American property supervisor BlackRock has actually provided its Ethereum ETF (exchange-traded fund) on a Brazilian stock market, with trading readied to start on Wednesday, August 28.

The Brazilian market is progressively welcoming crypto ETFs, supplying institutional financiers with better accessibility to electronic properties. This growth notes one more action in the expanding approval of cryptocurrencies in standard monetary markets.

BlackRock Takes Ethereum ETF to Brazil

BlackRock has expanded its just recently released Ethereum ETF, recognized in the United States as iShares Ethereum Count on (ETHA), to the Brazilian market under the ticker ETHA39. This offering is readily available to Brazilian financiers via Brazilian Depositary Invoices (BDRs) traded on the B3 stock market. BDRs are certifications that stand for shares of international firms, making BlackRock’s ETHA39 an ETF BDR.

ETHA39 is valued at one-third of ETHA’s share, trading within the series of R$ 40 to R$ 50 ($ 7.26 to $9.07) with a monitoring cost of 0.25%. Nonetheless, BlackRock has actually momentarily decreased this cost to 0.12% on the very first $2.5 billion in AUM for a year.

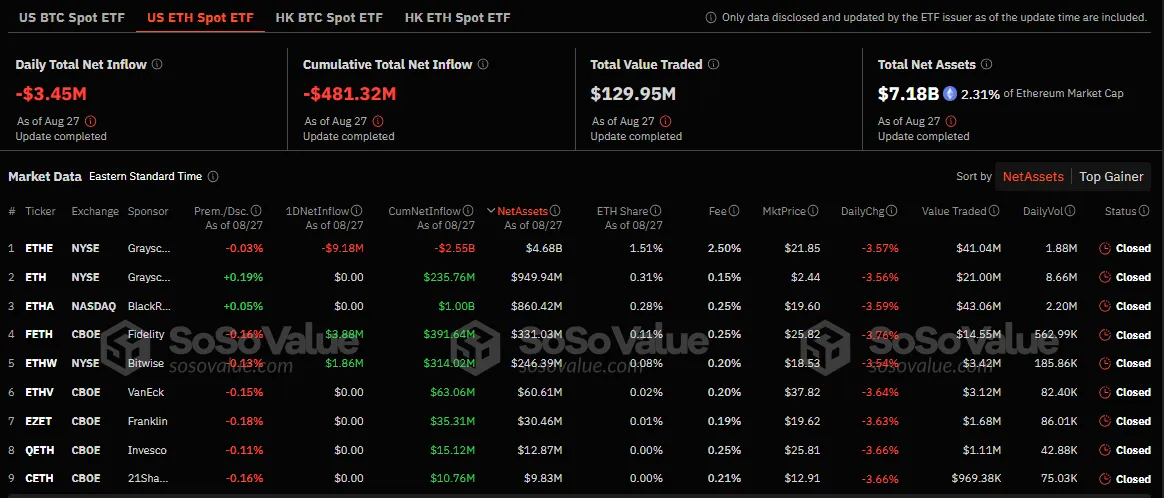

Just recently, BlackRock’s ETHA attained a vital landmark by coming to be the very first Ethereum ETF to exceed $1 billion in web inflows. In contrast, its rivals– Integrity’s FETH, Bitwise’s ETHW, and Grayscale’s ETH– videotaped web inflows of $367 million, $310 million, and $227 million, specifically.

Learn More: Just how to Buy Ethereum ETFs?

ETHA, BlackRock’s Ethereum ETF, presently holds $860 million in web properties. It exceeds Grayscale’s tiny Ethereum count on (ETH) and Ethereum count on (ETHE). Additionally, BlackRock’s Bitcoin fund has actually placed amongst the leading 5 ETFs by 2024 inflows, consisting of non-crypto ETFs, additionally strengthening BlackRock’s management in the marketplace.

Along with Ethereum, BlackRock additionally supplies an area Bitcoin ETF in Brazil, called IBIT39. Released in March complying with a site choice in January, IBIT39 is marketed as the BDR of BlackRock’s Bitcoin ETF.

” The launch of ETHA39 broadens the offering of electronic properties and streamlines financiers’ accessibility to a property that has the prospective to sustain a broad and varied series of blockchain applications,” claimed Cristiano Castro, BlackRock’s supervisor in Brazil.

While BlackRock’s growth of its crypto ETF profile in Brazil proceeds, Ethereum ETFs in the United States have actually been underperforming. Including in the current fad of discharges, Ethereum ETFs saw $3.45 million in web discharges on Tuesday.

In spite of the discharges, this growth highlights Brazil’s dedication to broadening electronic property gain access to for its financiers. Significantly, Brazil leads the United States around, having actually spearheaded the very first Solana ETF in very early August.

This monetary tool, provided on Brazil’s B3 stock market, currently started trading. With ETHA39 currently readily available together with IBIT39 and the QSOL11 Solana ETF, Brazil remains to place itself as a leader in the crypto ETF area.

Learn More: Ethereum ETF Described: What It Is and Just How It Functions

On the other hand, the course for Solana ETFs in the United States stays difficult. As reported earlier by BeInCrypto, current regulative activities recommend that authorization under the existing management is not likely.

” A snowball’s possibility in heck of authorization unless there’s a modification in management. Near-zero possibility in 2024, and if Kamala Harris wins, there’s most likely near-zero possibility in 2025, also. The only hope, in my viewpoint, is if Donald Trump wins,” Bloomberg ETF expert Eric Balchunas said

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to give exact, prompt info. Nonetheless, viewers are encouraged to confirm realities separately and seek advice from an expert prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.