Considering that reaching its all-time high in June, Notcoin (NOT) has actually decreased by 62%. The last 1 month have actually been testing too, with the rate coming by dual numbers.

Nevertheless, this evaluation recommends that the Telegram-based cryptocurrency may quickly see some alleviation.

Notcoin Favorable Aberration Sets Off Modification in Positions

Since this writing, Notcoin’s rate is $0.010. This is a significant autumn from $0.012, which it appealed August 19 and at some point became an incorrect outbreak. Yet on the day-to-day graph, the Chaikin Cash Circulation (CMF) has actually left its remain in the adverse area and leapt to the silver lining.

The CMF is a technological indication that assesses the degree of acquiring or marketing stress in the marketplace to give understandings right into future rate instructions. Commonly, an increasing CMF indicates that market individuals are building up.

A dropping ranking of the indication, nonetheless, reveals that circulation is significantly existing. Consequently, the contrary motion of NOT’s rate and the CMF is a favorable aberration, recommending that financiers are taking advantage of the current discount rate and acquiring the dip.

Learn More: Where To Acquire Notcoin: Leading 5 Systems In 2024

In addition, previous efficiency as current as July strengthens the prejudice. For example, as revealed over, NOT experienced a sag to $0.010 on July 5.

Throughout the decline, the CMF additionally adhered to. Yet minutes after the indication transformed instructions, the rate additionally adhered to, at some point driving a 43% boost to $0.017.

Nevertheless, this does not suggest that Notcoin’s rate will certainly reproduce the specific increase. Yet if cash remains to move right into the token, a significant rebound might be following. It additionally shows up that investors in the acquired market share a comparable view.

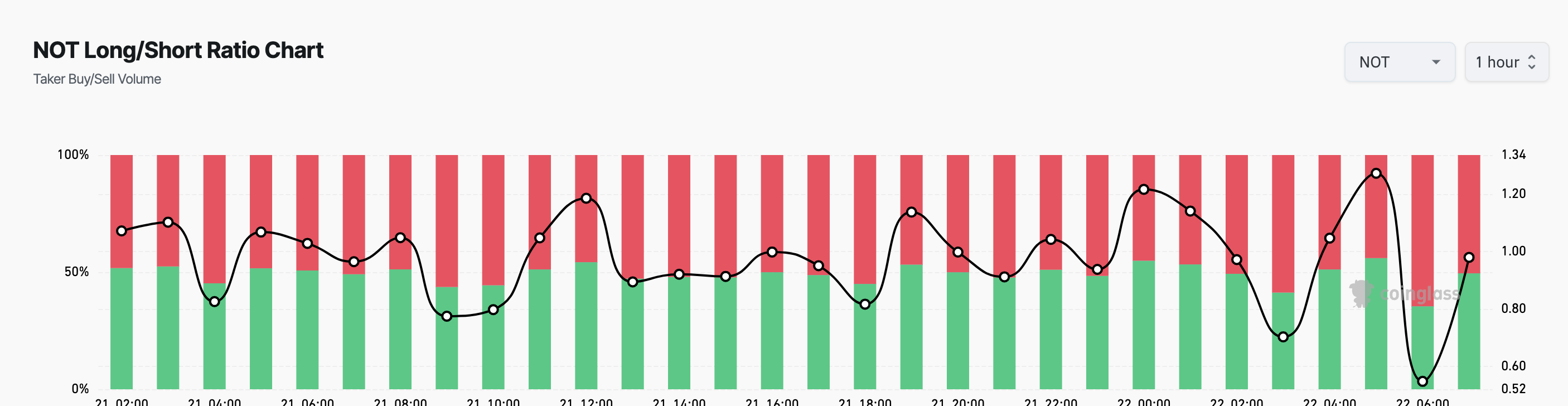

According to Coinglass, Notcoin’s Long/Short Proportion has actually struck a specific analysis of 1. This proportion is a measure of capitalist assumptions.

If the analysis drops listed below 1, the typical employment opportunity is bearish, while an analysis over the worth recommends or else. Consequently, the increasing proportion exposes that there are much more longs (customers) than shorts (vendors).

NOT Rate Forecast: Ready to Review $0.013

At press time, the NOT/USD graph presented a coming down triangular, a pattern normally signifying bearish extension. Nevertheless, sometimes, a turnaround can take place, and Notcoin seems among those exemptions.

As revealed listed below, and sustained by expanding acquiring stress, Notcoin appears positioned to damage over the bearish development. For this outbreak to take place, customers need to outmatch vendors to move market energy.

If effective, NOT might increase to $0.013 in the short-term and possibly get to $0.016. Nevertheless, this expectation might be revoked if crypto whales remain to unload the token.

Learn More: Notcoin (NOT) Rate Forecast 2024/2025/2030

Remember that this capitalist friend played a vital function in driving the rate down formerly. If these sell-offs linger, Notcoin’s rate might decrease even more, possibly going down to $0.0085.

Please Note

In accordance with the Count on Job standards, this rate evaluation short article is for informative functions just and need to not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to precise, honest coverage, yet market problems go through alter without notification. Constantly perform your very own study and seek advice from a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.