Solana’s (SOL) rate is falling short to recuperate its current losses, not even if of the wider market’s bearishness however likewise as a result of establishments’ bearishness.

This follows Brazil accepted yet one more place, SOL ETF, making the uncertainty unusual.

Solana Institutional Investors Go Back

Solana’s rate was anticipated to take advantage of the 2nd place SOL ETF authorization in Brazil today. The authorization can have set off recuperation, establishing a criterion for the altcoin worldwide.

Nonetheless, institutional financiers have actually currently been taking out from SOL greatly, which can even more counter this bullishness. Actually, in regards to bearishness, Solana has actually outshined also Bitcoin and Ethereum.

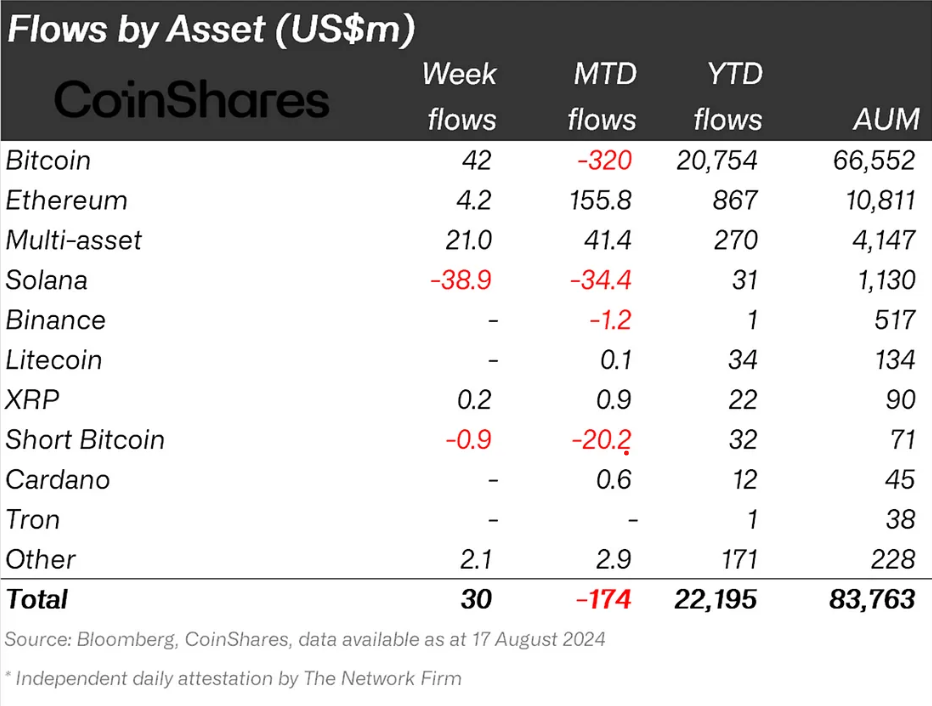

According to the record from CoinShares, for the week finishing August 17, SOL kept in mind discharges totaling up to $38.9 million. This brought Solana’s year-to-date circulations to $31 million much less than that of Litecoin.

Find Out More: 11 Leading Solana Meme Coins to Enjoy in August 2024

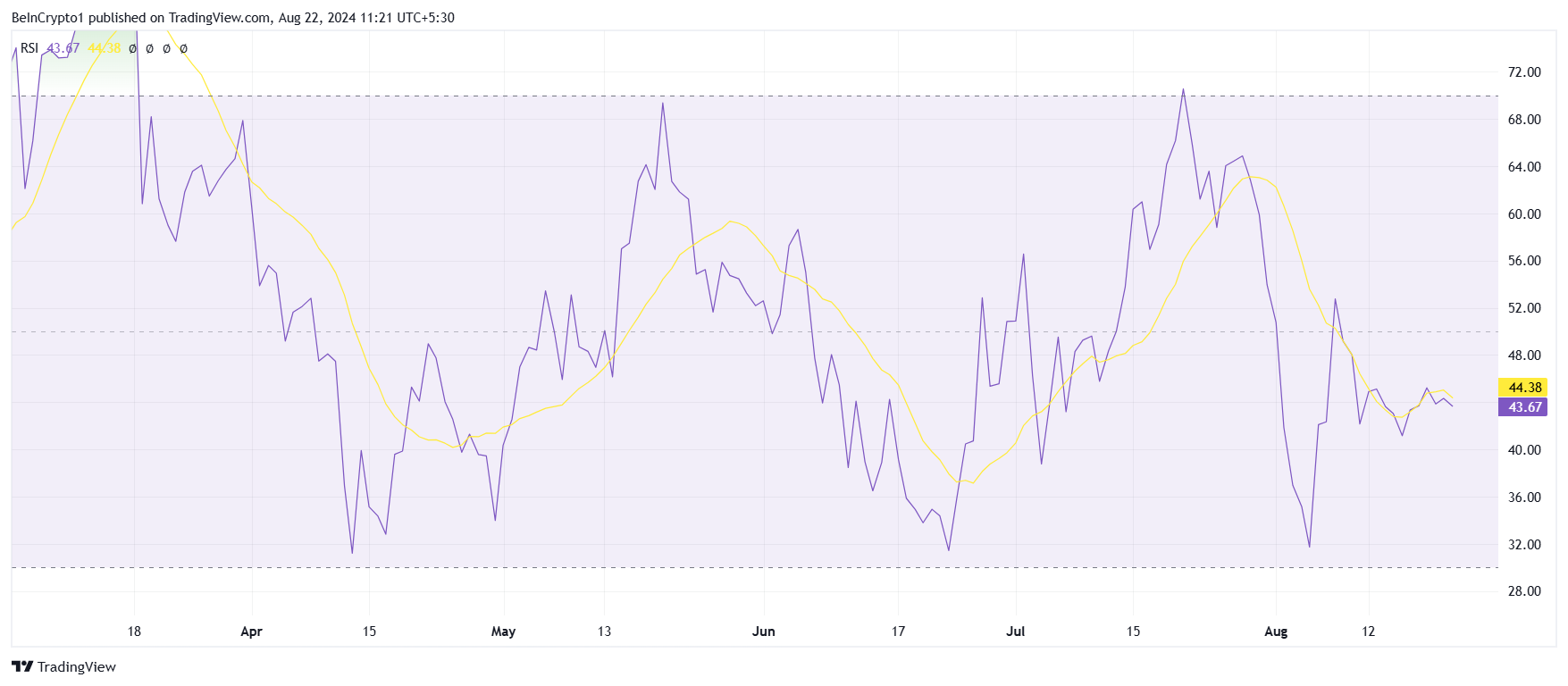

This withdrawal can intensify the downhearted ambience bordering the altcoin’s rate considering that the wider market hints are currently unfavorable. After breaching right into the favorable area, the Family member Stamina Index (RSI) is back under the neutral line.

The decline recommends that the purchasing energy was not lasting and, because of this, wound down. As long as RSI is listed below the neutral line, the opportunity of a recuperation stays grim.

SOL Rate Forecast: Maintaining a Reduced Account

Solana’s rate is trading around the $150 mark at $142 at the time of composing, holding over the assistance of $137. The temporary recuperation of SOL from $130 to $162 previously this month has actually virtually fallen short. The crypto possession is most likely collection to combine under $156 as it has previously.

Also if the assistance of $137 is revoked, the altcoin will certainly wind up being up to $126, which is the important assistance flooring. A recover from this factor will certainly proceed the macro combination within $186 and $126.

Find Out More: 6 Finest Systems To Get Solana (SOL) in 2024

Nonetheless, the expectation can transform if a steady recuperation assists Solana redeem $156 as assistance. T he SOL rate can increase to $169, which, while it might not recuperate from the 30% accident from July, can still revoke the bearish thesis.

Please Note

In accordance with the Trust fund Job standards, this rate evaluation short article is for educational functions just and ought to not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to precise, impartial coverage, however market problems undergo transform without notification. Constantly perform your very own research study and speak with a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.