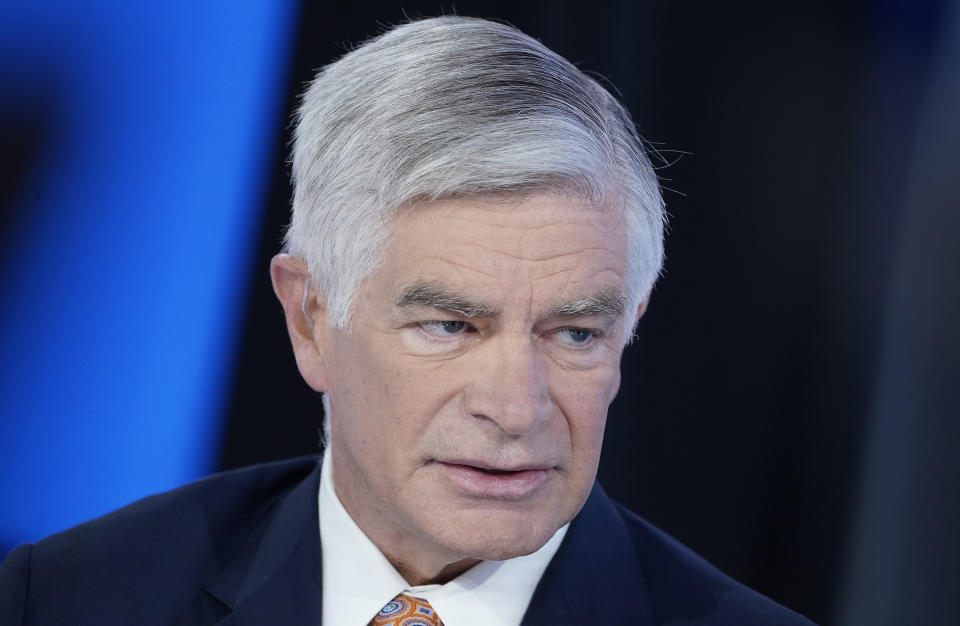

Atlanta Fed head of state Raphael Bostic is increasing his price quote of when price cuts might start, informing Yahoo Money that September or November is “most definitely in play” which a preliminary 25 basis factor decrease “might be one of the most ideal means onward.”

” For the majority of this year, my sight and my overview was that we would certainly do one cut this year and it would certainly remain in the 4th quarter,” he stated throughout a meeting Friday at the Kansas City Fed’s yearly financial seminar in Jackson Opening, Wyo.

” Rising cost of living has actually boiled down quicker than I anticipated. Labor markets have actually compromised significantly … that all recommends to me that it is mosting likely to be ideal to draw onward the start of our price step.”

Therefore, “being open to something in the 3rd quarter– September or November– is most definitely in play.”

The reserve bank policymaker made his remarks after Fed Chair Jerome Powell stated in a speech at Jackson Opening that “the moment has actually come for plan to change,” offering markets the all-clear indication that reduced prices are coming.

Powell’s speech comes simply over 3 weeks out of the Fed’s Sept. 17-18 conference, which ought to see the reserve bank reveal its very first rate of interest reduced considering that 2020.

Learn More: Federal funds price: What it is and just how it impacts you

Yet Powell was quiet on whether the very first cut would certainly be 25 basis factors or 50 and whether September was, actually, the beginning factor, stating “the timing and speed of price cuts will certainly depend upon inbound information, the progressing overview, and the equilibrium of threats.”

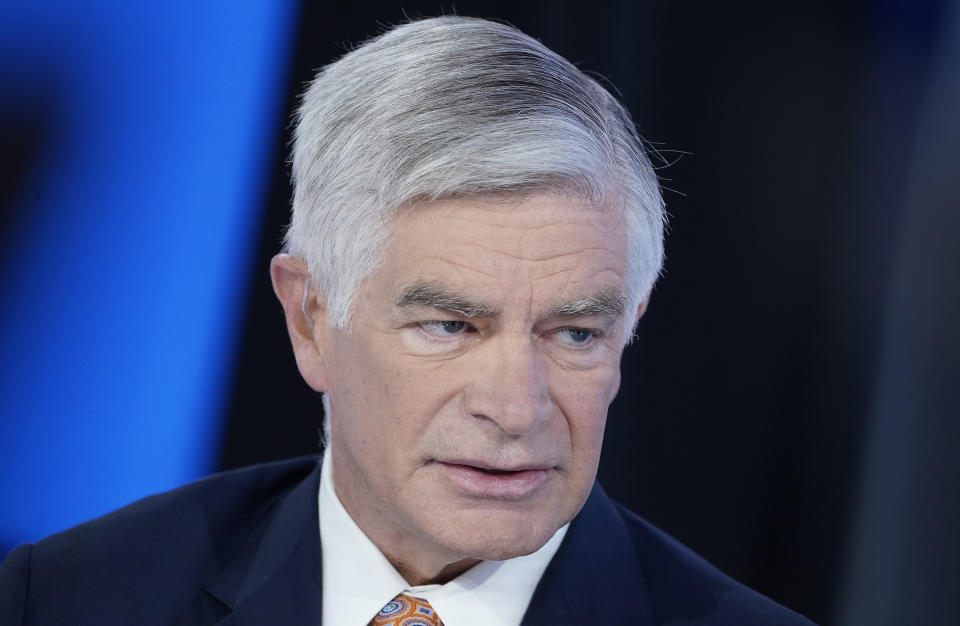

An additional Fed policymaker, Philly Fed head of state Patrick Harker, informed Yahoo Money in a different meeting Friday that he anticipates the reserve bank to begin with a 25 basis factor cut, and he would certainly be open to a bigger cut if the labor market weakens unexpectedly.

” Beginning at 25 makes a great deal of feeling to me,” Harker stated.

Bostic included a 25 basis factor step “might be one of the most ideal means onward” if rising cost of living remains constant with the air conditioning fads of the last a number of months.

” I am attempting to wait and see what takes place.”

He, like various other policymakers, is maintaining a close eye at work market as labor problems cool down.

Business are not as excited to employ as they were a year back, however Bostic stated he is not yet reading about a great deal of discharges coming up. Earnings, he kept in mind, are still greater than the price of rising cost of living.

When asked if the labor market can cool down without tipping the economic situation right into an economic downturn, he stated “it can and we will certainly need to see whether it does.”

Yet an economic downturn “is not in my overview.”

If firms carry out in reality begin laying employees off, that might transform the Fed’s calculus, he recognized: “That is a various circumstance and would certainly need a various plan action.”

Market wagers that a bigger step will certainly be available in September went up Friday early morning. Markets are valuing in a 34.5% opportunity the Fed cuts by 50 basis factors by the end of its September conference, up from an about 24% opportunity seen the day prior, per the CME’s FedWatch Tool.

Previous Cleveland Fed head of state Loretta Mester– that tipped down from the reserve bank’s rate-setting board much less than 2 months back– informed Yahoo Money in a meeting that she would not wish to begin with 50 basis factors due to the fact that “that is actually signifying the Fed lags the contour and I do not think the Fed is.”

” I believe a sensible standard would certainly be doing 25,” she included.

Click on this link for extensive evaluation of the most recent securities market information and occasions relocating supply rates

Check out the most recent monetary and service information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.