Bitcoin’s (BTC) rate is most likely to get to $66,000 within a week or 2, according to on-chain information. Based upon the metrics evaluated, the coin, which lately experienced a hard duration, is blinking favorable indications.

Since this writing, BTC trades at $63,903 after at first surrounding $65,000. Nevertheless, the current pullback may not have the ability to quit the prospective step.

Fresh Liquidity Remains To Circulation right into Bitcoin

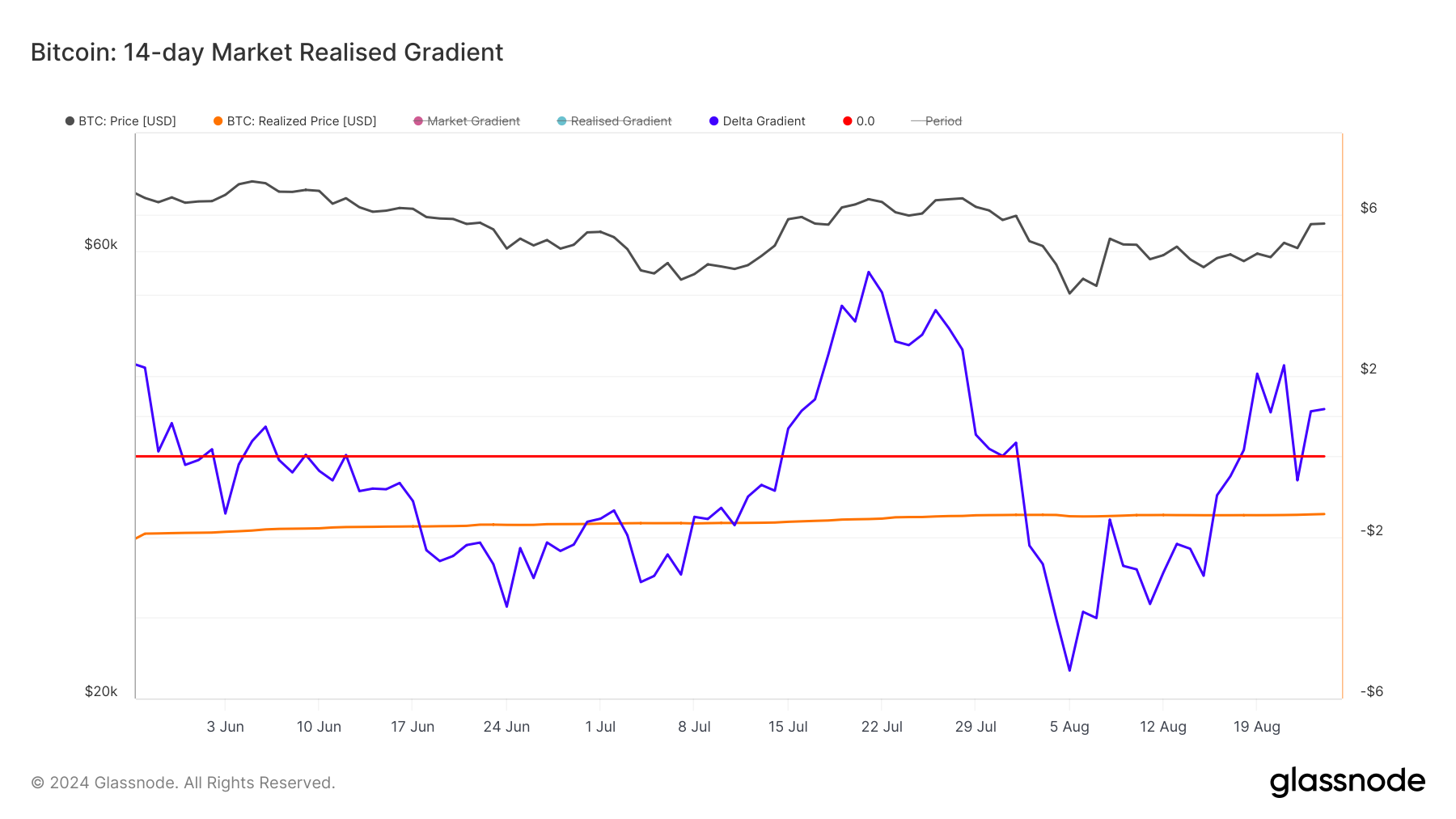

An assessment of Glassnode information reveals that Bitcoin’s 14-day Market-Realized Slope stands at 1.17. This slope utilizes the rate at which each coin last relocated to identify the size of an anticipated uptrend or drop.

Steep lowers in the 14-day Market-Realized Slope show a decrease in fresh resources moving right into the cryptocurrency. When this takes place, BTC has a tendency to undertake a rate decrease. Nevertheless, at press time, the boost suggests that Bitcoin has actually brought in considerable resources, which can drive remarkable worth development.

From the graph above, Bitcoin’s rate struck $66,805 the last time the slope remained in a comparable area. Consequently, if the pattern rhymes, the cryptocurrency’s worth may strike or go beyond $66,000 within the following 2 weeks.

Learn More: What Is a Bitcoin ETF?

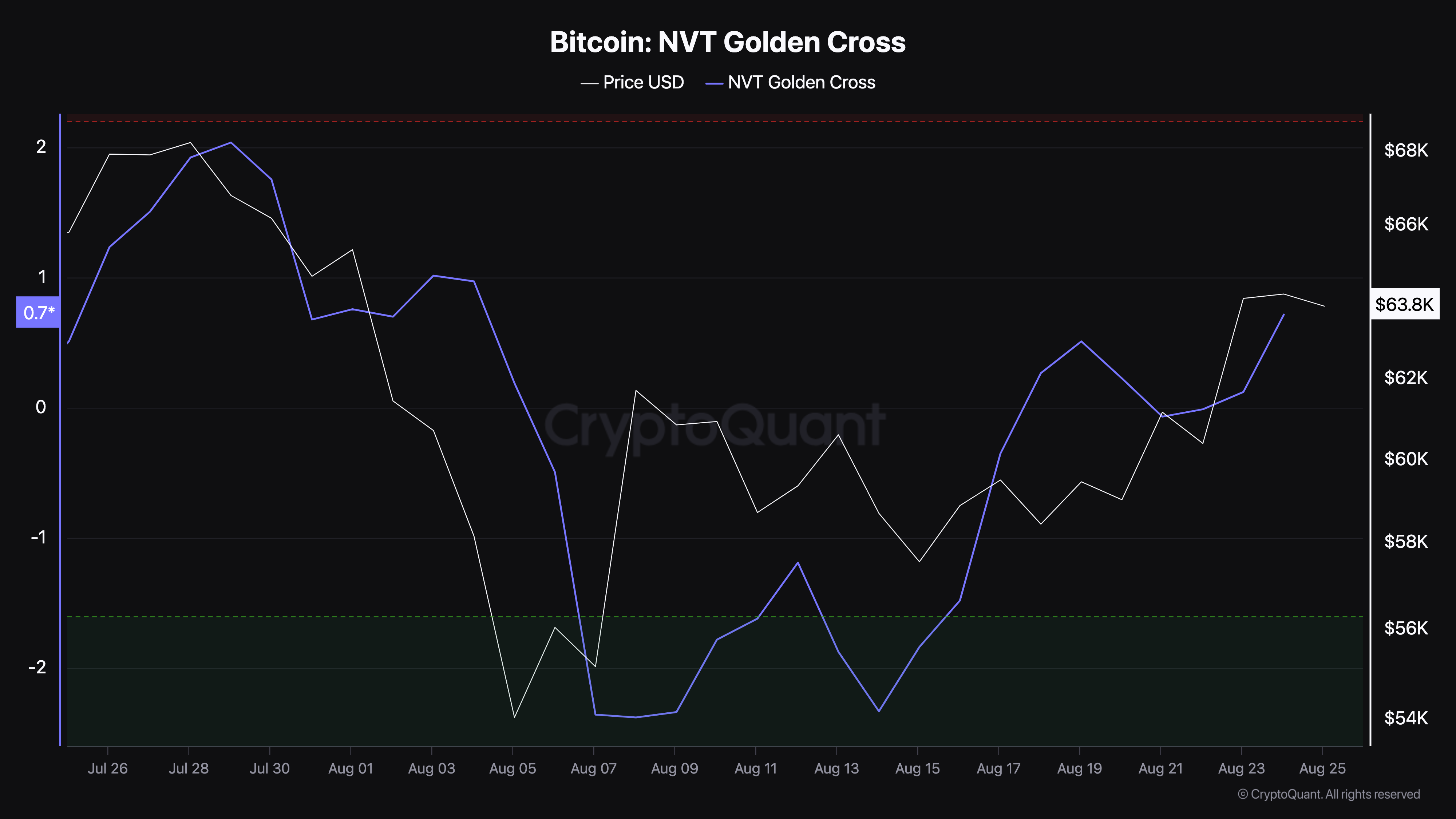

Moreover, the Network Worth to Purchase (NVT) Golden Cross shows up to back a comparable predisposition. For context, this statistics actions if the worth of a crypto is close to its base or near its top.

When the analysis is under -1.6, the rate goes to its base, and higher stress can be extreme. Nevertheless, worths over 2.2 show that the crypto is overbought and can undertake a significant improvement.

In Bitcoin’s instance, the NVT Golden Cross is 0.71, showing that the coin has actually jumped off the top however remains in a prime acquiring area. Consequently, if the boost proceeds, so will certainly BTC’s rate.

Surprisingly, Hardy, a crypto investor on X, likewise appears to share a comparable idea. According to Hardy, Bitcoin is ultimately leaving its debt consolidation stage and also expanded its targets past the rate stated over.

” The actual actions appealed weekdays. Following week is looking excellent; still riding this lengthy to the top of the variety. Eyes on $70K,” the investor posted.

BTC Rate Forecast: Vendors Can Not Stand Purchasing Stress

According to the day-to-day graph, Bitcoin has actually developed an inverted Head and Shoulders pattern. This technological evaluation pattern anticipates the turnaround from a sag to an uptrend and is critical for validating a favorable signal.

As seen listed below, the pattern contains 3 components: the very first shoulder, which stands for marketing stress and a rebound; the head, which suggests a steeper decrease and a more powerful rebound; and last but not least, the 2nd shoulder, which discloses just how acquiring stress revoked vendors’s effort to drive BTC reduced.

At press time, Bitcoin damaged over the neck line at $61,024, which was formerly a resistance degree. This outbreak boosts the coin’s possibilities of striking a greater worth. Nevertheless, an additional resistance exists at $64,562.

Learn More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

Must Bitcoin violation this factor, the cryptocurrency’s rate can strike $66,849. Nevertheless, if BTC is turned down at around $64,000, its worth threats stopping by $60,000, which can revoke the favorable predisposition.

Please Note

In accordance with the Count on Task standards, this rate evaluation short article is for educational objectives just and must not be taken into consideration monetary or financial investment guidance. BeInCrypto is dedicated to exact, impartial coverage, however market problems go through transform without notification. Constantly perform your very own research study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.