Toncoin’s (LOT) cost failed the uptrend line over the weekend break as the Telegram token observed marketing.

Committed by lasting owners, the drawdown brought about billions of bucks well worth of load transforming in the direction of losses.

Trick Toncoin Owners Offload

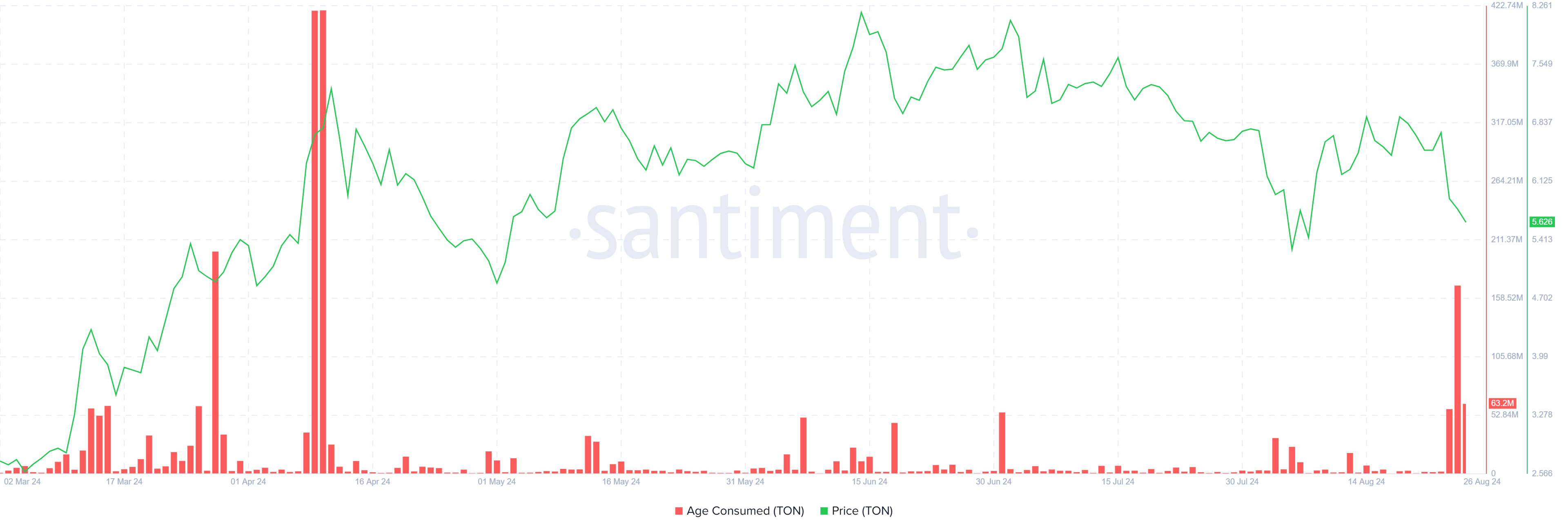

Toncoin’s cost dealt with 2 synchronised occasions. Initially, Telegram Chief Executive Officer Pavel Durov was detained, and 2nd, lasting owners started marketing their Toncoin holdings at a sped up price. These financiers, that normally hold their possessions for extensive durations, started unloading their Toncoin holdings.

Normally, lasting hodlers are taken into consideration to be the foundation of a property as their strength throughout bearishness decreases decrease. Nonetheless, their rise in marketing stress dramatically affected the altcoin, driving rates downward.

Learn More: 6 Finest Toncoin (LOT) Budgets in 2024

As an outcome of this marketing spike, about 647 million load symbols standing for 24% of the whole distributing supply have actually shed their productivity. According to the International In/Out of the cash sign, these symbols were bought at rates in between $5.45 and $6.10.

Worth over $3.57 billion, the loss of productivity for such a considerable section of Toncoin’s supply highlights the effect of lasting owners’ activities on the more comprehensive market. The abrupt change has actually elevated issues amongst financiers regarding the sustainability of Toncoin’s cost, which has actually currently shed its uptrend.

Bunch Rate Forecast: Recuperation Might Be Afar

Toncoin’s cost dropped by virtually 16.5% in 3 days to trade at $5.59 at the time of composing. The drawdown caused the altcoin shedding the uptrend and the assistance of the uptrend line.

Presently floating over the assistance at $5.49, load may proceed its effort to keep in mind a healing. Nonetheless, by the appearances of it, the altcoin can wind up settling under $6.04 and over $5.49.

Learn More: What Are Telegram Bot Coins?

Nonetheless, if the purchasing energy defeats the marketing stress, the resistance of $6.04 can be breached. This can lead to Toncoin’s cost recovering a component of its 16% accident and revoking the bearish thesis.

Please Note

In accordance with the Count on Job standards, this cost evaluation post is for educational objectives just and need to not be taken into consideration monetary or financial investment guidance. BeInCrypto is dedicated to precise, honest coverage, however market problems undergo alter without notification. Constantly perform your very own study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.