Shiba Inu’s (SHIB) cost has actually leapt 13% in the previous 7 days, matching the temporary energy seen throughout several altcoins.

Nonetheless, this uptick might come across a significant trouble as a result of variables described in this evaluation.

Reduced Liquidity, Weak Grip Threatens Shiba Inu’s Increase

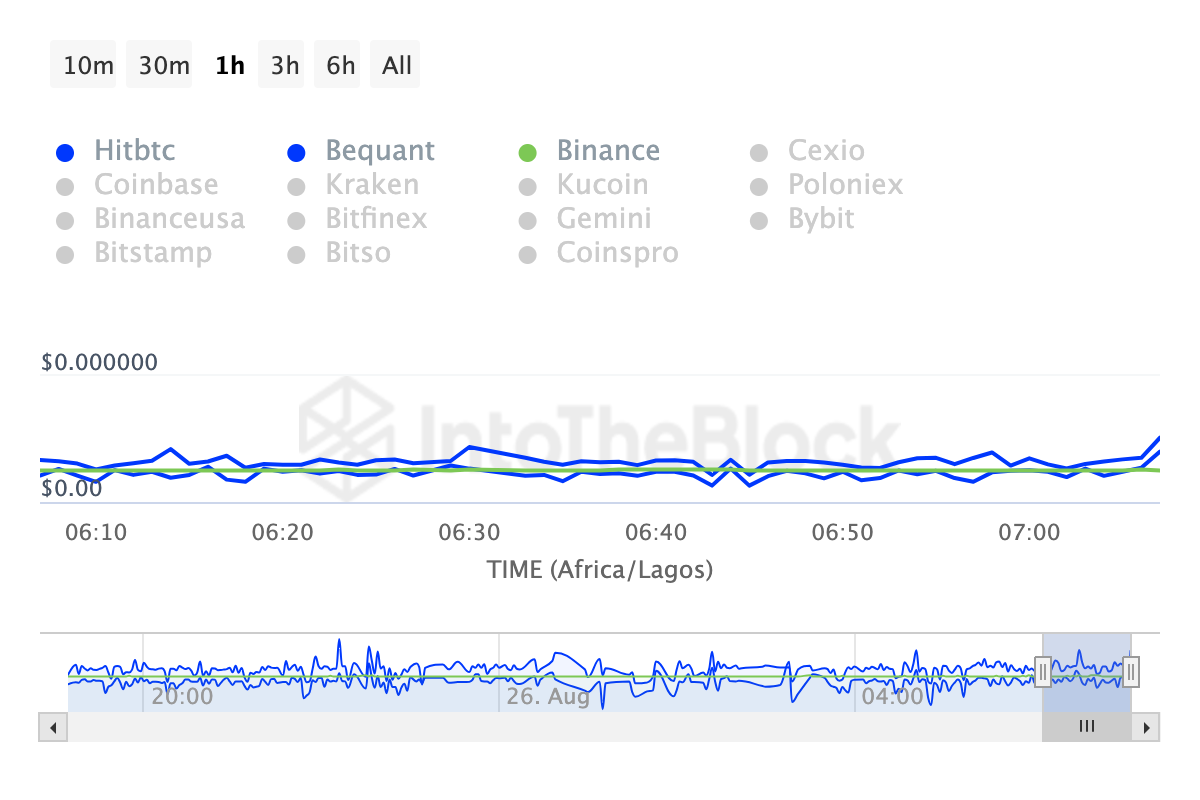

One secret worry is the current rise in Shiba Inu’s bid-ask spread, signifying expanding illiquidity for the token. The bid-ask spread, a critical liquidity metric, gauges the distinction in between deal costs.

A reduced spread suggests a fluid market, while spikes, as seen with SHIB, recommend lessened liquidity, resulting in temporary losses for investors.

This spike, paired with a current cost decrease, might cause sharp changes unless the spread tightens. Presently, SHIB is valued at $0.000014. If the liquidity problem lingers, the cost might see additional decreases.

Find Out More: 6 Ideal Systems To Get Shiba Inu (SHIB) in 2024

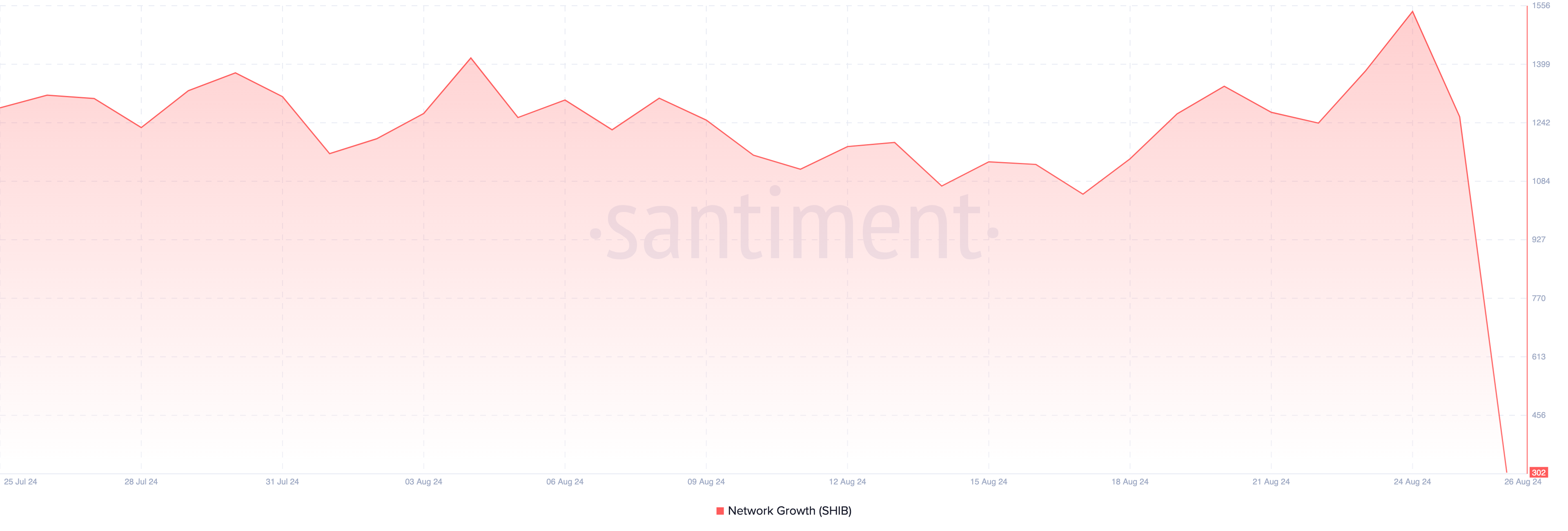

Additional adding to the bearish overview is Shiba Inu’s decreasing Network Development, an essential indication of fostering and customer grip. Network Development gauges the variety of brand-new addresses performing their initial deal on the blockchain. Normally, a boost signals increasing need, which can drive costs higher.

In SHIB’s instance, nevertheless, the remarkable in Network Development recommends subsiding rate of interest and decreased fostering. This decrease might damage long-lasting need for the token, contributing to the descending stress on its cost.

SHIB Cost Forecast: The $0.000013 Assistance Is Important

From a technological perspective, SHIB’s cost remains to show indications of frailty, particularly if liquidity worries linger. The everyday graph discloses a decrease in the Chaikin Cash Circulation (CMF) indication, which determines market trading task to gauge build-up versus circulation.

A greater CMF analysis normally suggests solid build-up, commonly coming before a cost uptick. Nonetheless, SHIB’s decreasing CMF recommends that circulation is surpassing build-up, indicating boosted marketing stress.

If this fad proceeds, SHIB might have a hard time to keep its present cost of $0.000014, increasing the threat of additional decreases.

Find Out More: Shiba Inu (SHIB) Cost Forecast 2024/2025/2030

A critical assistance degree to keep an eye on is $0.000013. If SHIB goes down listed below this limit, it might suggest a much deeper modification, possibly pressing the cost to $0.000010.

On the benefit, the $0.000016 resistance is an essential degree for bulls intending to expand the rally. Must bearish energy be revoked and bulls gain back control at $0.000016, SHIB might target a healing towards the $0.000020 array.

Please Note

In accordance with the Trust fund Job standards, this cost evaluation post is for educational functions just and need to not be thought about economic or financial investment guidance. BeInCrypto is dedicated to exact, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own research study and speak with a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.