Nvidia supply (NVDA) is back. Yet it will be tested once again.

The following large occasion for the marketplace is the chip beloved’s incomes record, established for after the bell Wednesday.

And it’s not simply Nvidia supply that gets on the line: Nvidia’s outcomes will certainly establish the rate for various other AI gamers.

” Nvidia’s record and assistance will certainly be definitely vital to the AI framework profession,” technology capitalist Paul Meeks informed Yahoo Money.

The previous a number of weeks have actually been a roller-coaster trip for technology financiers. Shares of AI titans Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL) are down over the previous 3 months, with Alphabet dropping greater than 6% and both Amazon and Microsoft down greater than 3%.

And second-tier AI gamers are having a hard time to gain back grip too. AMD (AMD) has actually dropped greater than 16% considering that mid-July while Marvell Innovation (MRVL) is off almost 6% in the exact same duration.

Yet solid arise from Nvidia might reignite a few of that shed energy, according to Wedbush’s Dan Ives.

” Nvidia is the heart and lungs of this favorable technology profession as the AI Change holds,” Ives informed Yahoo Money.

Ives, that anticipates a “shock and wonder” quarter from Nvidia, claims proceeded solid need for the firm’s chips will certainly have causal sequences throughout the sector. In a current note to customers, Ives approximated that for every single buck invested in a Nvidia GPU chip, there is an $8 to $10 multiplier throughout the technology market.

Bernstein’s Mark Shmulik, that covers a lot of Nvidia’s greatest clients consisting of Meta, Amazon, and Google, informed me the chip titan’s outcomes will certainly be an essential motorist of Large Technology’s following action.

” Nvidia is a bellwether of the Stunning 7 and AI profession,” Shmulik clarified. “If there is any kind of soft qualities, possibly turning out of the Mag 7 gets a little of heavy steam, however paying attention to various other technology incomes, core principles maintain supplying.”

Thus far this year, Nvidia’s supply has actually risen. Shares are up 180% over the previous year and up almost 2,900% over the previous 5 years– establishing bench really high for incomes this quarter.

Quotes are for Nvidia’s profits to expand 112% in its most recent quarter, noting a significant stagnation from over 250% development one year earlier. For Wall surface Road, agreement stays favorable. KeyBanc, Citi, and Goldman Sachs were amongst those on the road that repeated their Buy rankings on the supply today in advance of outcomes.

While only time will certainly inform whether Nvidia meets the buzz this incomes period, it’s secure to state the risks are high.

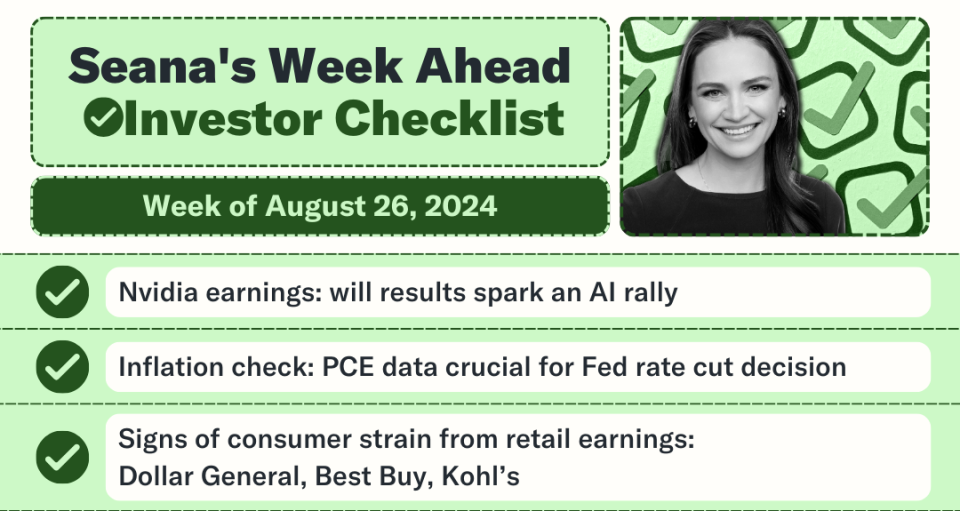

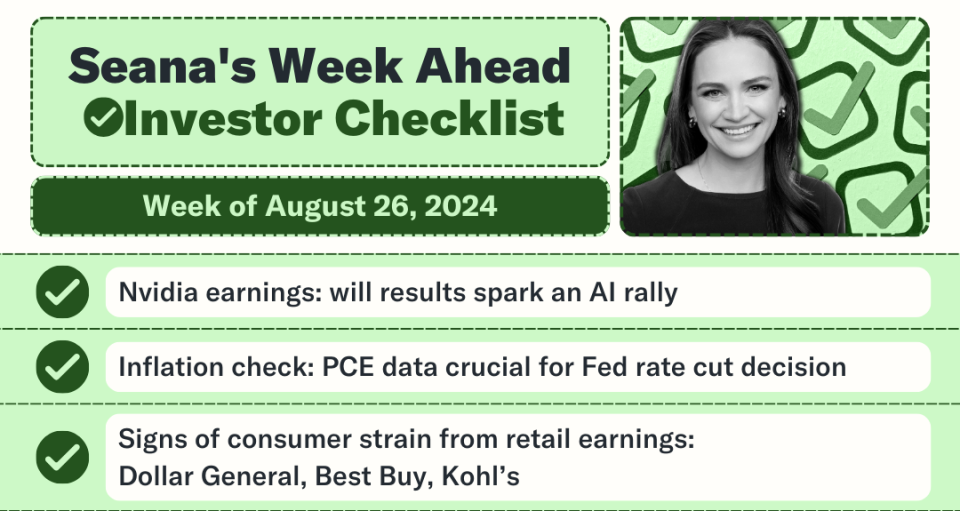

Seana Smith is a support at Yahoo Money. Comply With Smith on Twitter@SeanaNSmith Tips on bargains, mergings, lobbyist circumstances, or anything else? Email seanasmith@yahooinc.com.

Visit This Site for the most recent modern technology information that will certainly affect the securities market

Check out the most recent monetary and company information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.