Solana’s (SOL) cost has actually climbed up 5% over the previous week, relocating closer to the top line of its in proportion triangular. An effective outbreak over this line can indicate the begin of a favorable pattern.

The technological arrangement on the one-day graph recommends this circumstance is feasible.

Solana Efforts to Start a Favorable Fad

SOL started trading within the in proportion triangular pattern on July 29. This pattern types when a possession’s cost actions in between 2 assembling lines, suggesting a duration of market loan consolidation where purchasers and vendors complete for control.

An outbreak over the triangular’s top line signals that purchasers have actually taken the lead. As purchasing stress rises, the property’s cost usually remains to climb, expanding the uptrend.

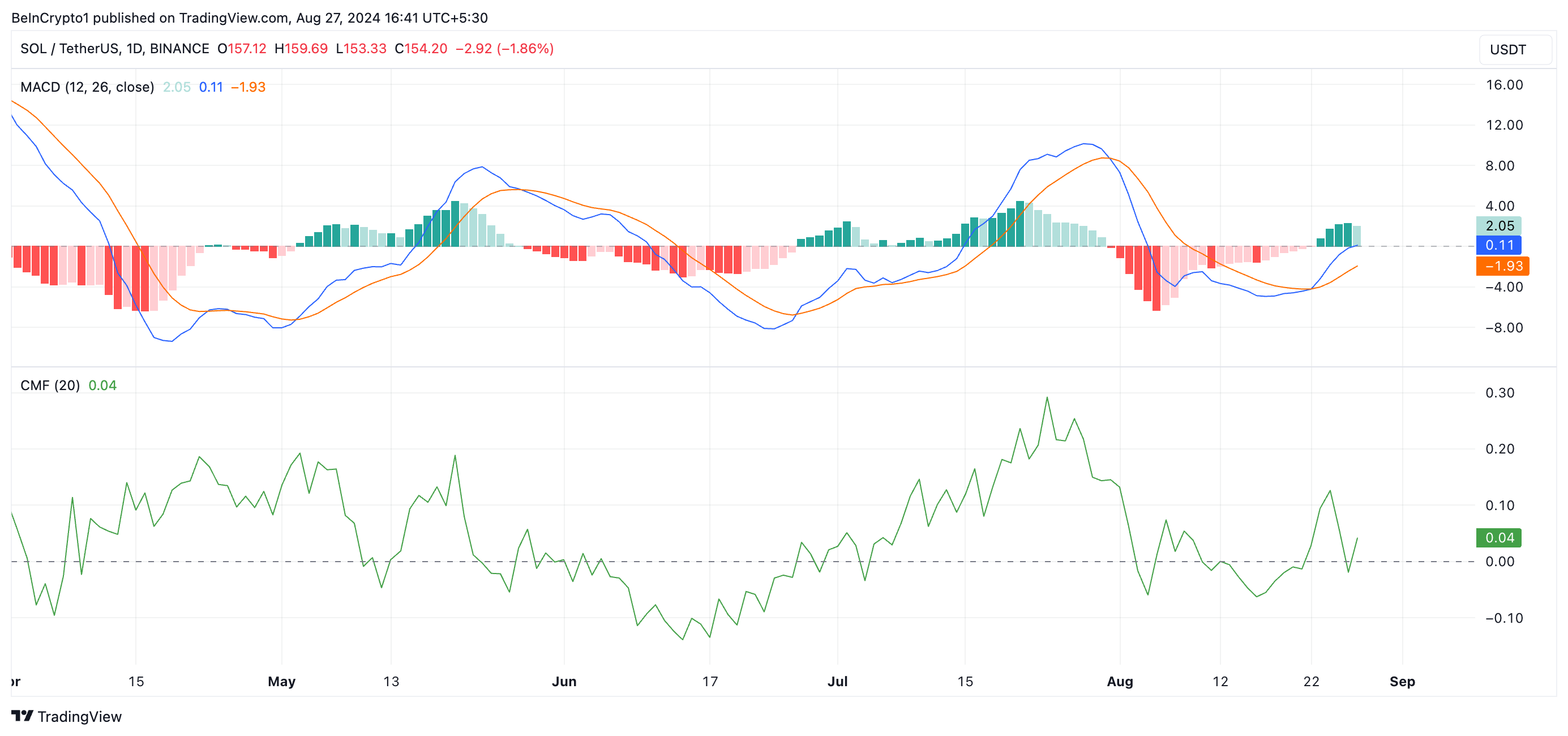

Analyses from SOL’s technological indications recommend a possible higher outbreak in the close to term. As an example, the Relocating Typical Merging Aberration (MACD) indication reveals the MACD line (blue) located over the signal line (orange) and coming close to the no line.

The MACD tracks a possession’s cost pattern, instructions, and energy changes. When the MACD line is over the signal line, it shows that purchasing stress is surpassing marketing, signifying reinforcing favorable energy. A rally over the no line validates the favorable pattern, motivating investors to leave brief settings and go long.

Find Out More: 11 Leading Solana Meme Coins to Enjoy in August 2024

In addition, SOL’s favorable Chaikin Cash Circulation (CMF) analysis strengthens this overview. At press time, the CMF is over the no line at 0.04.

The CMF determines the circulation of funding right into and out of a possession. A worth over no shows solid market need and favorable liquidity inflows, both of which are important for maintaining a cost rally.

SOL Cost Forecast: 12% Cost Rise Anticipated

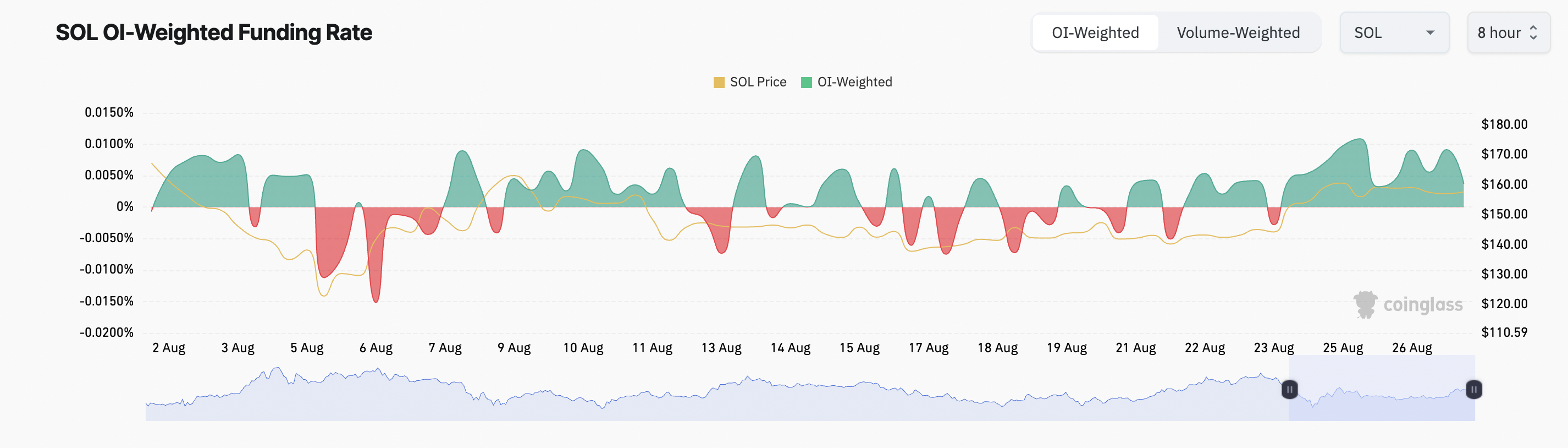

SOL’s financing price throughout cryptocurrency exchanges stays favorable, suggesting more powerful need for lengthy settings in its futures market. In continuous futures agreements, financing prices are repayments traded in between investors based upon the distinction in between the continuous agreement cost and the area cost.

When the financing price declares, investors with lengthy settings pay a cost to those holding brief settings. This vibrant recommends that even more investors are hopeful concerning SOL’s cost motion, expecting more gains and ready to preserve lengthy settings.

If SOL efficiently damages over the top line of the in proportion triangular, its cost can rally to $171.91, noting a 12% rise from its present worth. This outbreak would certainly indicate the extension of a favorable pattern, driven by enhanced purchasing stress and favorable market view.

Find Out More: 11 Leading Solana Meme Coins to Enjoy in August 2024

Nonetheless, if the marketplace pattern transforms bearish, SOL’s cost can be up to the reduced line of the in proportion triangular at $148.27.

Please Note

According to the Count on Task standards, this cost evaluation post is for informative objectives just and need to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to exact, honest coverage, yet market problems go through alter without notification. Constantly perform your very own study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.