labor market, indicating a dovish tone and indicating (possibility) substantial threats in advance. A few of the labor market information was simply modified reduced. This makes the coming week essential for danger properties as brand-new financial information will certainly be launched. Regardless of positive elements like business share buybacks, supplies, especially the Nasdaq, have actually battled to rally over the previous week,” 10x Study expert informed BeInCrypto.

This paints a somewhat bearish image for BTC as the marketplace waits for the launch of the Personal Usage Expenses (PCE) information. The assumption is a surge in the year-on-year PCE from 2.6% in June to 2.7%.

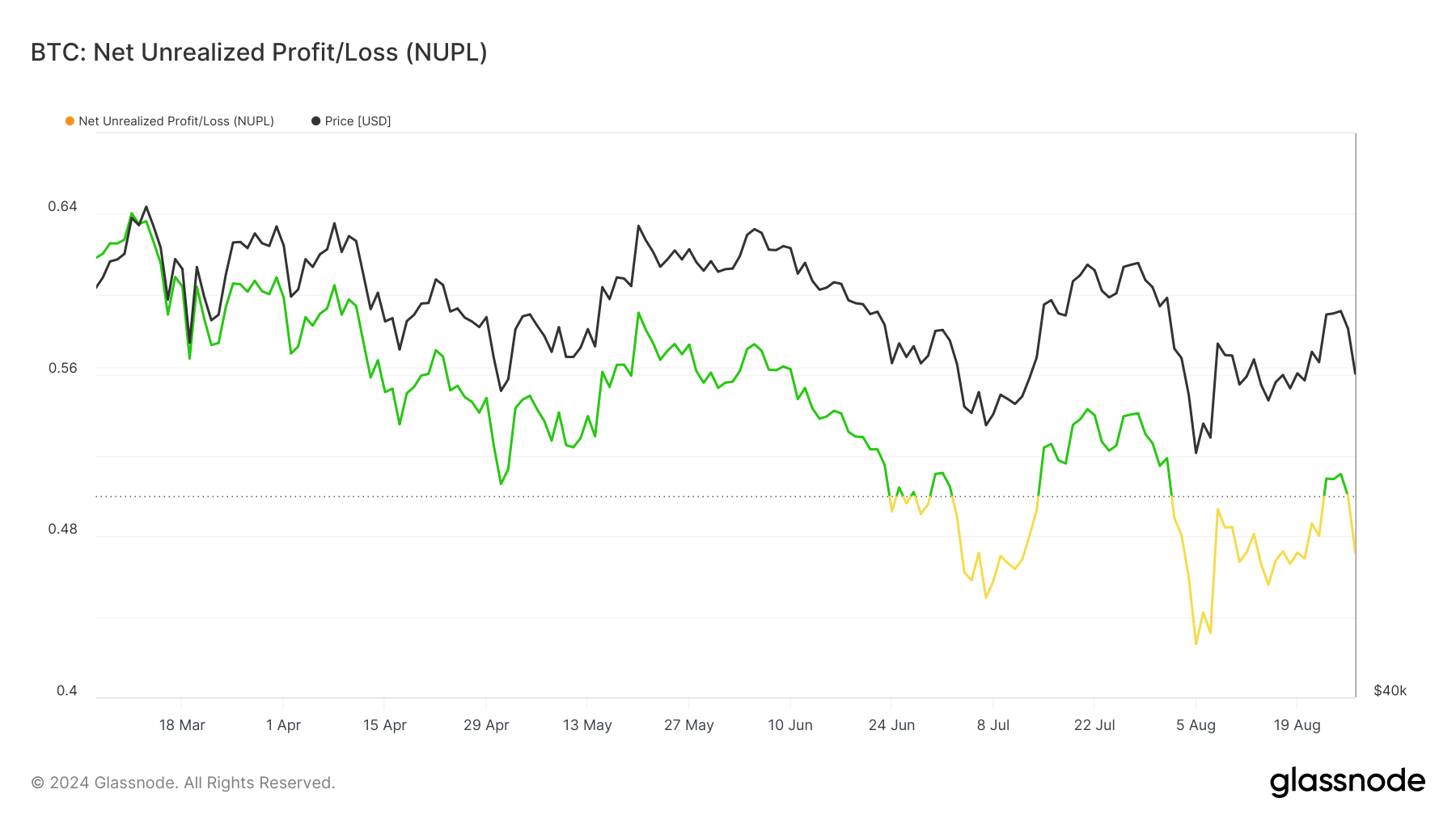

Nonetheless, also if the temporary bearishness effects Bitcoin’s cost, financiers are still hanging on to a surge. The Internet Latent Profit/Loss (NUPL) sign reveals that financiers are still confident regarding healing.

NUPL is an on-chain metric that determines the distinction in between latent revenues and losses throughout all Bitcoin holdings. It aids analyze whether the general market remains in a state of earnings or loss, suggesting possible market view changes.

Today, NUPL is dipping listed below 5.0 for the 2nd time this month. Throughout a bearish market, this dip generally represents that, in spite of the decrease, financiers still have a tip of Positive outlook.

This view will certainly maintain them from offering extremely presently, protecting against one more collision. Also if some BTC owners pick to do so, it would certainly not be substantial adequate to produce surges in the marketplace.

BTC Cost Forecast: Favorable Eyes Wide Open

Bitcoin’s cost, embeded a drop because mid-March, has in fact been confirming the favorable coming down wedge pattern. This pattern recommends that a 22% surge upon outbreak is likely, which would certainly take BTC to $84,111.

While this surge is challenging, the outbreak might absolutely cause the development of a brand-new all-time high past $73,800. This might spend some time, as the existing overview recommends a battle under $65,000.

Find Out More: Bitcoin Halving Background: Whatever You Required To Know

Nonetheless, the winds might transform if $65,000 is turned right into assistance, allowing a surge in the direction of $67,100. Crossing this degree might revoke the bearish-neutral thesis and lead BTC in the direction of healing.

Please Note

In accordance with the Depend on Task standards, this cost evaluation short article is for informative functions just and need to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to precise, objective coverage, yet market problems go through transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.