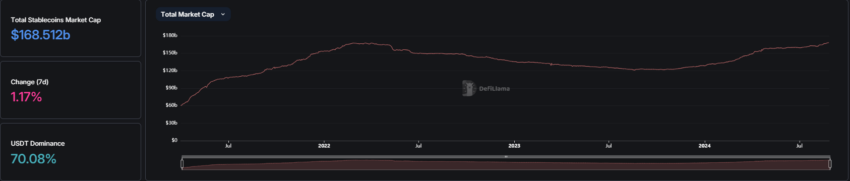

The stablecoin market has actually gotten to a brand-new landmark, with complete market capitalization establishing a brand-new all-time high document.

This success is driven by a mix of technical development, regulative clearness, and boosted institutional fostering.

USDT and USDC Preponderate Amidst Arising Stablecoin Rivals

DefiLlama information reveals that, since August 26, stablecoin market capitalization (leaving out mathematical) has actually gotten to an unmatched $168.51 billion. Tether’s USDT controls the marketplace, as confirmed by its market cap of over $117 billion. This makes up almost 70% of the complete market cap.

Circle’s USDC has actually additionally seen consistent development. While still listed below its height in 2022, USDC got to over $34 billion in market capitalization in August 2024. With each other, these 2 stablecoins make up the lion’s market share, showing their essential function in the more comprehensive crypto environment.

Learn More: What Is a Stablecoin? A Novice’s Overview

Although USDT and USDC stay the leading pressures, brand-new participants like PayPal’s PYUSD and First Digital USD (FDUSD) are additionally getting grip. BeInCrypto reported that PYUSD’s market capitalization had actually exceeded the $1 billion mark last weekend break. This landmark is specifically notable, considered that PayPal introduced PYUSD one year back.

Among the vital chauffeurs behind this rise is its assimilation with the Solana blockchain in Might 2024. This step opened up brand-new chances for customers in Solana-based DeFi procedures, which provide appealing motivations, such as 20% yearly returns for PYUSD down payments.

At The Same Time, FDUSD has actually experienced impressive development in Binance– the biggest worldwide crypto exchange by trading quantity. Released in June 2023, FDUSD’s market share on Binance got to an all-time high of 39% by the end of July 2024.

According to a current report by research study company Kaiko, this rise was sustained by Binance’s critical reintroduction of zero-taker costs for the FDUSD trading set. Subsequently, this step considerably increased its day-to-day profession quantity to approximately $6.5 billion.

” Nevertheless, FDUSD’s success is greatly dependent on Binance, as it is exclusively traded on the system and very closely linked to its charge plans,” experts at Kaiko warned.

Learn More: Stablecoin Laws Around The Globe

Beneficial regulative growths additionally pressed the development of the stablecoin market. For example, in the European Union (EU), the intro of the marketplaces in Crypto-Assets (MiCA) structure in June 2024 given much-needed clearness for stablecoin companies.

This regulative clearness has actually urged even more institutional engagement, with significant gamers like Circle getting required licenses to run within the EU. In addition, typical banks, such as Deutsche Financial institution’s DWS, have actually revealed strategies to introduce controlled stablecoins, better legitimizing the marketplace.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to supply precise, prompt details. Nevertheless, viewers are recommended to confirm truths individually and seek advice from a specialist prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.