Solana’s (SOL) cost has actually come by 5% in the previous 24-hour, leaving owners wishing for a healing. Nevertheless, numerous indications recommend that a considerable rebound might not happen for numerous days or weeks.

Presently trading at $146.96, this evaluation lays out why SOL might deal with additional decreases in the short-term.

Solana Still Incapable to Quote Drop Farewell

On August 25, Solana (SOL) published a red candle holder on the everyday graph, complied with by an additional the following day. Presently, bulls are attempting to press the token towards $150. Nevertheless, the development of a rounding top throughout this duration recommends that getting to such degrees may be tough in the short-term.

A rounding top is a bottom-side-up U-shaped pattern that indicates the turnaround of a favorable fad right into a bearish one. In this pattern, a break listed below the neck line validates the bearish extension, while a break over it might revoke this expectation. For SOL, the cost is nearing the neck line at around $142.87.

Furthermore, the Bull Bear Power (BBP) sign, which determines the stamina of purchasers (bulls) versus vendors (bears), is presently in adverse area. This decrease recommends that offering stress is surpassing getting rate of interest, showing a prospective velocity of the sag.

Learn More: Solana vs. Ethereum: An Ultimate Contrast

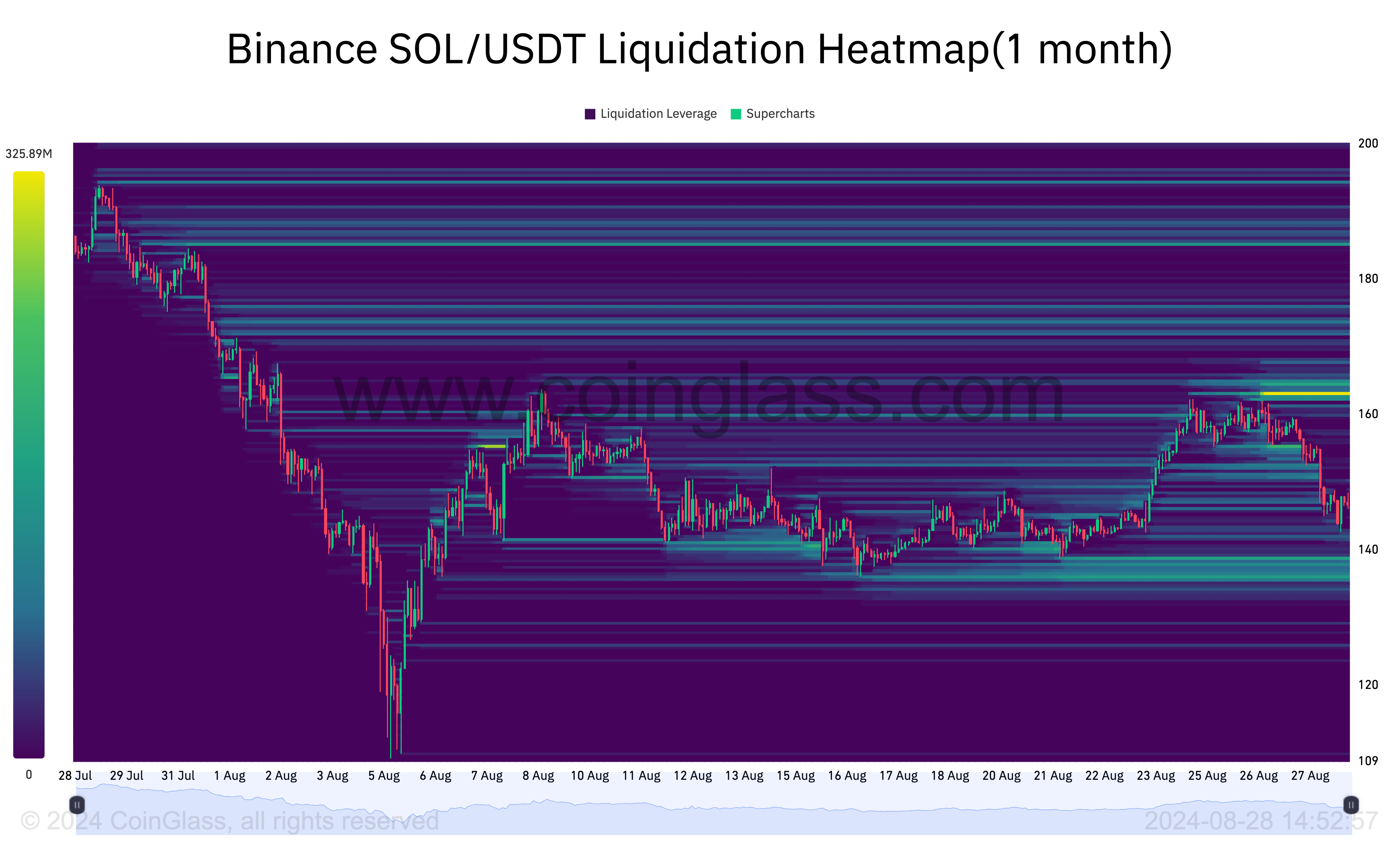

If the bearish expectation is verified, Solana’s (SOL) cost might come by about 8.80%, getting to around $130.09. In addition, the liquidation heatmap from the previous 1 month exposes a considerable focus of liquidity in between $130 and $138.

The liquidation heatmap highlights cost degrees where large liquidations are most likely to happen, making it an important device for recognizing assistance and resistance locations that might affect cost motion. Essentially, the higher the liquidity at a certain cost array, the greater the possibility that the cost will certainly relocate that instructions.

In Solana’s (SOL) situation, not enough acquiring stress might drive the cost to the $130 to $138 array. Nevertheless, the picture over likewise highlights a considerable liquidity focus near $162. If more comprehensive market problems boost, SOL’s cost might possibly approach this greater degree.

SOL Cost Forecast: Bears Maintain Control

An extra check out the everyday graph provides SOL’s possible cost targets according to the Fibonacci retracement sign. The Fib degrees, as it is generally called, determine assistance and resistance making use of a collection of proportions or series.

One of the most essential proportions in this sign consist of 23.6%, 38.2%, 50%, 61.8%, and 78.6% degrees. For a cryptocurrency’s cost to have an opportunity at striking the following proportion, it needs to initially go beyond the coming before one.

According to the graph below, SOL seems on the brink of moving listed below the 38.2% Fib, which lies at $142.09.

Learn More: Solana (SOL) Cost Forecast 2024/2025/2030

If offering stress escalates, Solana’s (SOL) worth might go down listed below $130, getting to the 23.6% small pullback degree at $129.85. On the other hand, if acquiring stress enhances, a rebound towards $161.87 ends up being a sensible opportunity.

Please Note

According to the Count on Task standards, this cost evaluation short article is for informative functions just and must not be thought about economic or financial investment suggestions. BeInCrypto is devoted to exact, impartial coverage, however market problems go through alter without notification. Constantly perform your very own research study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.