Over the previous one month, 62,699 ETH, valued at $172 million at present market value, have actually been included in the leading altcoin’s flowing supply.

The flowing supply currently stands at 120.30 million ETH, noting its highest degree given that the year started.

Ethereum Sees Decrease in Task and Shed Price

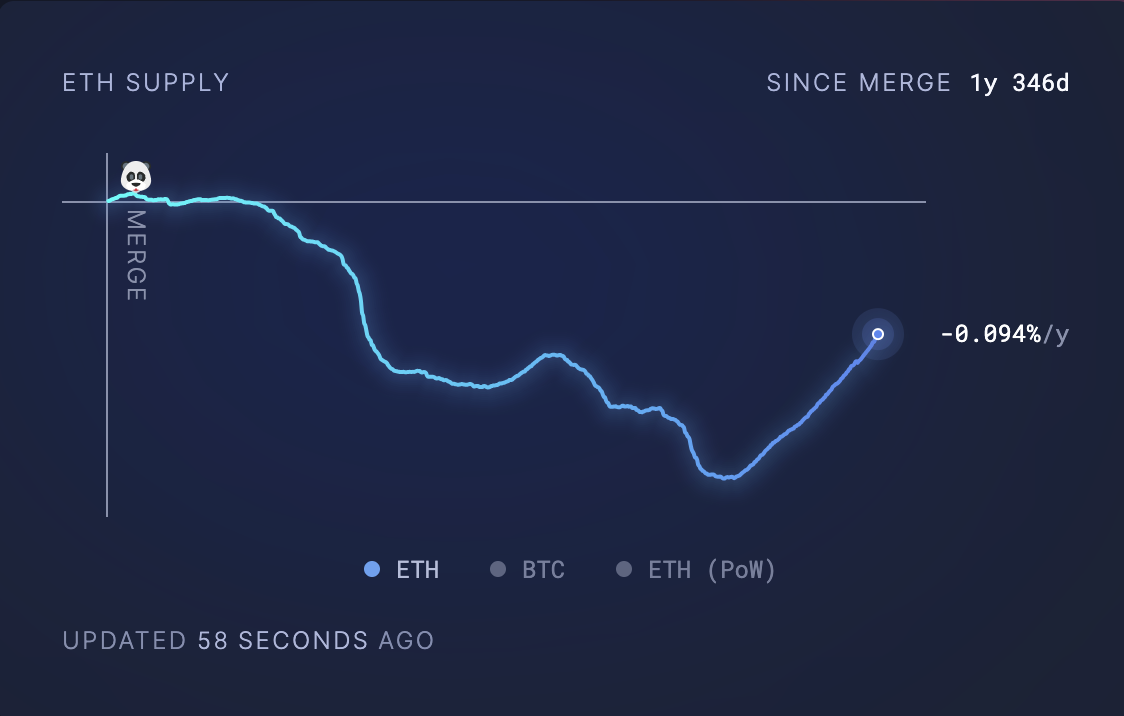

According to information from Ultrasound.money, ETH’s flowing supply has actually progressively increased given that April 14.

A property’s flowing supply describes the variety of coins or symbols readily available to the general public. It raises when a lot more symbols appear for trading. In Ethereum’s instance, this supply development occurs when the network witnesses a need decline, lowering the shed price.

Normally, as even more customers negotiate and involve with Ethereum, the shed price– determining ETH symbols completely gotten rid of from blood circulation– boosts, driving Ethereum’s deflationary supply dynamic. Nevertheless, when customer task declines, the shed price additionally decreases, leaving even more coins in blood circulation and broadening the flowing supply.

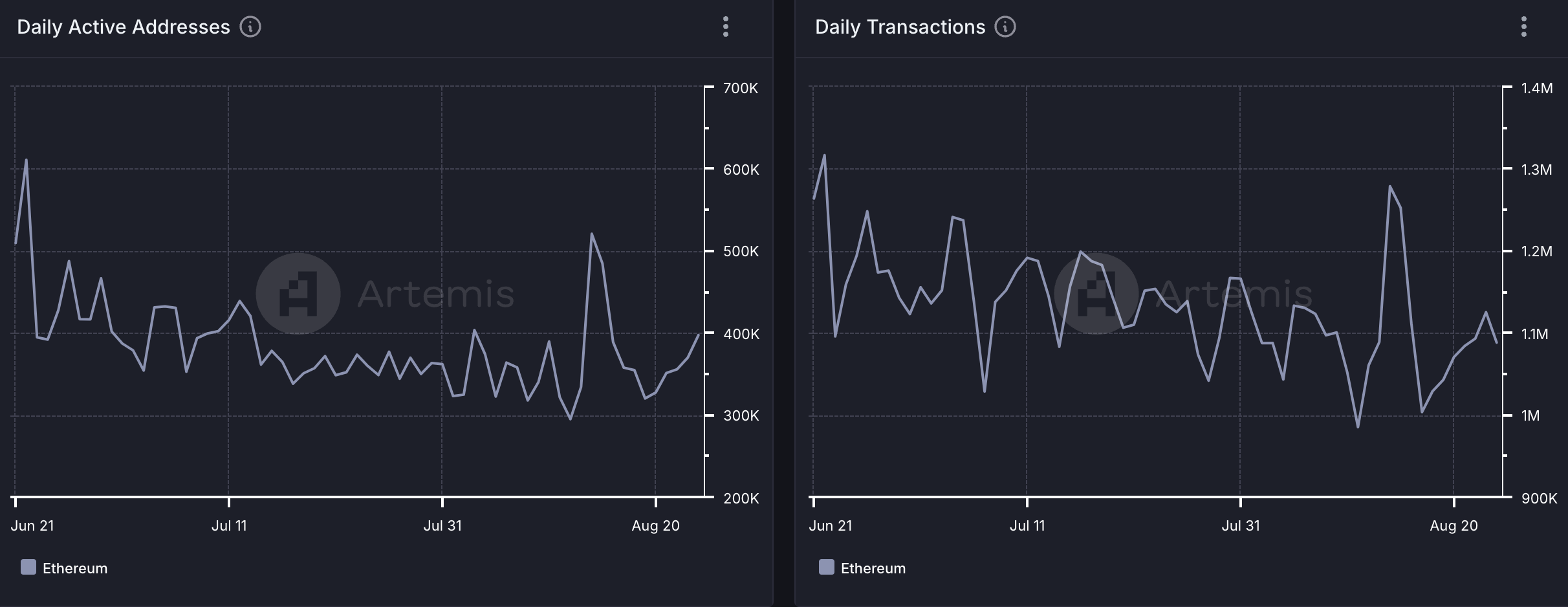

Customer task on Ethereum has actually been trending downward in current months. Information from Artemis exposes that given that everyday energetic addresses came to a head at 611,000 on June 22, the variety of customers on Ethereum has actually reduced by 37%.

Find Out More: Exactly how to Purchase Ethereum ETFs?

Consequently, the variety of everyday deals finished on the network has actually additionally dived. Per Artemis, given that reaching a high of 1.3 million on June 22, the everyday matter of special on-chain communications with Ethereum has actually reduced by 15%.

ETH Cost Forecast: Customers and Vendors Take A While Off

When even more ETH symbols go into blood circulation, the general supply readily available for acquisition usually raises. This can result in a rate decrease if supply exceeds need. This situation has actually unravelled as ETH battles to damage over the $3,000 cost mark given that the start of the month.

At press time, ETH professions at $2,742, mirroring a 15% decline over the previous one month because of the wider market slump. Nevertheless, in current days, the marketplace has actually maintained, revealing a loved one equilibrium in between trading stress. This is shown by the level Family member Toughness Index (RSI).

Find Out More: Ethereum (ETH) Cost Forecast 2024/2025/2030

When a property’s RSI is level, it suggests that it is neither overbought neither oversold, recommending a duration of market indecisiveness or combination. When this occurs, investors are awaiting a driver to cause either a purchasing or marketing spree.

A rise in buildup can press ETH towards a rate target of $2,867. On the other side, enhanced circulation could drive it to $2,535.

Please Note

In accordance with the Depend on Task standards, this cost evaluation short article is for informative objectives just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to precise, impartial coverage, however market problems go through transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.