All eyes get on Bitcoin (BTC) after it recovered the $61,000 mark, complying with the launch of the Federal Competitive Market Board (FOMC) mins. The current cost activity has actually reignited rate of interest in the cryptocurrency, particularly offered Bitcoin’s connection with worldwide liquidity.

This connection likewise accentuates the United States buck index (DXY), as modifications in the DXY can affect BTC. Usually, when the buck damages, Bitcoin enhances as a result of capitalists looking for different possessions.

DXY Records New 2024 Lows: a Take A Look At Macro Drivers

The United State Buck Index (DXY) has actually developed reduced highs considering that June, striking fresh lows in 2024. After damaging listed below the January 1 reduced of $101.340, the DXY went down even more, bottoming at $100.923 on Wednesday.

At the time of composing, it’s trading at $101.311. A dropping DXY is favorable for danger possessions like Bitcoin and various other cryptocurrencies.

On the various other hand, worldwide liquidity (M2) is trending up. M2 gauges the overall quantity of cash flowing in the worldwide economic climate, consisting of examining accounts, interest-bearing accounts, and various other fluid possessions that can be rapidly exchanged money.

Danger possessions, consisting of Bitcoin, generally associate with increasing liquidity. The connection in between Bitcoin’s cost and M2 development mirrors more comprehensive market belief and financial problems. A greater M2 development suggests a loosened financial plan and an enhanced cash supply, which usually improves danger possessions like cryptocurrencies.

” BTC is one of the most delicate possession to liquidity. Historically, a 10% rise in worldwide liquidity has actually matched in a 40% rise in Bitcoin’s cost,” wrote Cryptonary.

Learn More: Exactly how to Secure Yourself From Rising Cost Of Living Utilizing Cryptocurrency

The Federal Book is most likely to alleviate financial plan at its following conference, according to the FOMC mins launched on Wednesday. Nonetheless, this depends upon information remaining to line up with assumptions. The mins likewise showed that some policymakers sustained a 25-basis-point (bps) price reduced throughout the July conference. In spite of this, the Fed selected to maintain prices unmodified, as BeInCrypto reported.

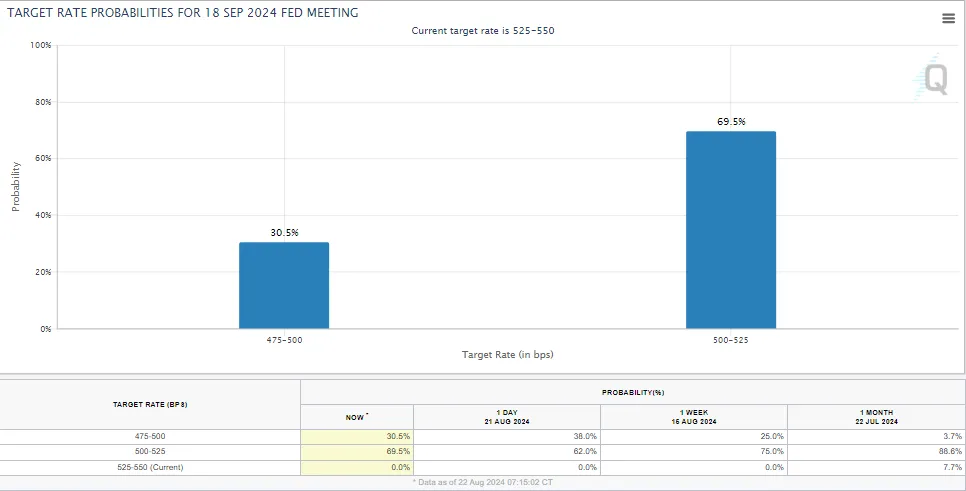

Based Upon the CME FedWatch Device, the possibility of a 50 bps price reduced in September has actually enhanced to 30.5%, mirroring expanding market belief towards a prospective easing of plan.

Nonetheless, it is essential to keep in mind that Fed Chair Jerome Powell has actually continually advised care, highlighting that reducing prices prematurely stays a significant worry. Nevertheless, the FOMC mins usually supply essential understandings right into policymakers’ progressing sights on rates of interest. This is especially pertinent if there’s a change in their position.

All eyes will certainly get on Powell’s upcoming speech on Friday at the Jackson Opening seminar, as markets try to find even more ideas concerning the Fed’s following actions. As BeInCrypto reported, Powell’s statements can activate market volatility, particularly in risk-on possessions like Bitcoin.

The possibility of reduced rates of interest usually advantages take the chance of possessions, which lines up with Bitcoin’s current relocation over $61,000. The cost has actually damaged over the in proportion triangular, yet verification of this outbreak is still pending. Markets will very closely check Powell’s remarks for additional instructions.

Learn More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

A secure candle holder close over $60,000, sustained by the Loved one Toughness Index (RSI) holding over 50, would certainly validate the extension of Bitcoin’s uptrend. For additional advantage, Bitcoin needs to appear the supply area in between $65,777 and $68,424. If this resistance is turned right into assistance, referred to as a favorable breaker, it can lead the way for a press towards a brand-new all-time high.

On the other hand, Bitcoin can drop back listed below $60,000, breaching the top trendline of the in proportion triangular. In a worst-case situation, additional marketing stress can drive BTC listed below the triangular’s reduced trendline and right into the need area.

If acquiring stress within the assistance area in between $53,485 and $57,050 stops working to combat the vendors, Bitcoin’s cost can go down also additionally, possibly targeting the liquidity residing listed below $52,398. This would certainly note a disadvantage relocation, suggesting a feasible turnaround in pattern.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to supply precise, prompt details. Nonetheless, viewers are recommended to confirm truths separately and seek advice from a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.