The Real Life Properties (RWA) tokenization market surpassed $10 billion in assessment, driven by expanding institutional passion and a basic press to incorporate standard (TradFi) and decentralized financing (DeFi).

Fans of tokenized real-world properties (RWAs) think they provide numerous benefits. They make it much easier for capitalists to expand their profiles, profession properties, and gain access to extra financial investment alternatives. In addition, they supply higher liquidity, streamline property transfers, and improve regulative conformity with clever agreements.

Over $10 Billion of Tokenized RWAs on Public Blockchains

On-chain information from OurNetwork reveals that the tokenized RWA market has actually gone beyond $10.9 billion. This stands for an increase of greater than $2 billion because the start of the year, driven by solid need for exclusive fundings and United States Treasury financial obligation.

” The exclusive credit scores market presently stands at $8.1 billion while that of tokenized treasuries is $1.9 billion. The staying tokenized property courses drop under $1 billion,” the study highlighted.

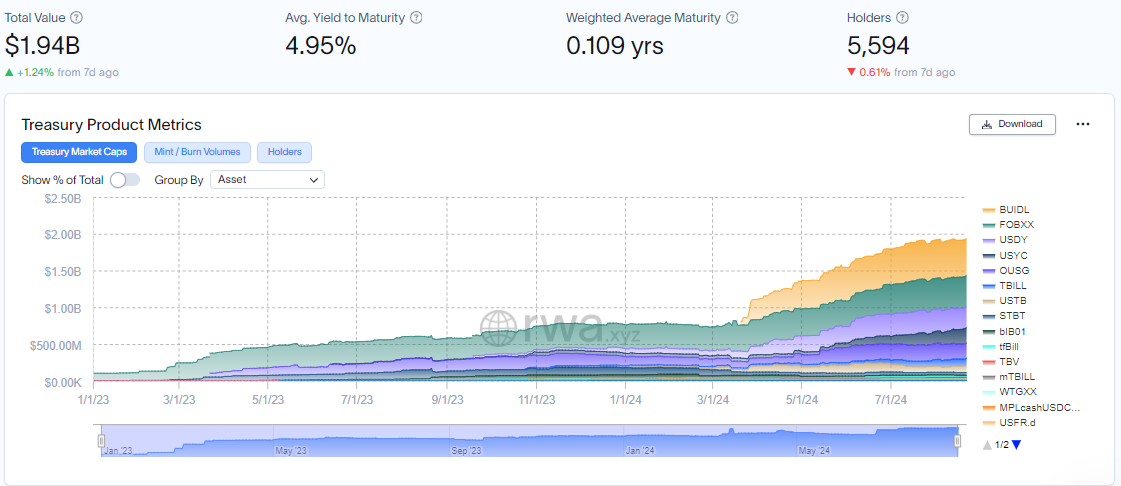

Certainly, the tokenized United States Treasury market has actually experienced considerable development in 2024. RWA.xyz information reveals that this section’s overall worth increased from $726.23 million to $1.94 billion this year.

Find Out More: What is The Influence of Real Life Property (RWA) Tokenization?

BlackRock’s BUIDL, a tokenized real-world property (RWA) fund released in March, is becoming a leader in the field. The fund’s rising dividend yields emphasize institutional capitalists’ enhancing passion in tokenized cash market funds. DeFi methods like Ondo are leveraging BUIDL for acquired items, better increasing its usage instance.

Various other considerable gamers in the tokenized RWA room consist of Franklin Templeton and Grayscale. Franklin Templeton’s Nasdaq-listed Onchain United States Federal Government Cash Fund (FOBXX) has actually lately been released on Arbitrum and Avalanche. Grayscale, like Franklin Templeton, runs a tokenized RWA fund on Avalanche yet additionally provides a wide profile of crypto investment company throughout different symbols.

Institutional passion is expanding, with companies like Goldman Sachs discovering tokenized treasuries. In Addition, State Road has actually partnered with Swiss crypto company Taurus to release a solution making it possible for RWA tokenization. These relocations indicate an expanding press to incorporate standard financing right into the decentralized financing ecological community.

Ondo Drives RWA Tokenization in DeFi

On The Other Hand, it’s essential to highlight Ondo Financing (ONDO) as a leading company of tokenized united state Treasuries. According to information from DefiLlama, the overall worth secured (TVL) on ONDO surpasses $536 million, standing for cash-equivalent items. This settings ONDO as a principal in the expanding tokenized financing field, using a bridge in between standard properties and decentralized financing.

This development is driven by Ondo Financing’s concentrate on enhancing fostering, assimilations, and liquidity for its symbols. Its yield-bearing stablecoin, USDY, is readily available throughout several blockchains, consisting of Ethereum, Solana, Universe, Aptos, Mantle, and Sui.

The increase of tokenized real-world properties (RWAs) comes with an essential time, as institutional gamers significantly obtain direct exposure to cryptocurrencies. The authorization of Bitcoin (BTC) and Ethereum (ETH) ETFs brought these properties to Wall surface Road, drawing in even more institutional resources.

Tokenizing RWAs addresses the demands of institutional customers looking for safe and secure financial companions and wardship remedies for their crypto holdings. By tokenizing properties, blockchain modern technology provides a much safer choice contrasted to much less safe and secure exchanges or purse carriers. This procedure additionally improves procedures and opens brand-new chances.

Find Out More: What is Tokenization on Blockchain?

Nevertheless, the field encounters numerous difficulties prior to attaining prevalent fostering. Concerns like developing token authenticity, making certain lawful approval in courts, and safeguarding clever agreements are difficulties that require to be resolved for tokenized RWAs to go mainstream in standard and decentralized financing

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to supply exact, prompt details. Nevertheless, visitors are encouraged to confirm truths individually and speak with a specialist prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.