Cookware and home items seller Williams-Sonoma (NYSE: WSM) missed out on experts’ assumptions in Q2 CY2024, with earnings down 4% year on year to $1.79 billion. It made a non-GAAP revenue of $1.74 per share, boosting from its revenue of $1.56 per share in the exact same quarter in 2014.

Is currently the moment to acquire Williams-Sonoma? Find out in our full research report.

Williams-Sonoma (WSM) Q2 CY2024 Emphasizes:

-

Profits: $1.79 billion vs expert price quotes of $1.81 billion (1.2% miss out on)

-

EPS (non-GAAP): $1.74 vs expert price quotes of $1.61 (8% beat)

-

Decreased complete year earnings advice: currently anticipates complete year earnings down 3% year on year vs. previous assumption of level year on year earnings (miss out on)

-

Gross Margin (GAAP): 46.2%, up from 40.7% in the exact same quarter in 2014

-

Cost-free Capital Margin: 12%, below 17.7% in the exact same quarter in 2014

-

Locations: 521 at quarter end, below 532 in the exact same quarter in 2014

-

Same-Store Sales dropped 3.3% year on year (-11.9% in the exact same quarter in 2014) (miss out on)

-

Market Capitalization: $18.5 billion

” Today we are reporting solid outcomes for the 2nd quarter of 2024, which were driven by our Q2 boosted top-line pattern, market-share gains, and proceeded shipment on our dedication to productivity. In Q2, our compensation was available in at -3.3%, and we went beyond productivity price quotes with an operating margin of 16.2% and profits per share of $1.74, showing the 2-for-1 supply split we finished in July,” claimed Laura Alber, Head Of State and Ceo.

Began in 1956 as a shop focusing on French pots and pans, Williams-Sonoma (NYSE: WSM) is a specialized seller of higher-end cookware, home items, and furnishings.

Home Furnishings Merchant

Furnishings sellers recognize that ‘home is where the heart is’ yet that no home is total without that comfortable couch to unwind on or a wonderful bed to relax in. These shops concentrate on offering not just what is virtually required in a home yet additionally visual appeals, design, and beauty in the kind of tables, lights, and mirrors. Years back, it was believed that furnishings would certainly withstand shopping due to the logistical obstacles of delivery huge furnishings, now you can acquire a bed mattress online and obtain it in a box a couple of days later on; so much like various other sellers, furnishings shops require to adjust to brand-new truths and customer actions.

Sales Development

Williams-Sonoma is bigger than a lot of customer retail business and take advantage of economic situations of range, offering it a side over its rivals.

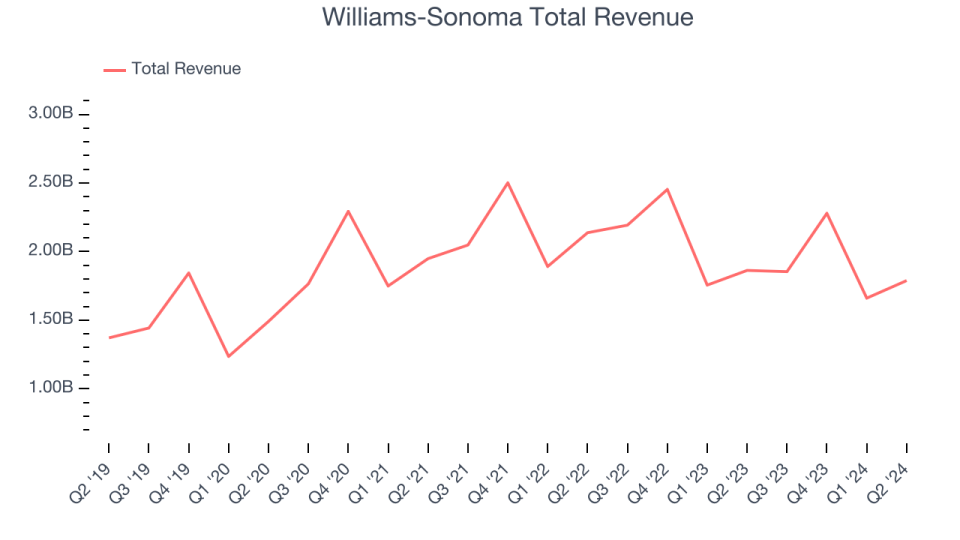

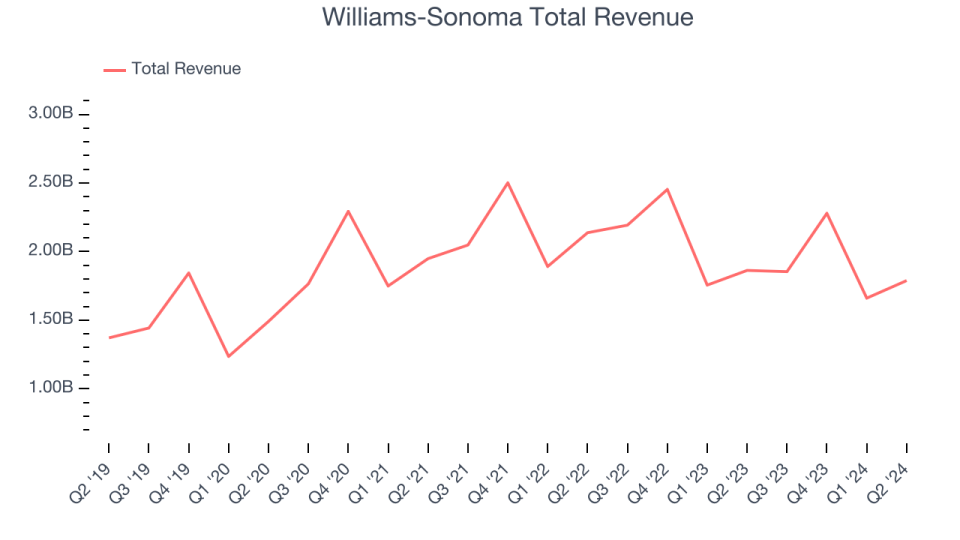

As you can see below, the business’s annualized earnings development price of 5.5% over the last 5 years was slow-moving as its shop matter went down.

This quarter, Williams-Sonoma missed out on Wall surface Road’s price quotes and reported an instead unexciting 4% year-on-year earnings decrease, creating $1.79 billion in earnings. Looking in advance, Wall surface Road anticipates sales to expand 4.1% over the following year, a velocity from this quarter.

When a firm has even more cash money than it recognizes what to do with, redeeming its very own shares can make a great deal of feeling– as long as the cost is right. Fortunately, we have actually discovered one, an inexpensive supply that is spurting totally free capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

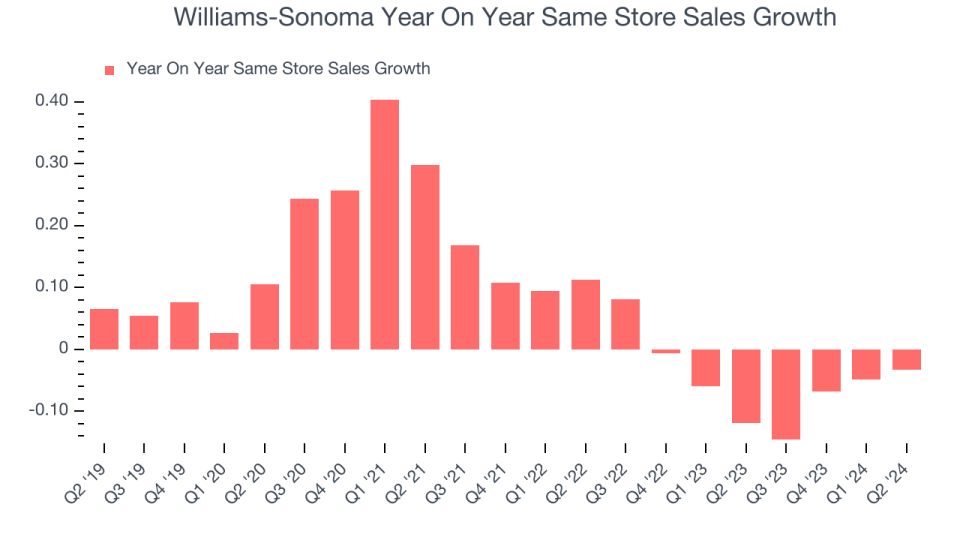

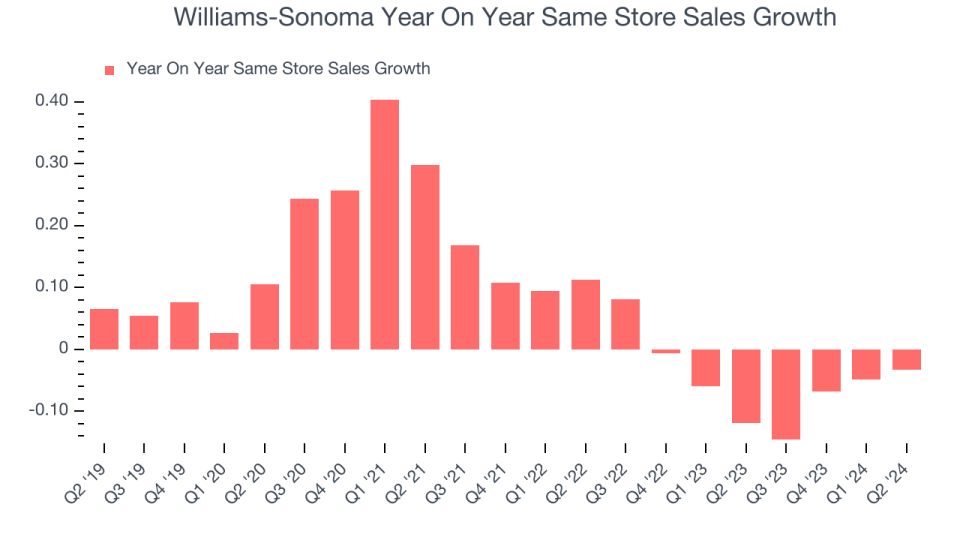

Williams-Sonoma’s need has actually been reducing over the last 8 quarters, and typically, its same-store sales have actually decreased by 5% year on year. The business has actually been decreasing its shop matter as less places often result in greater same-store sales, yet that hasn’t held true below.

In the most recent quarter, Williams-Sonoma’s same-store sales dropped 3.3% year on year. This reduction was an enhancement from the 11.9% year-on-year decrease it uploaded year back. It’s constantly terrific to see an organization boost its leads.

Trick Takeaways from Williams-Sonoma’s Q2 Outcomes

While EPS beat, same-store sales and earnings both missed out on. The business additionally reduced its complete year earnings advice “to show reduced web earnings patterns” although Williams-Sonoma anticipates greater complete year margins. The locations listed below assumptions appear to be driving the supply action, and shares traded down 11.5% to $127.35 right away after reporting.

So should you purchase Williams-Sonoma now? When making that choice, it is essential to consider its assessment, organization top qualities, along with what has actually occurred in the most recent quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.