Ethereum (ETH) rate might be on the edge of one more rise regardless of the current pump to $2,800, according to numerous signs examined on-chain.

Presently, ETH professions at $2,771. If the indicators lately found stand, the cryptocurrency’s worth might strike degrees not seen because the succesful area ETF launch on July 23.

Ethereum Offers an Unusual Possibility as Buildup Picks Up

The Other Day, throughout the very early Eastern hours, ETH traded at $2,624. Complying with comments from Fed Chair Jerome Powell indicating a strengthened dedication to rising cost of living decrease and possible rate of interest cuts, the altcoin’s worth rose. The ETH rate rise brings the complete gains over the last 7 days to 6.93%.

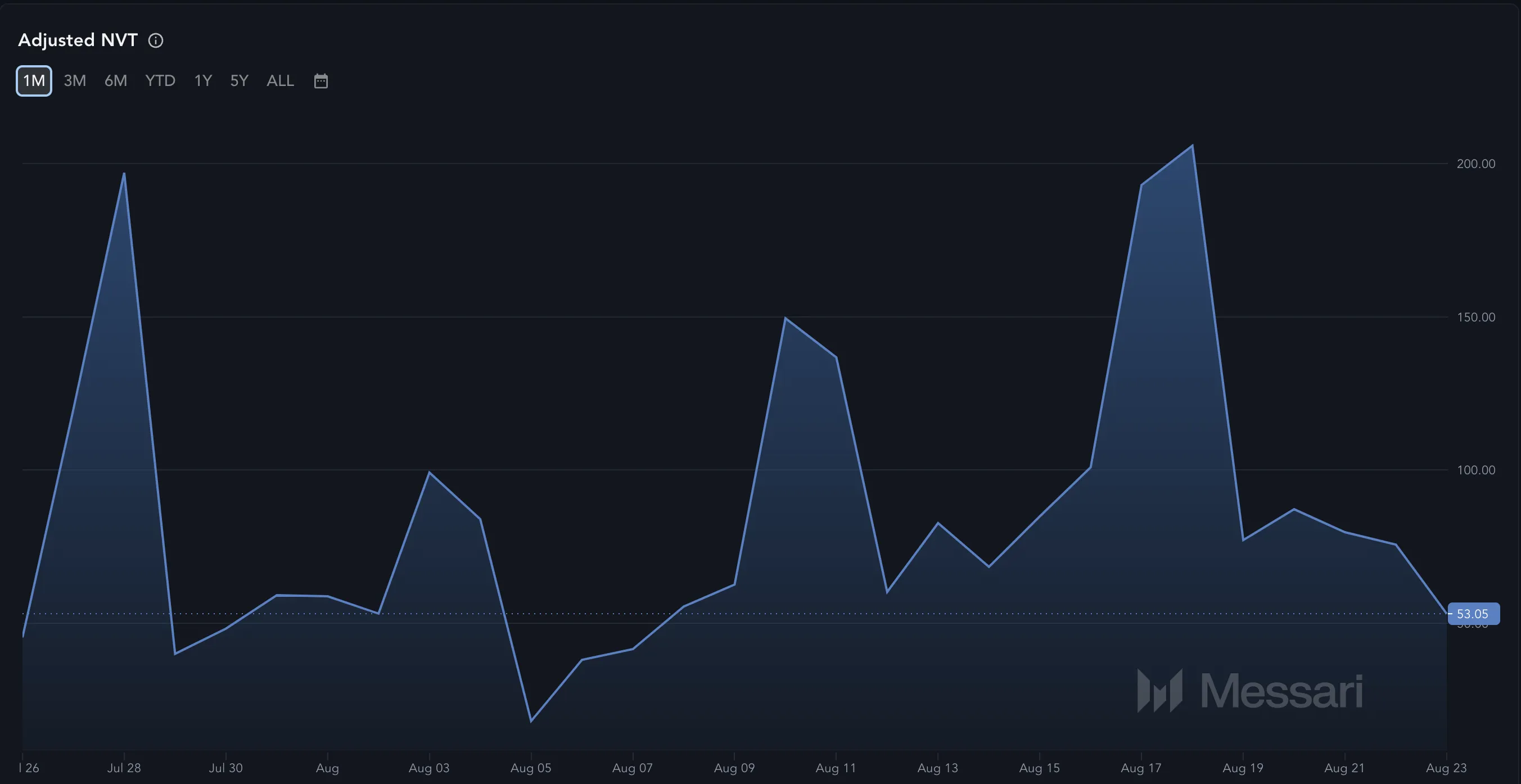

Messari information discloses that Ethereum’s changed Network Worth to Purchases (NVT) proportion has actually gone down to -53.05. The NVT proportion mirrors whether a network’s market cap is expanding quicker than its purchase quantity. High NVT analyses generally recommend that a possession is overpriced, frequently showing market tops and overvaluation durations that might bring about a rate decrease.

Find Out More: Ethereum ETF Described: What It Is and Just How It Functions

Nonetheless, in Ethereum’s circumstance, the large decrease in the proportion suggests that the network is underestimated, and ETH itself goes to a price cut. Consequently, it is not misplaced to discuss that the cryptocurrency is near its base, and the probabilities of a significant rate rise in the coming weeks could be high.

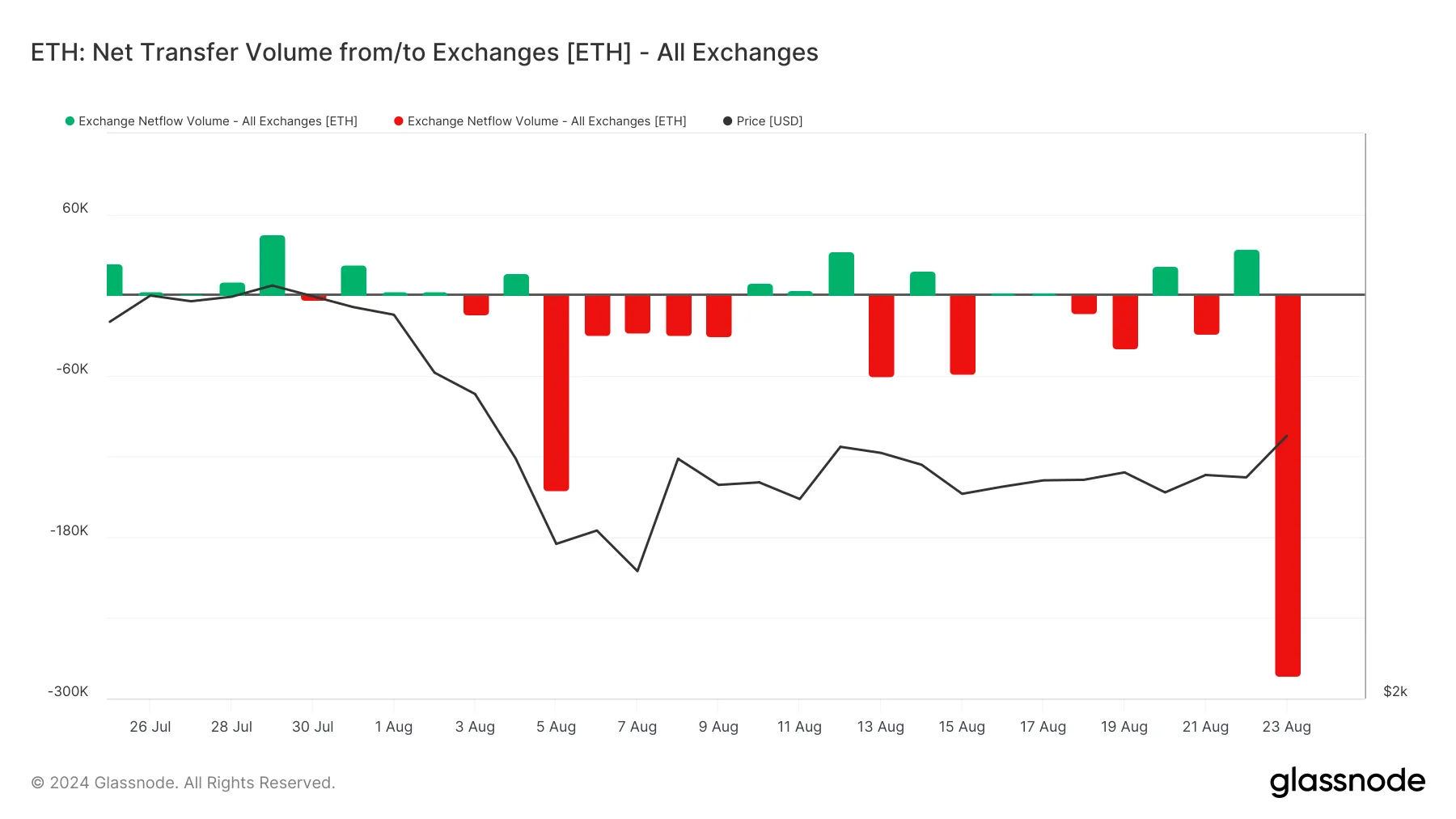

Besides this, Ethereum is experiencing a high degree of exchange withdrawals. Based upon Glassnode’s information, the exchange web transfer quantity saw a significant decrease of over 280,000 ETH on August 23.

This quantity determines the distinction in between coins streaming right into an exchange and those gotten. A favorable worth suggests that even more coins are being sent out right into exchanges — an indicator of marketing stress.

Consequently, the current withdrawals, valued at virtually $800 million, verify a rise in getting stress. If continual, this might verify the predisposition of getting ETH at the present market price.

ETH Rate Forecast: Ready to Rally

According to the everyday ETH/USD graph, Ethereum’s failing to damage listed below the $2,536 assistance degree played a vital function in its current bounce. Had it slid listed below this degree, ETH might have gone down to $2,345, possibly producing a bearish overview.

The current acquiring energy, highlighted by the Relocating Ordinary Merging Aberration (MACD) indication, recommends ETH’s rate might get to $2,829.50 in the short-term. The MACD determines energy, with favorable analyses showing favorable view and adverse analyses indicating bearish fads.

In Addition, the Fibonacci retracement indication, which determines vital assistance and resistance degrees based upon historic rate activities, gives more understandings. If ETH exceeds $2,829, the following possible target might be about $3,265.60.

Find Out More: Just How To Acquire Ethereum (ETH) With a Charge Card: A Step-by-Step Overview

In the meanwhile, macro market expert Matthew Hyland shared his ideas on ETH’s rate activity. In a video clip published on X, Hyland pointed out that the cryptocurrency requires to shut over $2,800 to rally to the elevation it got to in July.

” If Ethereum can shut regular over $2,800, after that it might see a majour press towards the top $3,500 to $3,600 location,” the expert explained.

Nonetheless, ETH dangers revoking this favorable overview because of a current choice by the Ethereum Structure. Historically, it has actually offered big quantities of ETH for numerous factors, frequently bring about rate declines. Earlier today, on-chain data revealed that the structure moved 35,000 ETH to Sea serpent.

Like previous times, the transfer might ultimately bring about a sell-off. If it sends out one more round once more, ETH’s rate might be impacted, and a decrease to $2,516.21 might be following.

Please Note

In accordance with the Trust fund Job standards, this rate evaluation short article is for informative functions just and must not be thought about monetary or financial investment recommendations. BeInCrypto is dedicated to exact, objective coverage, however market problems go through transform without notification. Constantly perform your very own research study and speak with a specialist prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.