Solana’s (SOL) rate has actually been an institutional fave for the last number of months, however this is altering once again.

As Q3 approaches its end, the discharges of huge budget owners, together with the decreasing toughness, are eliminating the uptrend.

Solana Is Losing Its Grasp

Solana’s rate is bound to proceed its recurring loan consolidation after the altcoin fell short to keep in mind a significant healing. There are 2 factors in why SOL might not proceed its uptrend, the very first being the passing away fad.

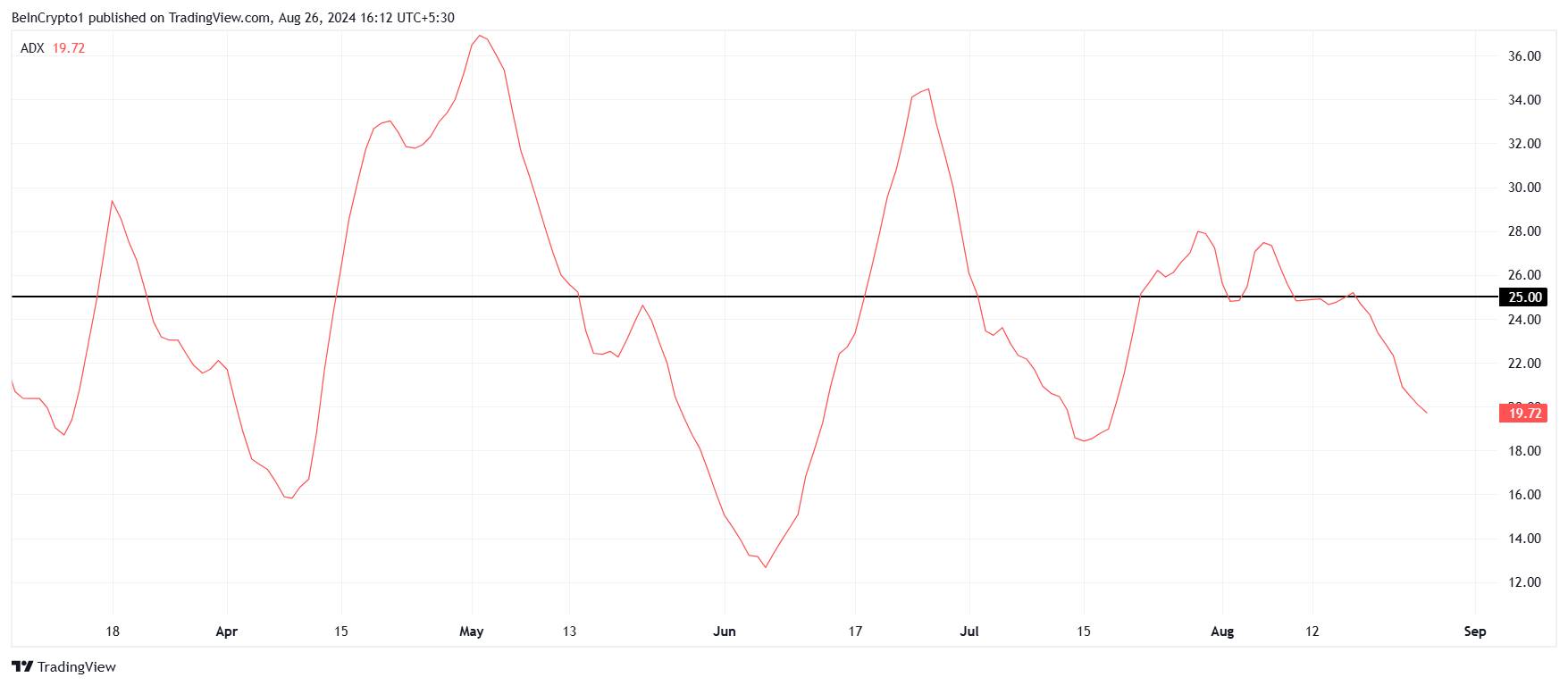

The Ordinary Directional Index (ADX) dropping listed below the 25.0 limit suggests that the uptrend has actually totally shed its energy. This technological indication, which gauges the toughness of a fad, recommends that the marketplace no more has a solid directional prejudice.

This recommends that the opportunity of a recuperation has actually ended up being progressively challenging. Without a clear fad instructions, the marketplace might battle to obtain higher energy. If marketing stress heightens, this scenario can bring about a duration of loan consolidation and even additional decrease.

Learn More: 11 Leading Solana Meme Coins to Enjoy in August 2024

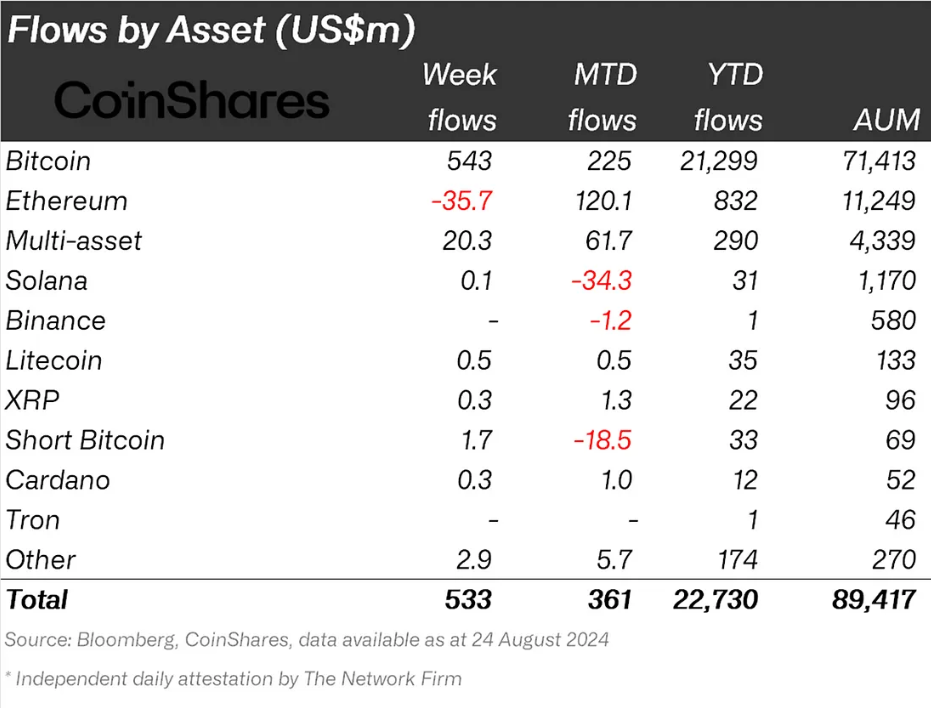

More validating this end result is the subsiding rate of interest of the huge budget owners, i.e., the institutional financiers. These huge financiers had actually revealed solid rate of interest in the property, however their rate of interest has actually considering that decreased.

According to the record from CoinShares, the week finishing August 24 saw inflows of simply $100,000 in SOL. This is the most affordable of all the possessions, with also Cardano keeping in mind $300,000 in inflows. Because of this, SOL’s month-to-date discharges have actually gotten to $34 million.

If this proceeds, it can have an adverse impact on Solana.

SOL Cost Forecast: Obstacles Ahead

Solana’s rate has actually increased by 24% in the period of 20 days, bringing the altcoin to trade at $161. Presently holding over the assistance of $156, SOL is aiming to breach the obstacle of $175 in order to launch healing.

Nonetheless, the abovementioned variables can obstruct this increase, leaving Solana’s rate stranded under $175. The loan consolidation in between $175 and $126 would certainly proceed, leaving a few of the losses from July’s 20$ crash unrecovered.

advertisement a lot more: 11 Leading Solana Meme Coins to Enjoy in August 2024

Funded

This could, nevertheless, modification if $175 is turned right into assistance and the crypto property proceeds its uptrend. Getting to $186 recuperates the shed gains and, at the exact same time, revokes the bearish thesis.

Please Note

In accordance with the Trust fund Job standards, this rate evaluation post is for educational objectives just and must not be taken into consideration monetary or financial investment suggestions. BeInCrypto is dedicated to precise, honest coverage, however market problems go through transform without notification. Constantly perform your very own research study and seek advice from a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.