The cost of MATIC, the token powering Polygon, Ethereum’s leading Layer-2 scaling service, has actually gotten to a 60-day high.

Over the previous week, MATIC’s cost rose 28% as capitalists expect the upcoming token movement from MATIC to POL.

Polygon Whales Leaves Absolutely Nothing to Possibility

Since this writing, MATIC trades at $0.52. Its double-digit cost walking in the previous 7 days is partially as a result of an increase in whale task throughout that duration. Information from IntoTheBlock reveals that the token’s huge owners’ netflow has actually climbed by 43% throughout that duration.

Huge owners describe capitalists that hold greater than 0.1% of a possession’s flowing supply. Their netflow gauges the distinction in between the coins they acquire and the quantity they offer with time.

When a possession’s huge owner netflow climbs, it signifies that whale addresses are collecting extra coins. This is taken into consideration a favorable sign that frequently causes a cost rally. As retail capitalists observe huge owners raising their placements, their self-confidence commonly expands, which drives added acquiring and can maintain cost energy.

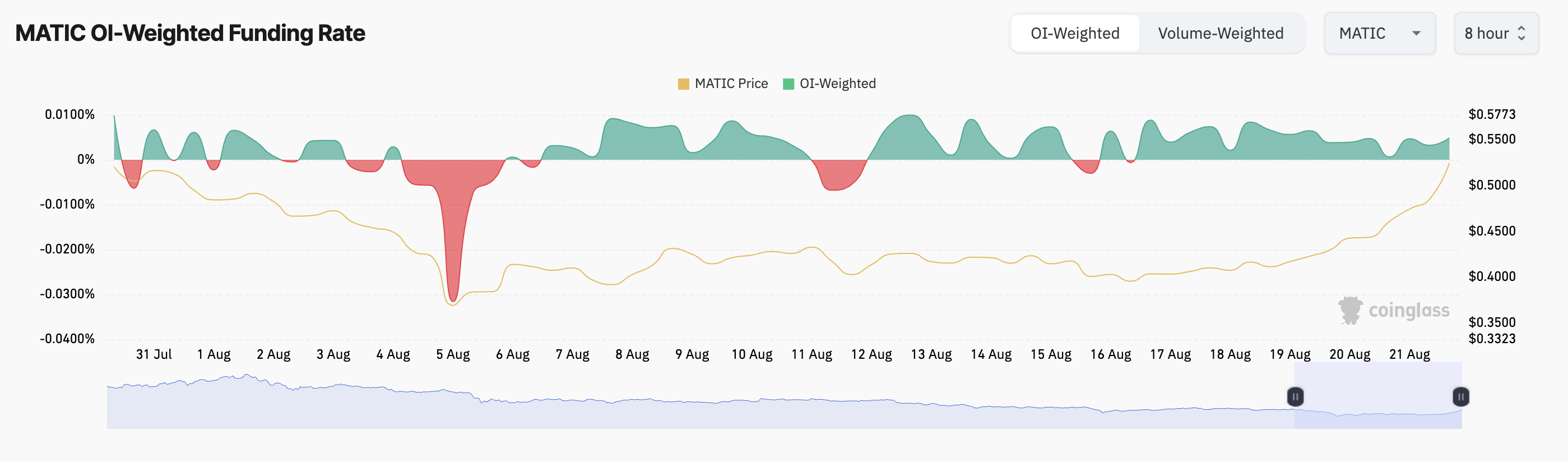

Moreover, MATIC futures investors have actually continually revealed need for lengthy placements. This is shown in the altcoin’s favorable financing price considering that August 17, showing that investors agree to pay a costs for keeping favorable placements in the by-products market.

Find Out More: 15 Finest Polygon (MATIC) Purses in 2024

When a possession’s financing price declares, there is even more need for lengthy placements. It suggests that even more investors are banking on a cost rally than those expecting a decrease.

MATIC Rate Forecast: Existing Uptrend Is Solid

MATIC’s Ordinary Directional Index (ADX) verifies that the existing uptrend is solid. Evaluated on a one-day graph, the sign remains in an uptrend at 48.17.

The ADX gauges the toughness of a fad no matter its instructions. At 48.17, MATIC’s ADX signals that its existing fad is extremely solid.

MATIC’s Directional Motion Index arrangement reveals that the fad is favorable. Since this writing, the token’s Favorable Directional Indication (+ DI) relaxes over its Adverse Directional Indication (- DI). When the +DI is over the -DI, it recommends that the marketplace fad is favorable and acquiring stress is leading.

Find Out More: Polygon (MATIC) Rate Forecast 2024/2025/2030

Preserving the existing fad might press MATIC’s cost to $0.55. Nevertheless, profit-taking might apply descending stress, possibly going down the cost to $0.33.

Please Note

In accordance with the Count on Task standards, this cost evaluation post is for informative objectives just and need to not be taken into consideration monetary or financial investment guidance. BeInCrypto is devoted to precise, objective coverage, however market problems go through alter without notification. Constantly perform your very own research study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.