Because Bitcoin (BTC) struck a six-month short on August 5 throughout the wider market slump, it has actually seen a small surge sought after, developing a rising triangular pattern.

Presently trading at $60,940, the leading cryptocurrency has actually recoiled by 13% from its August 5 reduced of $54,018.

Bitcoin Seeks to Damage Above Resistance

A rising triangular is a favorable graph pattern that creates when a possession’s cost relocations in between a level straight resistance line and a climbing assistance line. This pattern signals expanding acquiring stress while marketing task stays focused at a particular cost degree. As need boosts, the cost borders closer to damaging the resistance.

For Bitcoin, the crucial resistance degree within this pattern is $61,845. Presently trading at $60,940, BTC is trying to damage over this resistance, showing that purchasers might quickly get rid of offering stress, possibly pressing the cost greater.

The Chaikin Cash Circulation (CMF) indication sustains this expectation. With an analysis of 0.01, the CMF has actually relocated over the no line for the very first time because August 13, showing raising resources inflows that reinforce the favorable energy.

This indication gauges the circulation of cash right into and out of a possession. When its worth is over no, it indicates liquidity access right into the marketplace and a spike in acquiring task. Investors frequently see it as a forerunner to a rate rally.

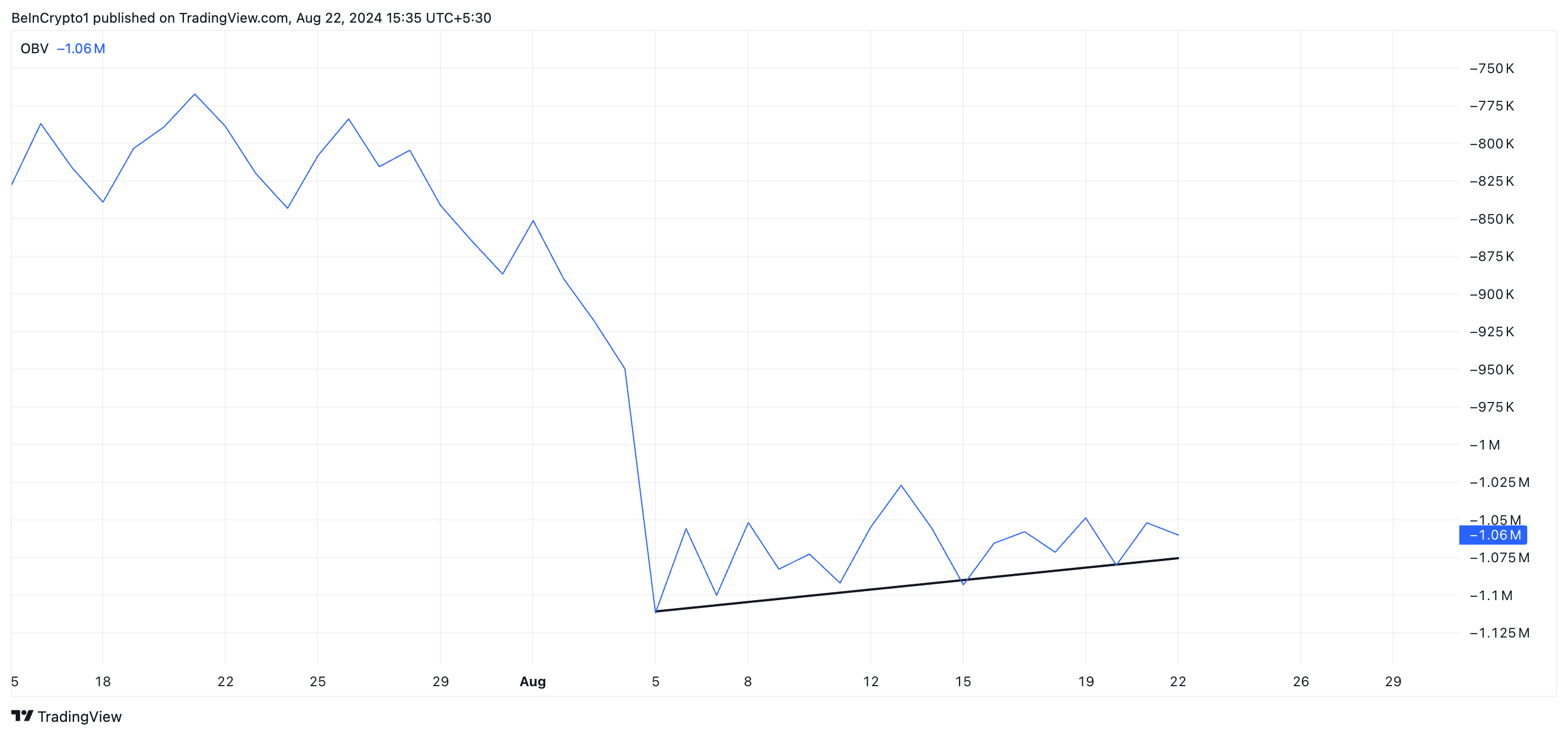

Furthermore, BTC’s on-balance quantity (OBV) has actually increased continuously because the rising triangular started. This indication steps dealing stress in a possession’s market.

Learn More: What Took place at the Last Bitcoin Halving? Forecasts for 2024

When it boosts, it suggests that getting stress outweighs offering task, meaning a favorable recuperation.

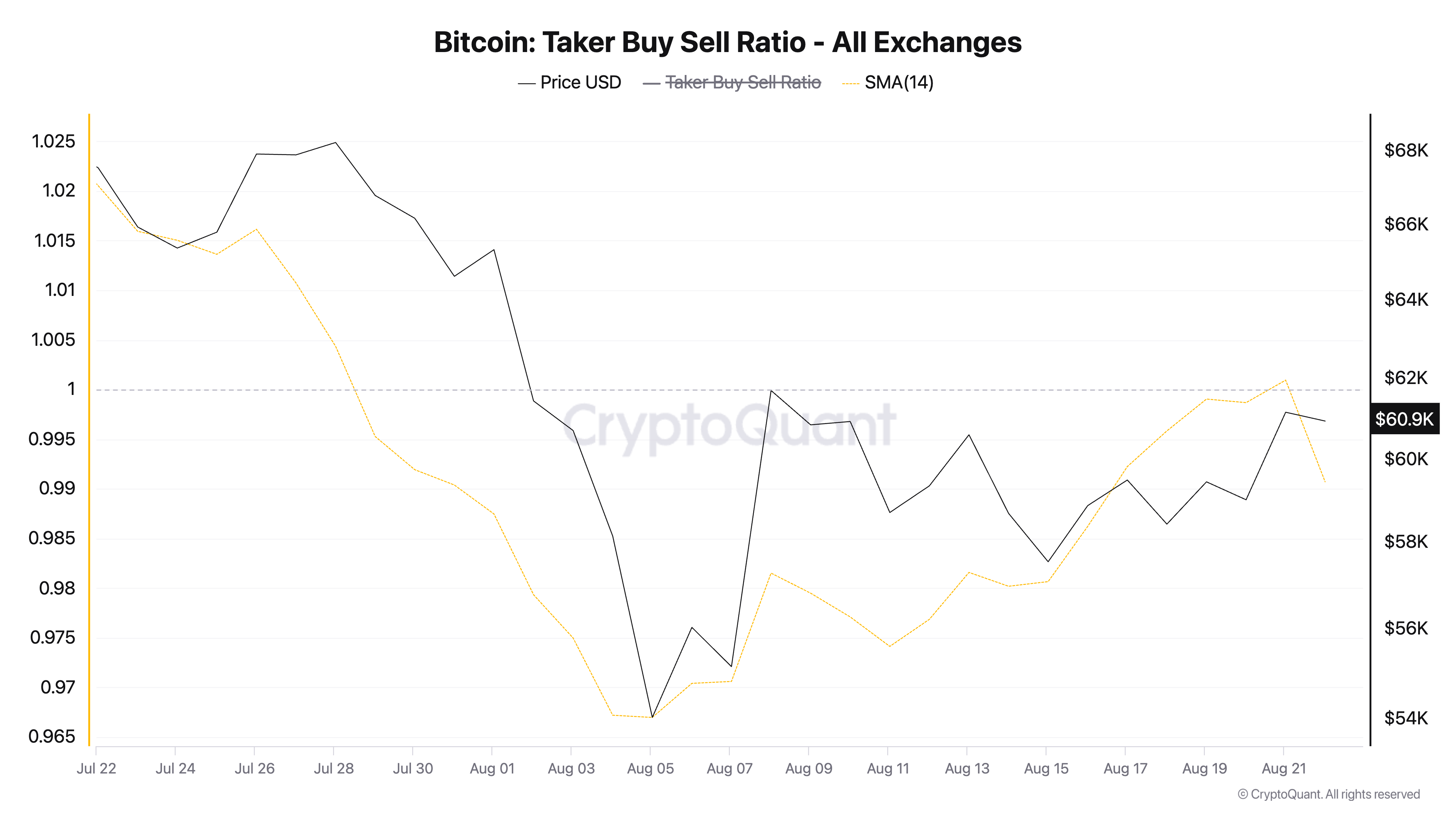

BTC Cost Forecast: Futures Investors Walk a Various Course

While BTC appreciates an expanding favorable prejudice in its place market, its by-products market investors have actually taken on a bearish technique. This appears in the coin’s taker-buy-sell proportion (examined utilizing a 14-day straightforward relocating standard), which has actually dropped listed below one. CryptoQuant’s information placed the metric’s worth at 0.99 at the time of composing.

This statistics steps the proportion in between deal quantities in a possession’s futures market. A worth more than one suggests even more buy quantity than offer quantity, while a worth much less than one suggests even more sell quantity than acquire quantity.

A taker buy-sell proportion listed below one is a bearish signal, as it suggests that investors in a possession’s continuous futures market are mostly offering their properties as opposed to getting even more.

Learn More: 7 Ways To Make It Through the Crypto Bearishness

If investors proceed offering, Bitcoin’s cost can go down to $58,464, backtracking several of its current gains. On the various other hand, if their technique changes towards building up even more BTC, it can damage over the rising triangular’s resistance, possibly pressing the cost to $64,321.

Please Note

According to the Trust fund Job standards, this cost evaluation post is for educational functions just and must not be thought about monetary or financial investment recommendations. BeInCrypto is devoted to precise, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.