On Sunday, Tron (TRX) owner Justin Sunlight revealed that the area has actually accepted increasing the network’s power cap to 120 billion. This was needed complying with recently’s blockage as a result of task on SunPump system.

This choice has actually created TRX’s cost to climb up by practically 5% over the previous 1 day to strike a 3-year high of $0.16.

Tron Encounters Unpredictability Amidst Market Volatility

By raising Tron’s energy cap, individuals can currently refine even more deals on the network at lowered charges. This favorable growth has actually resulted in a rise in the need for TRX over the previous 1 day. Its everyday trading quantity has actually risen by 46% to get to $923 million throughout that duration.

At press time, the altcoin traded at $0.16, seeing a 4% cost uptick. The last time TRX traded at this cost degree got on May 27, 2021. Over the previous 7 days, the altcoin’s cost has actually climbed up by 22%.

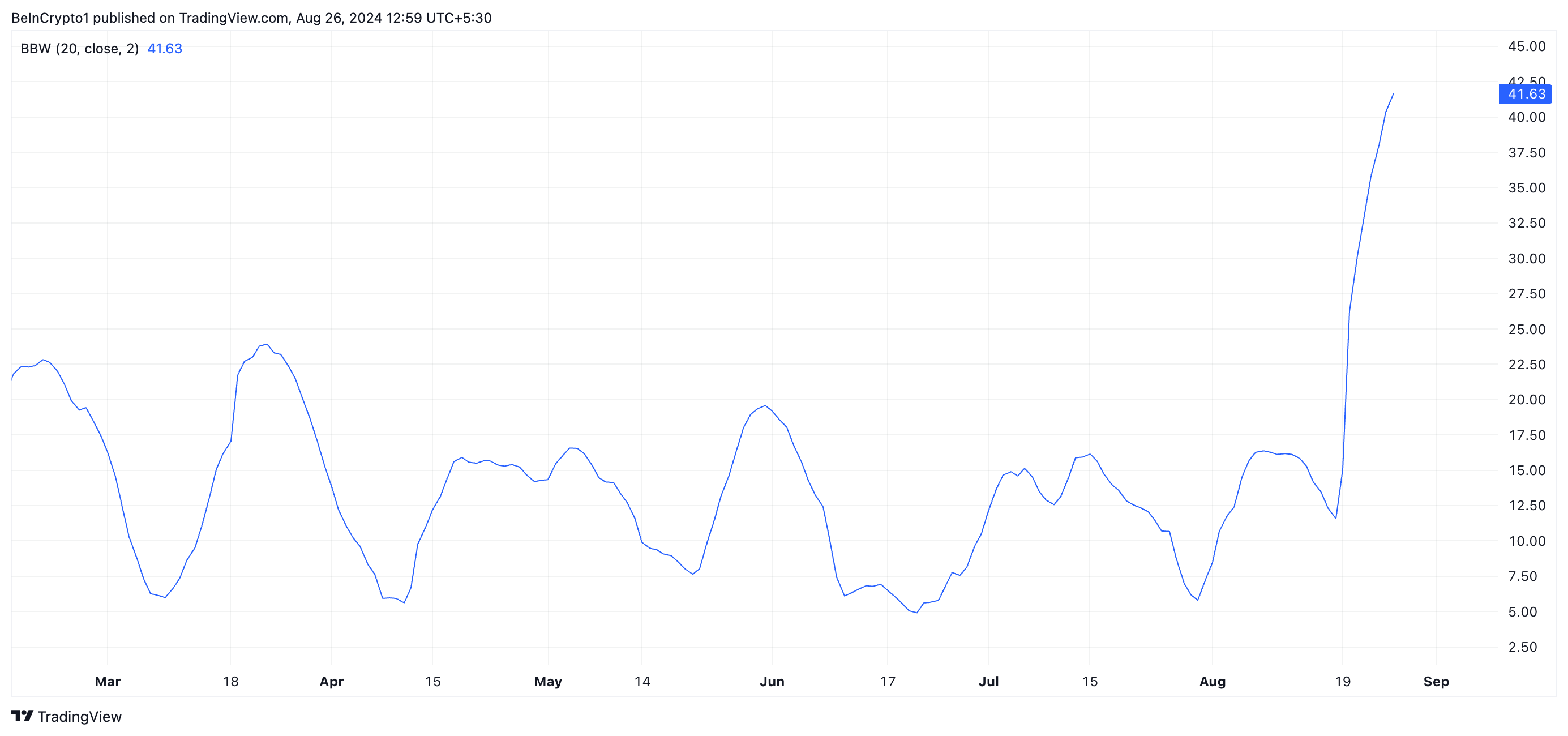

Nevertheless, TRX’s cost rally has actually been gone along with by a huge rise in market volatility, as confirmed by the broadening void in between the top and reduced bands of its Bollinger Bands indication.

This indication determines market volatility and determines possible overbought or oversold problems. The top band stands for the greater variety of a property’s cost activities, while the reduced band tracks the reduced array. When the void in between these bands expands, it recommends that market volatility has actually raised.

Even more, TRX’s Bollinger Transmission capacity– which aids investors assess the marketplace’s volatility and recognize possible outbreak possibilities– has actually increased to its highest degree because June. Since this writing, the coin’s Bollinger Transmission capacity is 41.63, having actually raised by over 250% in the previous 7 days.

A climbing data transfer such as this suggests that TRX’s bands are much apart, validating high market volatility.

Find Out More: What Is TRON (TRX) and Just How Does It Function?

TRX Cost Forecast: Keep An Eye Out For Purchasers’ Fatigue

The TRX token is presently in overbought area, which signifies an enhanced chance of a cost improvement. The Family Member Stamina Index (RSI) for TRX presently rests at 76.67.

The RSI is a preferred device that evaluates whether a property is overbought or oversold, with analyses in between 0 and 100. An RSI over 70 commonly suggests an overbought problem, which commonly comes before a pullback. On the other hand, an RSI listed below 30 recommends oversold problems, meaning a possible bounce.

At its existing RSI of 76.67, TRX suggests that purchasers are ending up being tired, making a cost dip most likely in the close to term.

Find Out More: TRON (TRX) Cost Forecast 2024/2025/2030

If this occurs, TRX’s cost might be up to $0.14, a 13% loss from its existing worth. Nevertheless, if the bulls handle to protect the rally and the rise proceeds, TRX’s worth might reach $0.17.

Please Note

In accordance with the Depend on Task standards, this cost evaluation write-up is for educational objectives just and must not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to precise, impartial coverage, however market problems undergo alter without notification. Constantly perform your very own research study and speak with a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.