On August 7, Surge’s (XRP) cost reached $0.63, triggering conjecture that the cryptocurrency can be on the verge of a significant outbreak. Nevertheless, that did not occur, as the cost had actually been up to $0.59 at press time.

The previous cost dive led investors to enhance their bank on agreements connected to the token, intending to make money from the motion. Nevertheless, that energy has actually changed since this writing.

Investors Go Back as Surge Supremacy Winds Down

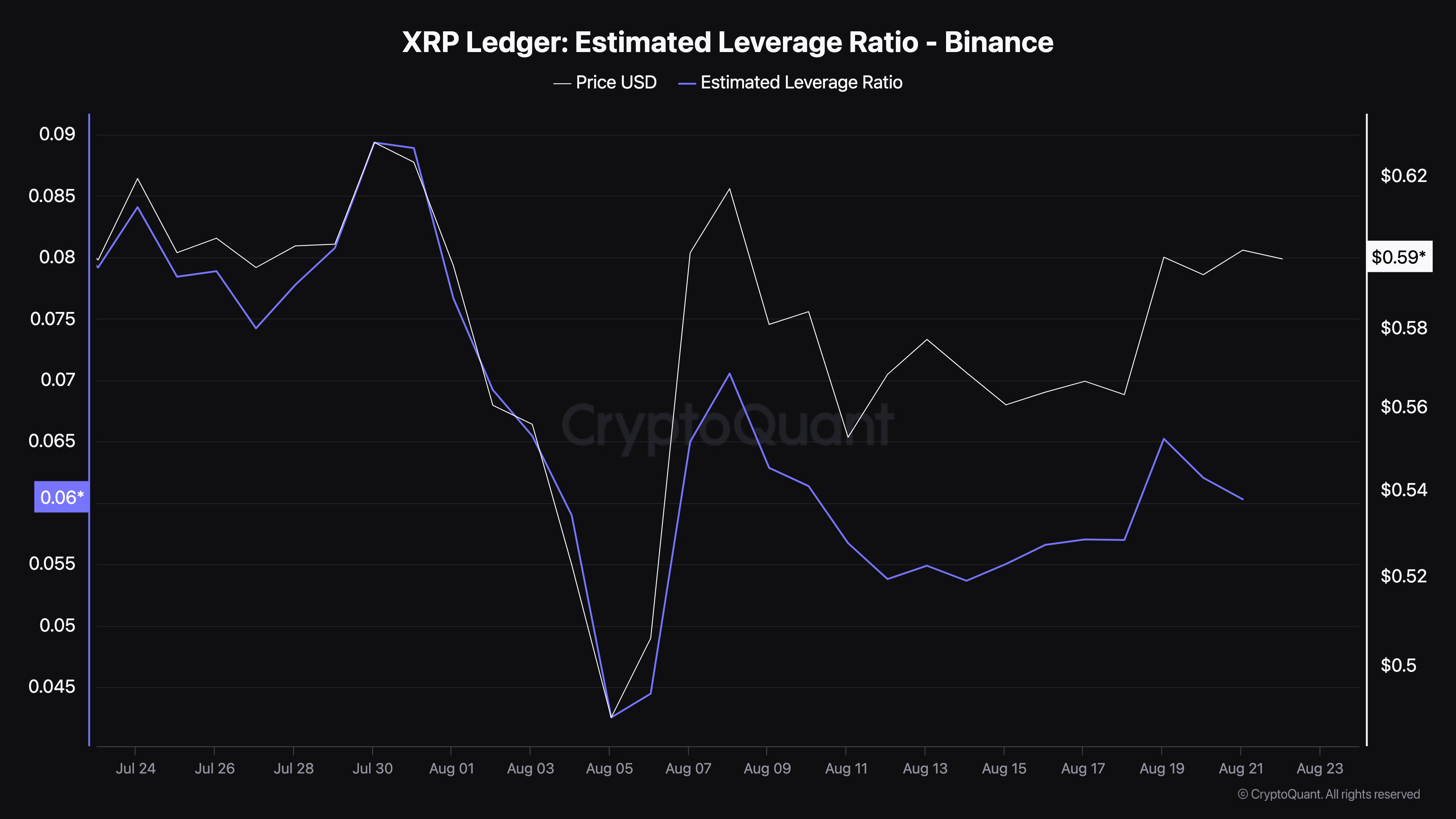

According to CryptoQuant, the XRP Approximated Utilize Proportion (ELR) is to 0.060. As the name recommends, the ELR recommends just how much take advantage of investors are utilizing to bank on their settings out there.

Boosting take advantage of proportion shows that investors are taking risky wagers out there. This generally implies self-confidence that the cost will certainly relocate a certain instructions.

Nevertheless, a reduction recommends that investors are doubtful regarding the cost motion. So, rather than opening up agreements with 25x, 50x, and 100x take advantage of, current information reveals that they are using care to prevent being sold off.

Learn More: Just How To Acquire XRP and Whatever You Required To Know

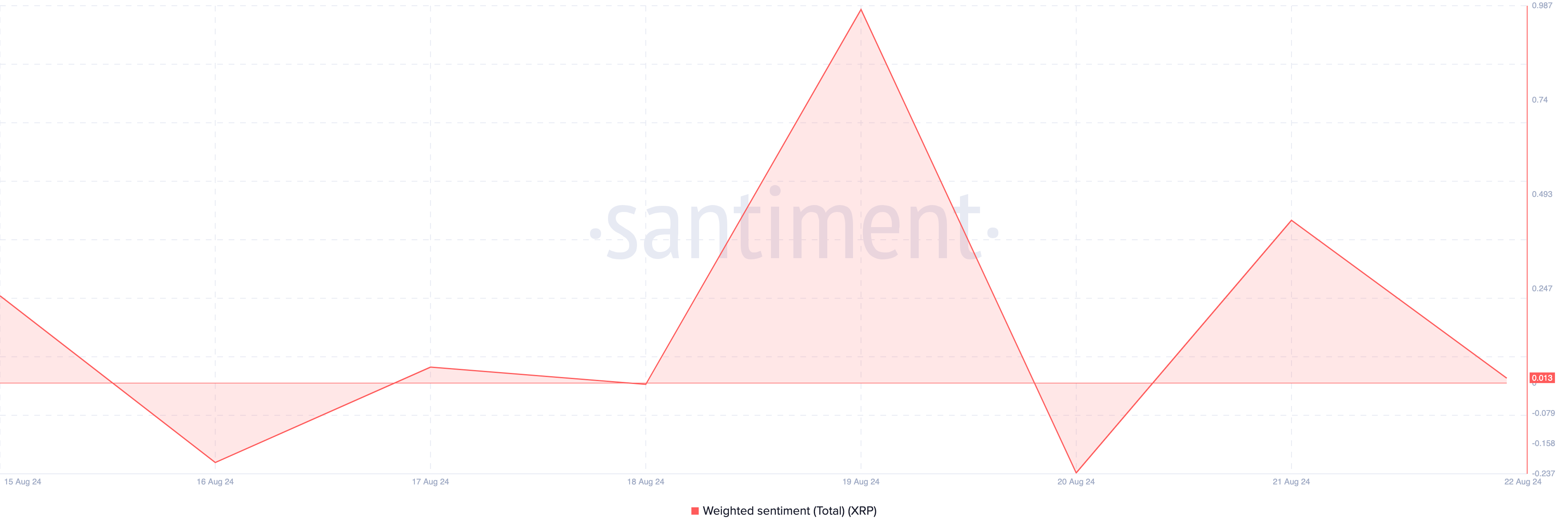

This careful technique shows up linked to XRP’s current efficiency. Both investors in the by-products market and the more comprehensive market have actually begun to solidify their favorable overview on XRP. This change is mirrored in the Weighted Belief statistics, given by the on-chain analytics system Santiment.

Weighted Belief determines just how favorably or adversely market individuals really feel regarding a cryptocurrency. When this statistics increases and remains favorable, it recommends high self-confidence that the cost will certainly enhance. Alternatively, an adverse analysis shows pessimism in market view.

Presently, the statistics is nearing unfavorable area, indicating a decrease in favorable view. If it dips better, need for XRP might deteriorate, possibly resulting in a cost decline listed below $0.59.

XRP Cost Forecast: Following Quit Might Be $0.55

XRP cost rally to $0.63 accompanied the partial verdict of the Ripple-SEC suit. Nevertheless, while market individuals anticipated a more rise, the crypto encountered a stopped working outbreak.

As seen in the graph below, bulls took care of to maintain XRP from going down listed below $0.55. Nevertheless, the token can deal with resistance at $0.60, which is an essential emotional degree. Remarkably, the Stochastic Family Member Toughness Index (Stoch RSI) has actually revealed a higher fad.

Stoch RSI determines a cryptocurrency’s energy based upon the rate and size of cost modifications. The indication generally indicates an overbought condition when the analysis strikes 80.00 and an oversold condition when it goes down listed below 20.00.

Learn More: Surge (XRP) Cost Forecast 2024/2025/2030

For XRP, the Stoch RSI presently reviews 87.24, indicating an overbought condition. This can possibly bring about a pullback, pressing the cost back to $0.55. Nevertheless, if purchasing stress constructs or the more comprehensive altcoin market rallies, XRP’s cost can jump towards $0.63.

Please Note

In accordance with the Depend on Job standards, this cost evaluation short article is for informative objectives just and ought to not be thought about economic or financial investment suggestions. BeInCrypto is devoted to precise, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.