In spite of crypto whales unloading big quantities of Ethereum (ETH), the possession’s strong advocates continue to be positive. Current information highlights a fad of stakeholders relocating big quantities of ETH, most likely offer for sale, in the middle of a basic decline in crypto possession costs.

Additionally, the area Ethereum ETFs have actually been tape-recording discharges for the previous 8 trading days.

Crypto Whales and Institutions Relocate ETH to Centralized Exchanges

Throughout today, significant motions have actually recorded the interest of market experts. Area On Chain reported that a whale’s budget, determined as 0x46c, moved 5,088 ETH– valued at concerning $13.66 million– from Potion to a down payment address at Binance.

” Especially, the whale took out those ETH symbols from Binance at $3,393 typically (approximated expense: $17.3 million), primarily in between March 28 and April 3, 2024. If really marketing currently at $2,682, the whale would certainly understand an approximated loss of $ 3.62 million (-21%) after 5 months,” Area On Chain mentioned.

Find Out More: Just How To Assess Cryptocurrencies with On-chain & & Essential Evaluation

In an additional purchase, a capitalist linked to budget 0x75b moved 8,825 ETH to Binance, worth around $24.07 million, noting an almost 23% loss.

Simultaneously, an additional entity believed to be related to Brownish-yellow Team relocated 6,443 ETH to Binance and Sea serpent. Additionally, an additional address that apparently comes from Cumberland relocated 6,439 ETH worth $17.66 million to Binance.

Normally, crypto entities relocate funds to central exchanges for the function of marketing them.

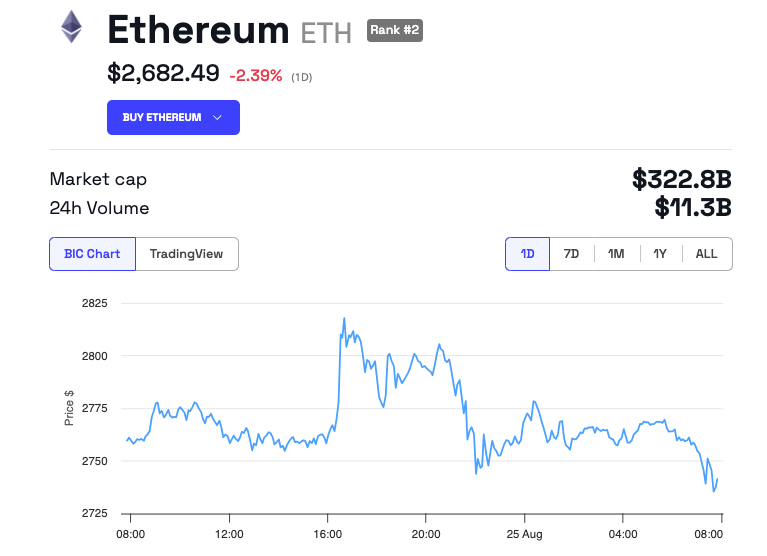

These motions of crypto whales and establishments have actually jointly presented virtually $73 million well worth of marketing stress right into the marketplace. In the middle of these sell-offs, Ethereum’s cost has actually lowered a little by 2.39% in the last 24-hour. It is presently trading at $2,682.49.

Ethereum exchange-traded funds (ETFs) have actually additionally seen substantial discharges, with a web discharge of $13.23 million on Monday alone. This expands the discharge streak to 8 days, completing around $112 million.

Nevertheless, the neighborhood view continues to be extremely favorable. Prominent numbers like Ryan Adams remain to promote the blockchain’s possible and future strongly. Adams has actually mentioned the staminas of Ethereum and its decentralized financing (DeFi) environments, recommending a brilliant future in advance.

” DeFi is amazing. ETH is an extraordinary possession. Ethereum is among one of the most vital systems in the world. Vitalik’s management and vision are remarkable. L2 groups are definitely squashing. DeFi is developing solid. The most effective is yet ahead,” Adams said.

Additionally, Vitalik Buterin, Ethereum’s founder, lately resolved worries concerning the system’s practicality in a challenging market. He additionally stressed Ethereum’s strong principles and kept in mind enhancements in purchase effectiveness on Layer-2 options.

Find Out More: That Is Vitalik Buterin? A Comprehensive Take a look at Ethereum’s Founder

The excitement is additionally sustained by the expectancy of Ethereum’s upcoming Pectra Upgrade. Arranged for very early 2025, this significant upgrade is anticipated to reinforce both the implementation and agreement layers of the network. Planned

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to supply exact, prompt details. Nevertheless, visitors are recommended to confirm realities separately and talk to a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.