The variety of Bitcoin (BTC) millionaires has actually risen by 111% this year, driven greatly by the increase of crypto exchange-traded funds (ETFs).

The authorization of area Bitcoin ETFs, complied with by Ethereum (ETH) ETFs, has actually brought in institutional gamers to crypto, developing a new age of need past retail capitalists.

Bitcoin ETFs Gas Boost in BTC Millionaires

According to research study by Henley & & Allies, there are currently 85,400 Bitcoin millionaires worldwide, mirroring a 111% rise in simply a year. The record associates the increase in crypto elites to the influence of ETFs, keeping in mind that these economic tools have actually strengthened Bitcoin’s condition as “electronic gold.”

” The overall market price of crypto possessions has actually currently gotten to a shocking $2.3 trillion, an 89% rise when contrasted to the $1.2 trillion reported in the company’s inaugural record in 2014. The top tiers of crypto riches have actually additionally increased significantly, with the variety of crypto centi-millionaires (those with crypto holdings of $100 million or even more) climbing by 79% to 325, and also the rarefied associate of crypto billionaires seeing a 27% rise to 28 worldwide,” a passage in the record read.

Find Out More: Exactly How To Get Bitcoin (BTC) and Whatever You Required To Know

Past Bitcoin, Ethereum is additionally getting interest, with 172,300 individuals around the world holding over $1 million in crypto possessions. The record highlights a 95% rise in ETH millionaires given that in 2014’s inaugural searchings for, enhancing Ethereum’s duty as a keystone of the marketplace.

Wide range Proficiency creator Lark Davis commends the blockchain for working as a structure for countless tasks, strengthening its significance in the crypto community.

” Most of what is integrated in crypto is improved Ethereum, based upon Ethereum, or bridges liquidity back to Ethereum,” Davis kept in mind.

Dominic Volek, Team Head of Exclusive Customers at Henley & & Allies, additionally stressed the expanding expectancy for Solana ETF. He kept in mind that these economic tools have actually triggered a brand-new period of crypto fostering, where electronic possessions significantly converge with typical financing (TradFi) and international flexibility.

Bitcoin Safeguards Its Digital Gold Condition

At the same time, institutional passion in crypto markets remains to expand. The intro of Bitcoin and Ethereum ETFs has actually driven both retail and institutional need, with the resulting purchasing stress adding to the worth rise in cryptocurrencies.

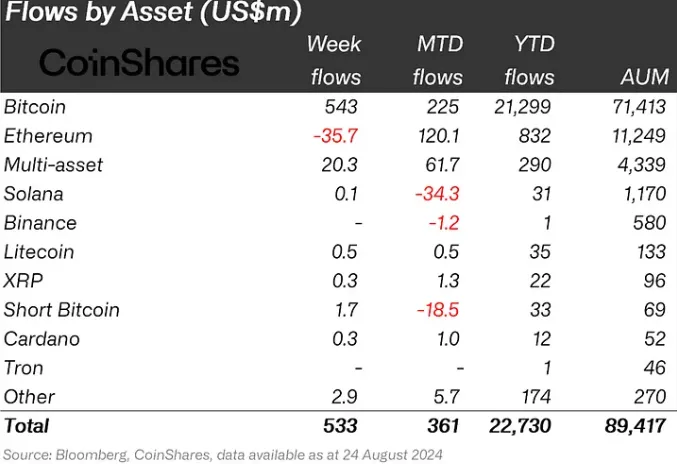

After the January authorization, Bitcoin got to a brand-new all-time high over $73,000, while Ethereum briefly touched the $4,000 emotional degree. According to BeInCrypto, need stays solid, with crypto financial investments amounting to $533 million recently. Bitcoin led the inflows with $543 million, while Ethereum encountered decreases, partially because of Grayscale client redemptions.

Nonetheless, raising funding inflows right into crypto financial investment items highlight the expanding acknowledgment of electronic possessions, additionally strengthening Bitcoin’s condition as a legit financial investment.

Mirroring this passion, Bitcoin ETFs saw internet inflows of $200.4 million on Monday, noting the 8th straight day of favorable gains. On the other hand, Ethereum ETFs experienced internet discharges amounting to $13.2 million.

Find Out More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

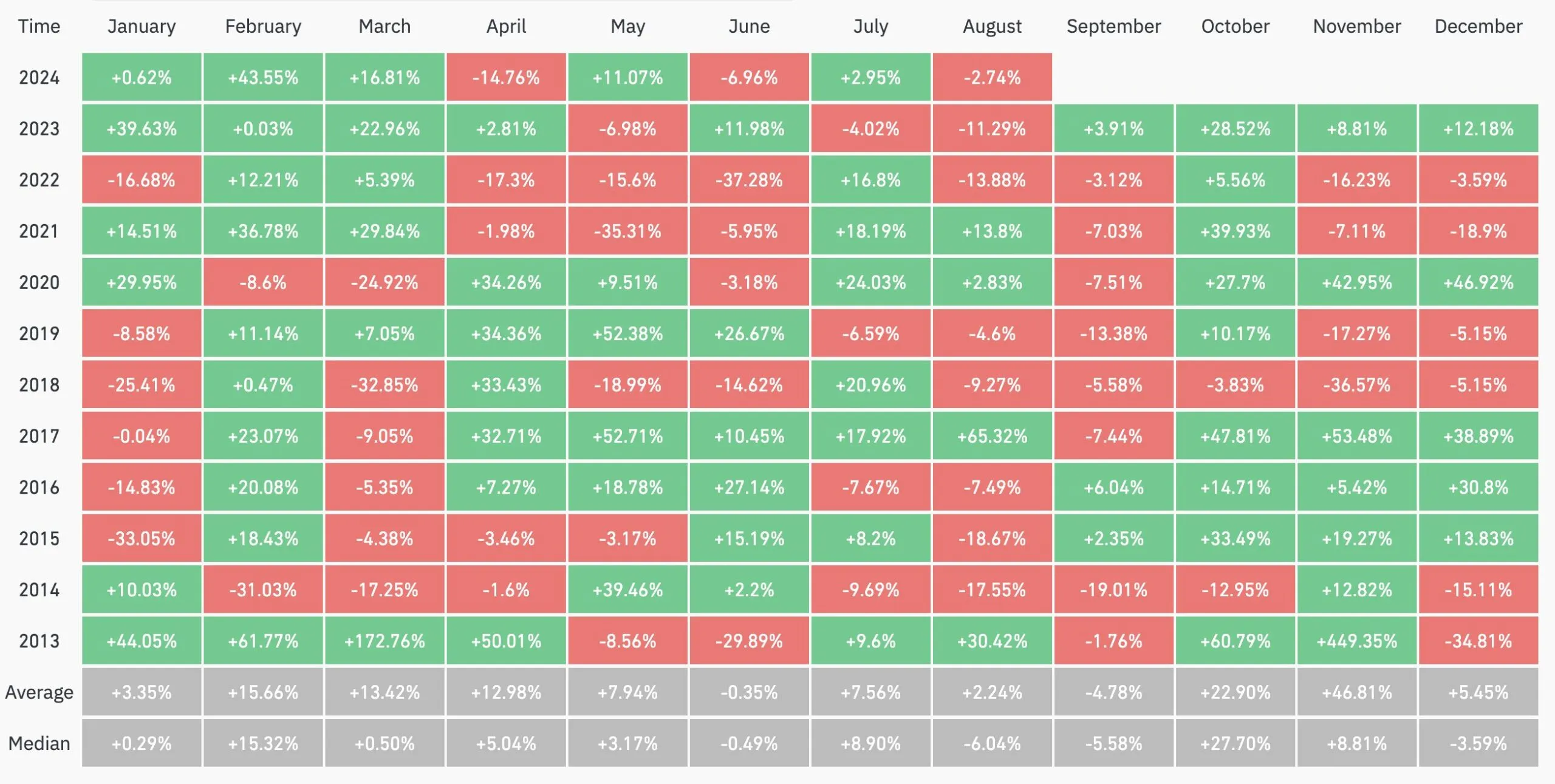

While this pattern has actually added to Bitcoin’s current cost rise and triggered expert conjecture regarding a possible booming market, it is very important to keep in mind that September is traditionally Bitcoin’s worst-performing month.

BeInCrypto information reveals Bitcoin is trading for $62,235, down 2.42% given that the Tuesday session opened up.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give exact, prompt details. Nonetheless, viewers are encouraged to validate realities individually and seek advice from an expert prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.