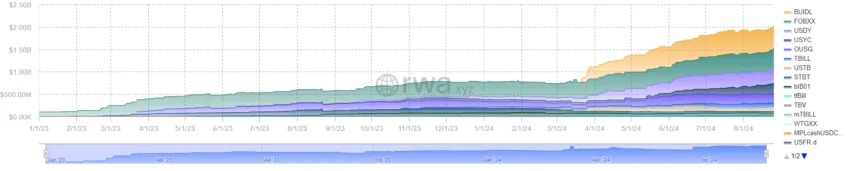

According to RWA.xyz information, the tokenized treasury market has actually just recently gotten to a considerable landmark. In simply 5 months, it has actually gone beyond a $2 billion market capitalization.

As this market remains to progress, journalism concern is: What exists in advance for tokenized treasuries?

Principal Driving the Tokenized Treasury Boom

The current rise in the tokenized treasury market is mainly credited to the outstanding efficiency of a number of principals. For example, since August 25, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) leads the marketplace with a capitalization of $502.67 million.

Adhering to carefully behind BUIDL are 2 various other significant items– Franklin Templeton’s Franklin OnChain United States Federal Government Cash Fund (FOBXX) and Ondo Money’s Ondo United States Buck Return (USDY). FOBXX has actually effectively caught a market capitalization of $425.46 million, while USDY has a market cap of $364.04 million. Past these significant gamers, various other substantial items in the marketplace consist of Hashnote’s United States Treasury Return (USYC) and Ondo Money’s Ondo Short-Term United States Federal Government Mutual Fund (OUSG), both of which significantly add to the staying market share.

Find Out More: What Are Artificial Possessions?

Tokenized treasuries stand for electronic variations of conventional United States Treasury safeties, enabling financiers to trade them flawlessly on public blockchains like Ethereum, Solana, and Stellar. This development improves ease of access for specific and institutional financiers, expanding the possible financier base by bring in worldwide individuals that might not have straight accessibility to United States Treasury markets.

Past the $2 Billion Mark: What’s Following?

Sector professionals are certain that the development trajectory of tokenized treasuries is much from over. The substantial capacity of this market is highlighted by the massive dimension of the wider United States Treasury safeties market, valued at $27 trillion since Might 2024, based upon Statistadata With such a considerable part of possessions yet to be tokenized, the chance for more development stays considerable.

21. carbon monoxide’s expert Tom Wan predicted that the tokenized treasury market might get to $3 billion by the end of the year. Raising rate of interest from decentralized independent companies (DAOs) and decentralized financing (DeFi) tasks will certainly drive this development. These entities are eager to incorporate tokenized United States Treasuries right into their profiles to accessibility secure, safe returns while staying within the blockchain community.

Eugene Ng, founder of OpenEden, declares this estimate. He highlights the expanding need for safe, high-yield financial investments in today’s financial setting.

” In a high interest-rate setting, the need for higher-yielding, safe possessions is solid. Tokenized Treasury costs, supplying affordable returns with the support of federal government safeties, are positioned to bring in substantial resources,” Ng said.

Kingsley Advani, owner and chief executive officer of Allo.xyz, additionally shared comparable views. He imagines a more comprehensive fostering of tokenized treasuries as component of a varied financial investment method within the DeFi community.

” We’re predicting an extremely solid Q4 this year. Stablecoins have to do with $200 billion. In TVL, we have treasuries at concerning a couple of billion bucks. Exclusive credit rating at concerning $10 billion. Treasuries, stablecoins, and personal credit rating are very early moving companies in the area, and we’ll see an extension of that,” Advani specified to BeInCrypto.

Certainly, the possible applications of tokenized treasuries prolong past simply financial investment. The ability to create DeFi items, like yield-bearing stablecoins backed by tokenized Treasury costs, stands for a considerable chance for the marketplace. These items might provide customers fringe benefits, such as balancing out deal costs, better improving the allure of tokenized treasuries.

Find Out More: RWA Tokenization: A Consider Safety and Trust Fund

In spite of the capacity, several see the tokenized treasury market’s trajectory will certainly additionally depend upon macroeconomic variables, consisting of rates of interest modifications. Nonetheless, a current report from study company Kaiko highlighted that in a situation where the Federal Get applies price cuts yet actual rates of interest stay secure, Treasuries, consisting of tokenized variations, could keep their allure because of their fundamental liquidity and safety and security. This element showcases the recurring significance of tokenized treasuries as a secure financial investment in unclear financial times.

Please Note

In adherence to the Count on Job standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to supply exact, prompt details. Nonetheless, viewers are encouraged to confirm realities individually and seek advice from an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.