In June, Binance Coin (BNB) surprised the crypto market by coming to be the very first of the leading 10 altcoins to get to a brand-new all-time high (ATH). Remarkably, this took place almost 3 months after Changpeng Zhao was punished to 4 months behind bars.

Commonly called CZ, the previous Binance chief executive officer is readied to be launched from prison following month. Right here is why his return can send out BNB’s cost to one more ATH.

CZ’s Homecoming Signals Stamina for Binance and BNB

According to the USA Federal Bureau of Prisons (BOP), CZ has actually been relocated from the jail at the Federal Correctional Organization Lompoc in main The golden state. A take a look at recent data reveals that Zhao is currently at the Residential Reentry Monitoring (RRM) Long Coastline.

The RRM is a midway home in San Pedro in the exact same city. From BeInCrypto’s searchings for, the transfer seems connected to his launch set up for September 29.

Nonetheless, on X, there have actually been reports that the exchange’s founder could be discharge early. Yet it was an instance of incorrect analysis. Despite the launch information, it appears that his return can stimulate a wave of getting stress for BNB.

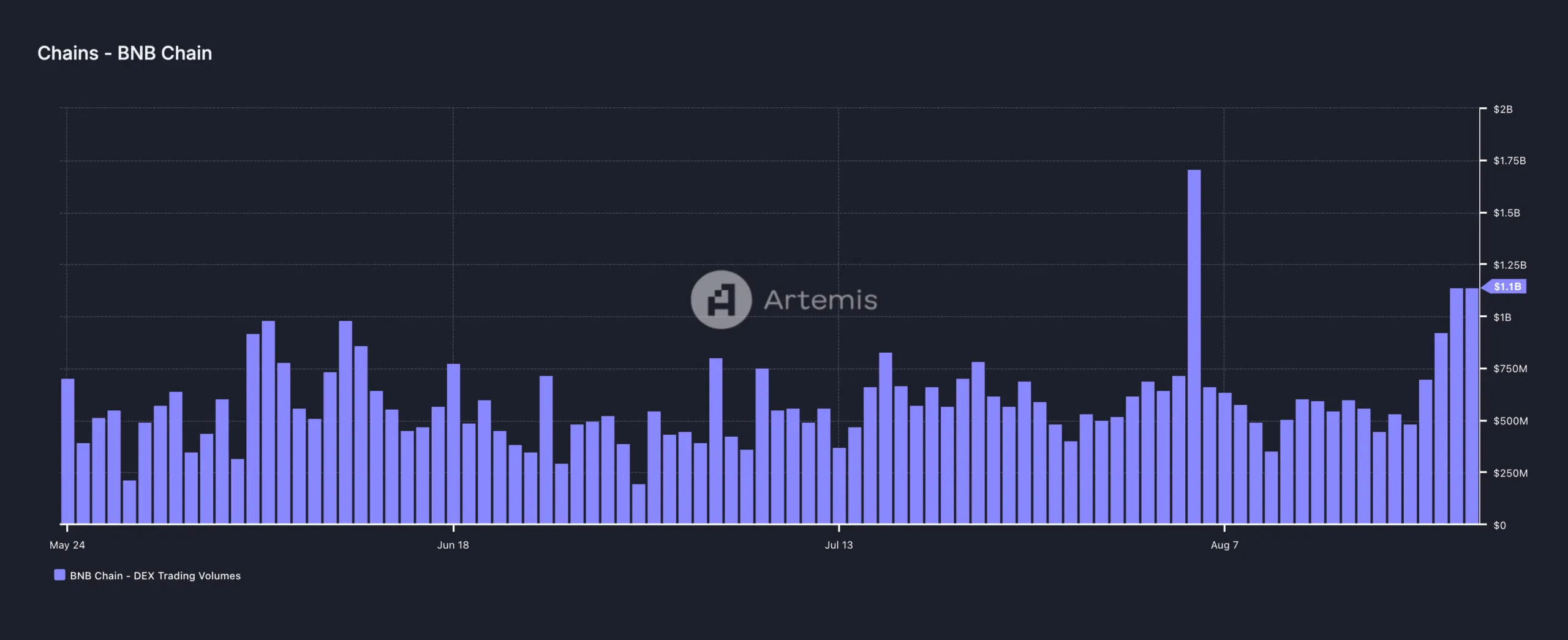

As an example, according to Artemis information, BNB’s DEX trading quantity has actually gone beyond $1 billion for the very first time considering that the August 5 market accident. This quantity is the quantity of cryptocurrency traded beyond central systems like Binance.

A rise in this worth recommends climbing need and foreshadows a cost boost for the coin entailed. BNB presently trades at $578.72, a 19.22% drawdown from its ATH of $720.67.

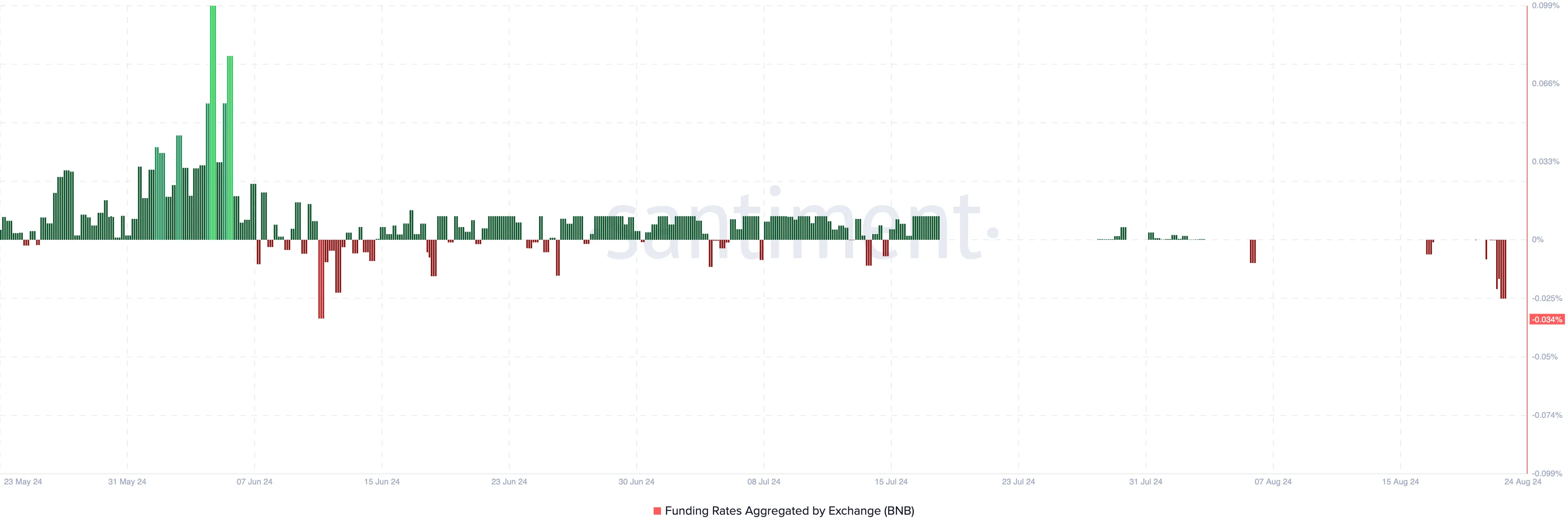

If the DEX quantity remains to raise towards CZ’s awaited launch, BNB’s cost could comply with. Ought to this occur, the coin worth could exceed its existing ATH. On top of that, Binance Coin’s Financing Price is unfavorable, suggesting that investors anticipate the cost to drop in the short-term.

Find Out More: That Is Changpeng Zhao? A Deep Study the Ex-CEO of Binance

Nonetheless, unfavorable financing and a rise in cost are seldom an excellent mix for those anticipating a cost reduction. Thus, if shorts (vendors) stay hostile and the cost boosts, BNB’s cost could experience one more growth.

BNB Rate Forecast: It has to do with Time to Return More Than $700

In spite of BNB’s cost changes, the 4-hour graph shows it is relocating within a rising network.

This pattern recommends that the favorable view stays undamaged. If the pattern holds, BNB can possibly retest the $700 degree prior to completion of September.

On the day-to-day graph, the Awesome Oscillator (AO) declares, verifying that the energy around the coin is favorable. This indication contrasts current cost activities to historic efficiency.

When the AO is unfavorable, it indicates that the energy around the cryptocurrency is bearish. Hence, in Binance Coin’s situation, the climbing energy can aid drive the cost greater.

As seen listed below, BNB’s cost can rally to $648.80 within the following couple of weeks. If getting stress boosts, it can additionally leap to $724.67.

Find Out More: Binance Coin (BNB) Rate Forecast 2024/2025/2030

Nonetheless, if Binance’s previous chief executive officer CZ is launched from jail and the United States SEC seeks one more suit versus him and Binance, BNB’s cost could decrease. In such a situation, the coin’s worth can go down to $526 or perhaps $472.

Please Note

In accordance with the Depend on Task standards, this cost evaluation short article is for informative objectives just and must not be taken into consideration economic or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, yet market problems go through transform without notification. Constantly perform your very own study and speak with a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.