Choices on Bitcoin (BTC) and Ethereum (ETH) completing $1.5 billion are coming close to expiration, all while the marketplace stays fairly tranquil. Nonetheless, this security might be brief.

The yearly reserve bank conference in Jackson Opening, which starts today, is commonly viewed as the month’s most noteworthy macro occasion. Financiers are especially concentrated on any kind of information relating to possible rate of interest cuts by the Federal Book.

What’s Following for the Bitcoin and Ethereum Options Market After Expiration

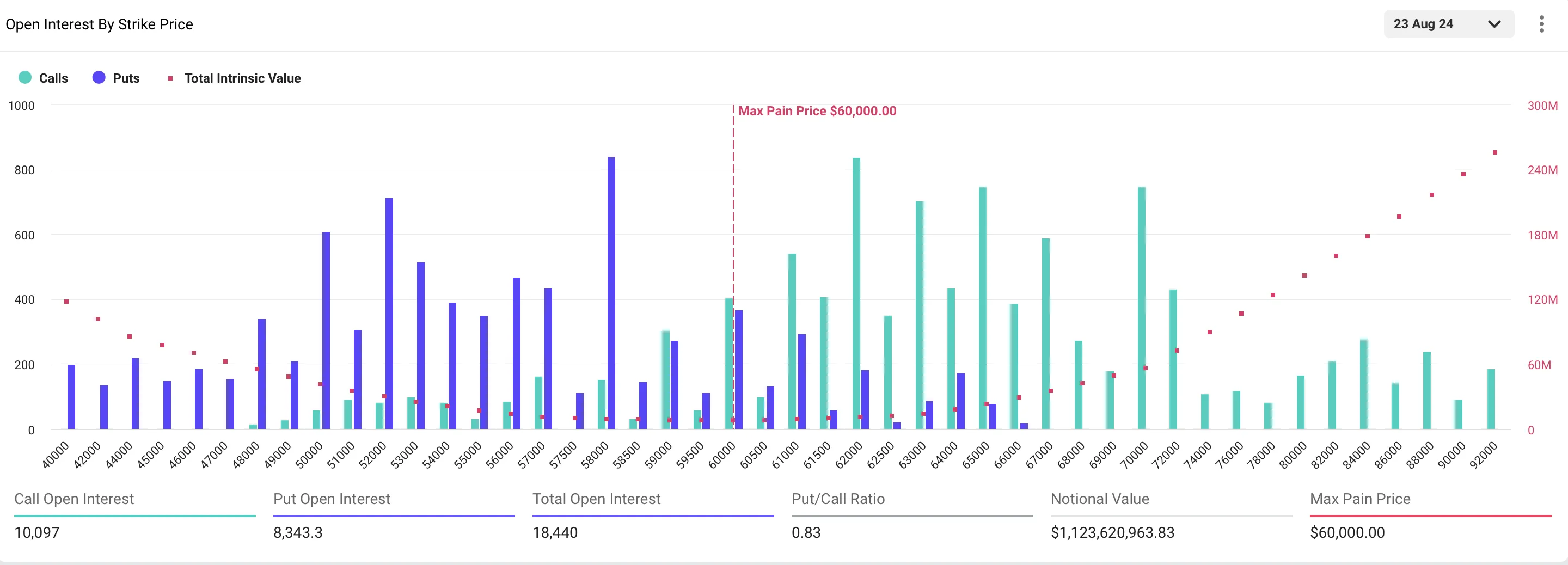

According to Deribit, over $1.12 billion in Bitcoin alternatives are readied to end, with an optimum discomfort factor of $60,000. This set of alternatives consists of 18,440 agreements, a decline from recently’s 24,383. The put-to-call proportion stays steady at 0.83.

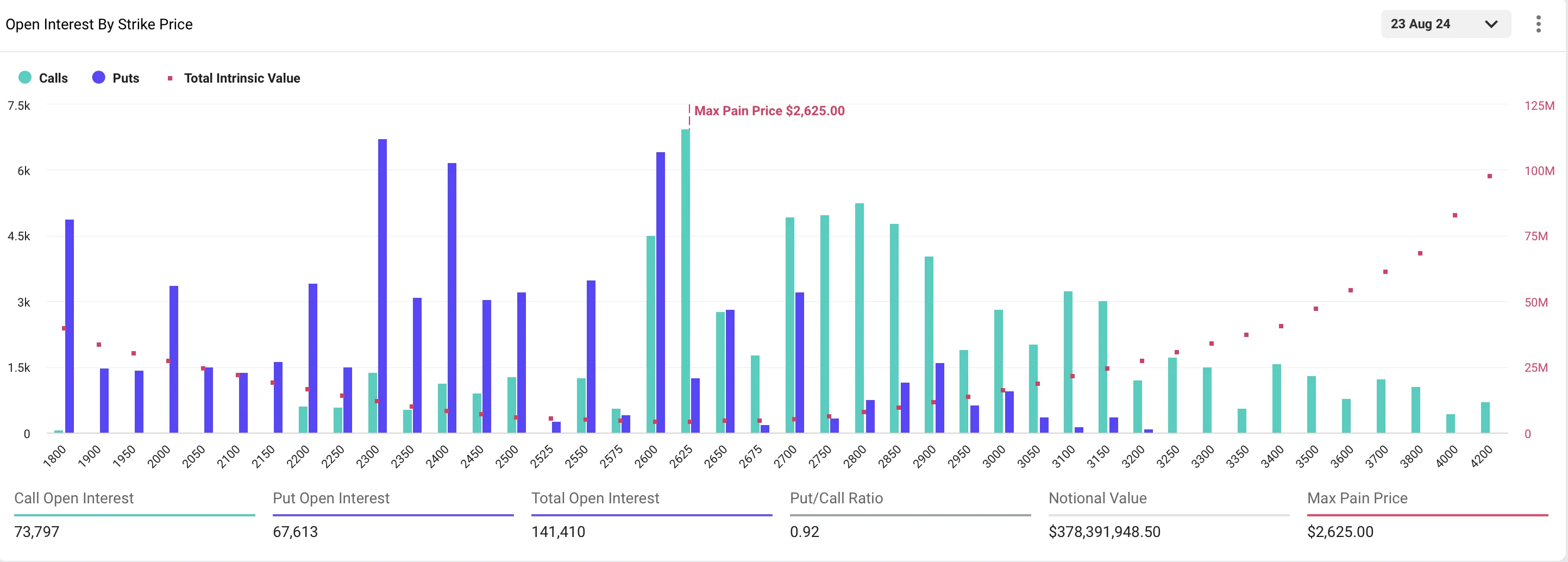

The optimum discomfort factor in alternatives trading is the rate degree where the greatest variety of alternatives end pointless, triggering one of the most economic loss for alternative owners and the least payment by vendors. This degree is commonly where market manufacturers have the best motivation to guide the rate.

The put-to-call proportion, which contrasts the variety of places (bank on decreases) to phone calls (bank on boosts), supplies additional understanding. A proportion listed below 1 shows a favorable view with even more phone calls than places, while a proportion over 1 recommends a bearish overview.

Learn More: An Intro to Crypto Options Trading

For Ethereum, $378.39 million in alternatives are readied to end, covering 141,410 agreements, below recently’s 183,821. The optimum discomfort factor is $2,625, with a put-to-call proportion of 0.92.

Experts from Greeks.live have actually discussed the marketplace problems leading up to today’s expiry. They noted that today’s macro occasions and information did not create significant market activities, causing an ongoing decrease in cryptocurrencies’ historic volatility (RECREATIONAL VEHICLE) and a steady reduction in the alternatives market’s volatility assumptions.

” Taking a look at alternatives information, placements in regular alternatives are remaining to drop, with placements standing for simply under 7% of overall today. There was additionally no considerable IV altitude at today’s yearly reserve bank conference. With the marketplace being fairly level, waiting appears to be the most effective method. Choices information recommends that the marketplace remains in an extremely tranquil cycle, with a strong term framework and a slowly lowering assumption of future volatility in the alternatives market,” Greeks.live experts suggested.

Already, Bitcoin is trading at $61,270, showing a moderate 0.7% boost in the previous 24 hr. Likewise, Ethereum has actually increased by 2.1% and is coming close to $2,700.

Learn More: 9 Finest Crypto Options Trading Operatings Systems

Historically, alternatives agreement expiries commonly cause sharp yet short-term rate activities, causing unpredictability and volatility as investors support for these changes. Nonetheless, the marketplace typically supports quickly after the expiries.

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to supply exact, prompt details. Nonetheless, viewers are suggested to validate truths individually and seek advice from an expert prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.