The worth of Toncoin (BUNCH) dove after Telegram chief executive officer Pavel Durov was jailed on August 24. Presently trading at $5.38, heap has actually seen a 9% decrease in rate.

Regardless of the sell-off and profit-taking, an essential on-chain metric has actually blinked a buy signal, recommending a feasible rebound.

Toncoin Offers Dip for Interested Investors

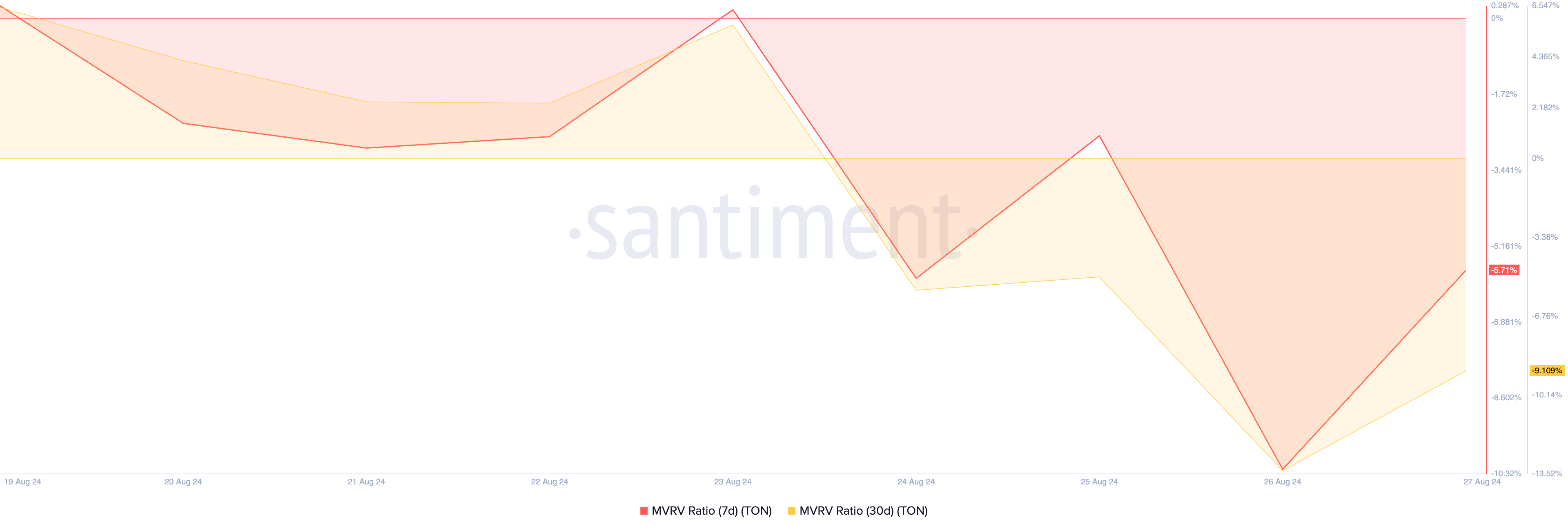

Toncoin’s (BUNCH) MVRV proportions, assessed throughout various relocating standards, recommend maybe a calculated time to get the altcoin. Information from Santiment reveals that the token’s 7-day and 30-day MVRV proportions presently stand at -5.71% and -9.10%, specifically.

The MVRV statistics contrasts a possession’s existing market value to the ordinary rate of its flowing symbols. An MVRV proportion listed below absolutely no shows undervaluation, implying the possession is trading listed below the ordinary procurement price of its flowing symbols.

Historically, an unfavorable MVRV proportion signifies a purchasing possibility, permitting market individuals to get properties at a reduced rate with the assumption of costing a greater worth later on.

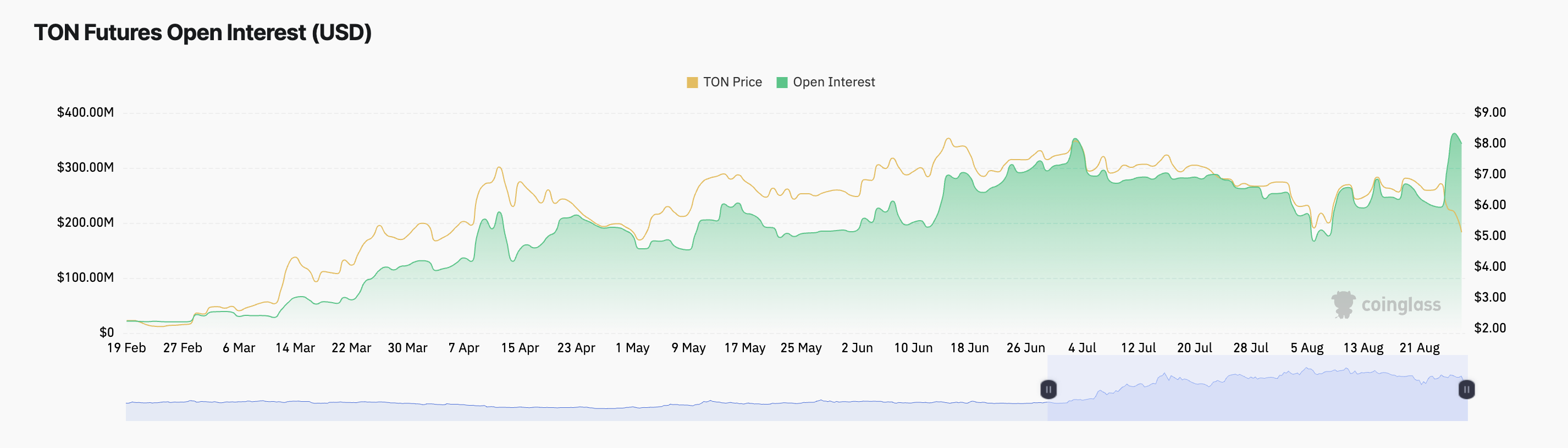

Furthermore, heap’s by-products market reveals durability regardless of the current difficulties. Climbing futures open passion and a favorable financing price throughout exchanges show consistent self-confidence amongst investors.

Presently, heap’s futures open passion stands at $345 million, up 46% considering that Durov’s apprehension. Futures open passion gauges the complete variety of uncertain agreements, and a rise shows expanding involvement from investors opening up brand-new settings.

Learn More: 6 Ideal Toncoin (BUNCH) Pocketbooks in 2024

In addition, heap’s favorable financing prices recommend enhancing need for lengthy settings. Regardless of the current rate decline, investors remain to prefer purchasing the possession. The current information reveals a financing price of 0.0074%, suggesting a bulk of investors expect a rate rally over a decrease.

Bunch Cost Forecast: Bearish View Stays in the Place Market

heap’s area investors have actually transformed progressively bearish considering that Durov’s apprehension. The token’s technological indications highlight a rise in offering stress, outweighing purchasing task.

For example, heap’s Directional Motion Index (DMI) reveals the favorable directional indication (+ DI) listed below the adverse directional indication (- DI), indicating a solid sag and increased marketing stress.

In addition, the token’s Loved one Stamina Index (RSI) emphasizes the bearish energy. Because the apprehension, heap’s RSI has actually gone down from a neutral 50 to 36.98, nearing the oversold area, suggesting raised marketing task.

Learn More: What Are Telegram Bot Coins?

If offering stress lingers, heap’s worth can go down to $4.73. Alternatively, a favorable change may drive the rate as much as $5.47.

Please Note

According to the Count on Task standards, this rate evaluation post is for educational functions just and need to not be thought about economic or financial investment guidance. BeInCrypto is dedicated to exact, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.