In the last couple of months, Bitcoin (BTC) has actually been trading within the $56,000 to $70,000 variety. According to a brand-new record from 10x Study, increasing liquidity inflows place the coin to maintain its uptrend.

Since this writing, Bitcoin (BTC) trades at $63,632, mirroring a 9% boost over the previous 7 days.

Bitcoin Might Be Positioned For Rally

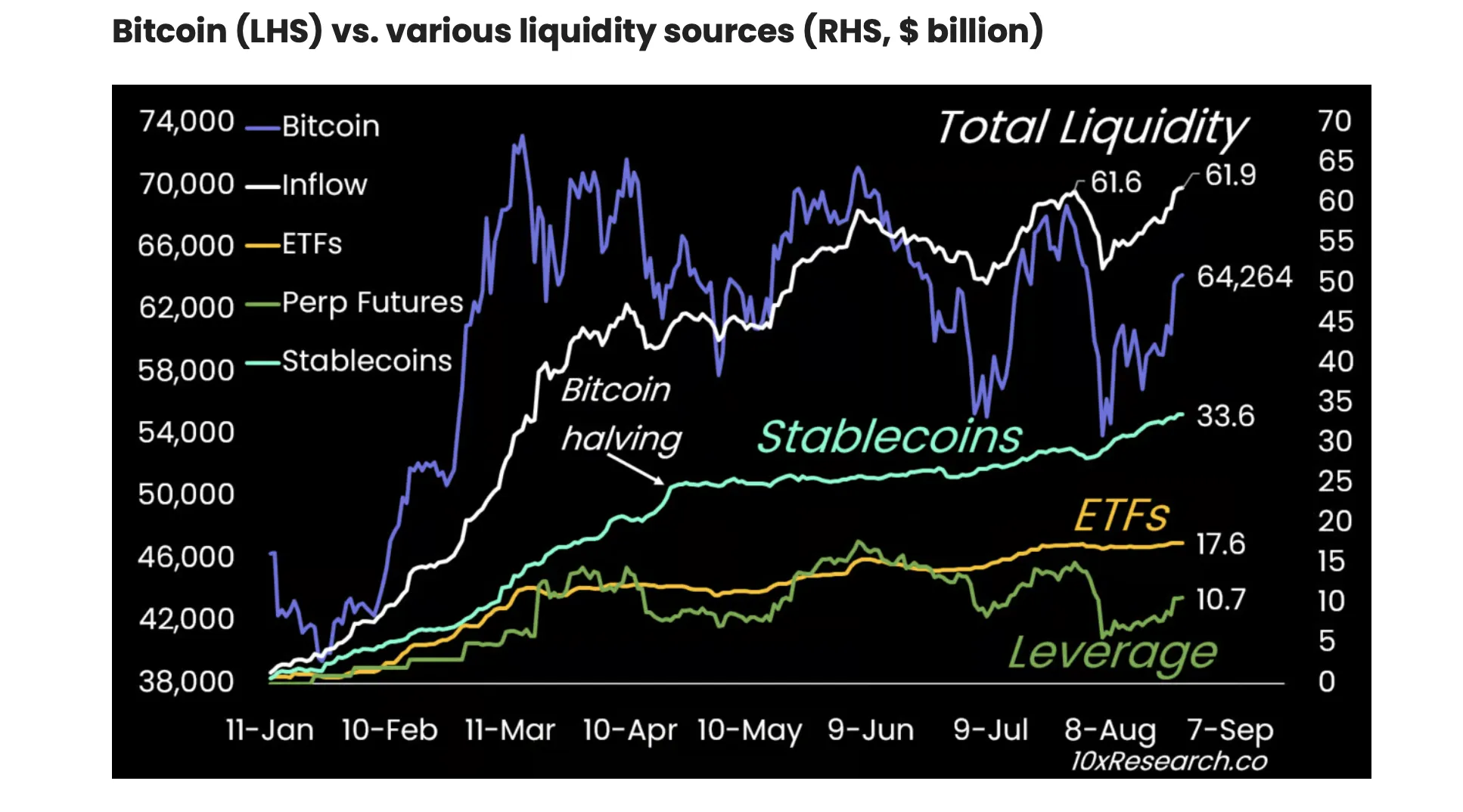

In its brand-new report, 10x Study discovered that the BTC market has actually ended up being flush with liquidity in the previous couple of weeks. According to it, overall liquidity inflows have actually gotten to a year-to-date high of $61.9 billion, going beyond the previous height in July

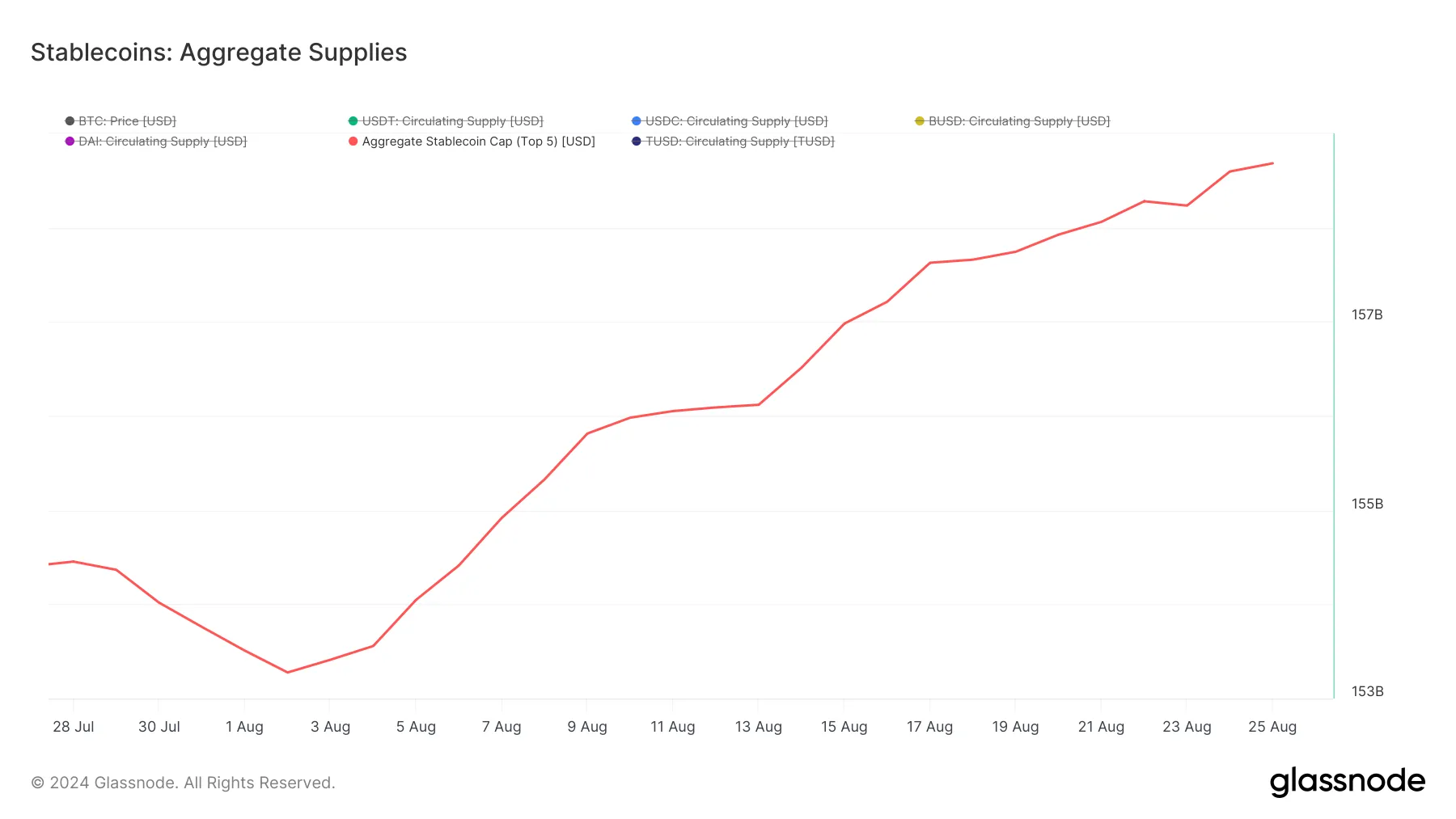

This rise in liquidity has actually been partially driven by a rise in stablecoin minting. According to Glassnode, the incorporated supply of the leading 5 stablecoins– Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and TrueUSD (TUSD)– has actually enhanced by 3% over the previous month.

Find Out More: What Is a Bitcoin ETF?

The increase in stablecoin minting is a favorable signal due to the fact that it shows an expanding need for cryptocurrencies. As even more individuals transform fiat money right into stablecoins, they efficiently purchase crypto.

While keeping in mind that the 7-day minting impulse has actually reduced from $2.7 billion to $1.0 billion, 10x Study mentioned that “it stays solid.”

In addition, the by-products market has actually experienced a surge in take advantage of via Bitcoin’s continuous futures, adding to its current rate energy. This take advantage of and continuous liquidity inflows can aid drive the coin’s rate towards $70,000.

Compromising Buck Amounts To Rate Walk For Bitcoin

Better, 10x Study observed a substantial macroeconomic change in very early July which might help BTC’s rate. According to the record, the United States Buck came to a head in the very first couple of days of July, and 10-year Treasury bond returns decreased.

Oil costs, an essential sign of financial stamina, likewise visited 10% after reaching their height in very early July. In addition, the ISM Production Index, which has actually continued to be listed below 50 for the 3rd successive month, recommends a prospective downturn in the United States economic climate.

When examining these macroeconomic fads in regard to BTC’s historic efficiency, the research study company kept in mind that a weak United States Buck and reduced bond returns have actually generally agreed with for the leading cryptocurrency.

” Fed Chair Powell’s speech, incorporated with the weak point in the ISM Production Index and the decrease in the United States Buck, has actually established the phase for assumptions of enhanced market liquidity, which can boost danger properties like supplies and Bitcoin,” 10x Study claimed.

On August 23, Bitcoin damaged over the resistance at $61,000 and has actually considering that trended upwards. Nonetheless, 10x Study keeps in mind that its favorable target of $70,000 will just emerge “if the more comprehensive economic climate does not fail.”

Find Out More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

If the macro pattern remains beneficial and Bitcoin preserves its uptrend, the following rate target is $64,442. If this degree holds and the rally proceeds, BTC can redeem the important $68,000 assistance prior to pressing towards $70,000.

Alternatively, if marketing stress heightens, BTC’s rate might go down to $61,509, revoking the favorable forecast.

Please Note

In accordance with the Depend on Task standards, this rate evaluation post is for educational objectives just and must not be thought about monetary or financial investment guidance. BeInCrypto is dedicated to exact, impartial coverage, however market problems go through alter without notification. Constantly perform your very own research study and speak with an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.