Ethereum (ETH) area exchange-traded funds (ETFs) ended up being tradeable on July 23. Nevertheless, regardless of preliminary interest, these mutual fund have actually battled to preserve capitalist passion.

In current weeks, ETH ETFs have actually encountered considerable internet discharges, with just one week of inflows tape-recorded considering that their launch.

Ethereum ETFs Document Steady Discharges

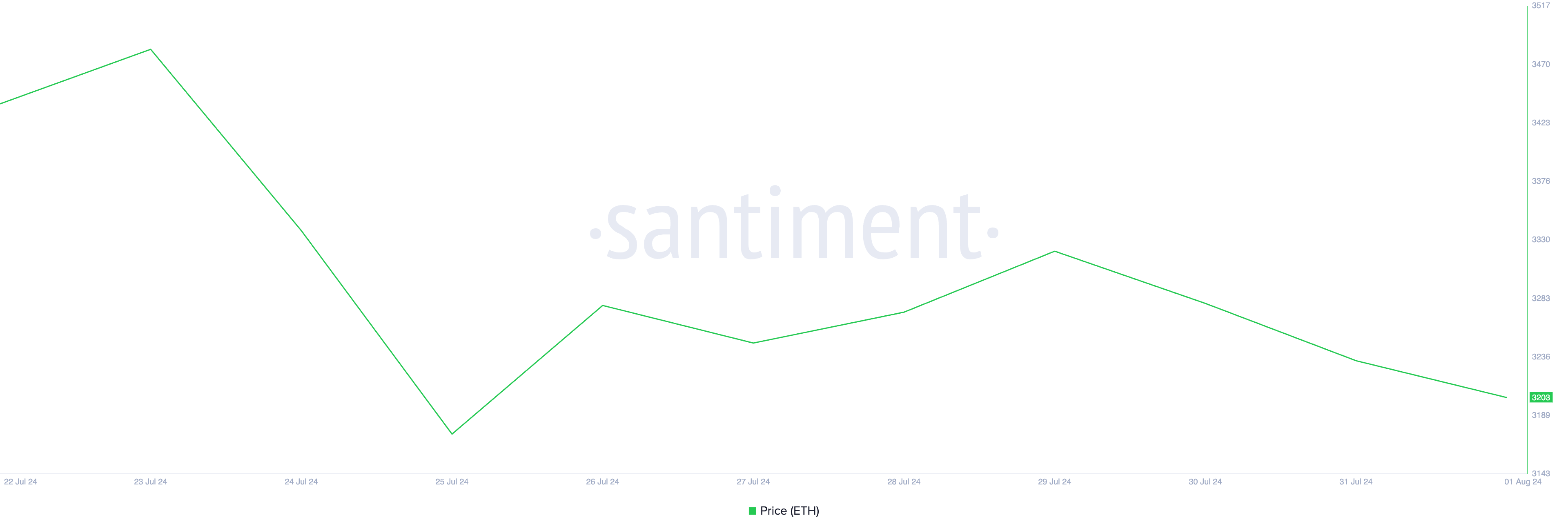

According to information from SosoValue, ETH area ETFs tape-recorded an internet discharge of $341.35 million in their initial week of trading, noting the biggest discharge to day. The 2nd week saw a lowered discharge of $169.35 million, showing that while capitalist passion remained to decrease, the rate of withdrawals reduced somewhat.

Within both weeks, the overall internet properties dropped from $9.24 billion to $8.33 billion. This decrease was because of funds withdrawal from these ETFs as ETH worth connected. In between July 23 and August 8, the cost of the leading altcoin came by 7%.

Although ETH’s worth decreased even more in the 3rd week, the ETFs tape-recorded their initial and just inflows, amounting to $104.76 million. Surprisingly, regardless of this favorable inflow, the overall internet properties in these funds visited an additional 13%.

By the end of that week, the consolidated internet worth of all properties held by United States Ethereum area ETFs stood at $7.28 billion. This stays the only week of internet inflows these funds have actually seen considering that their launch.

Discharges have actually totaled up to $38 million thus far today, with overall internet properties at $7.38 billion. This stands for 2.3% of ETH’s market capitalization.

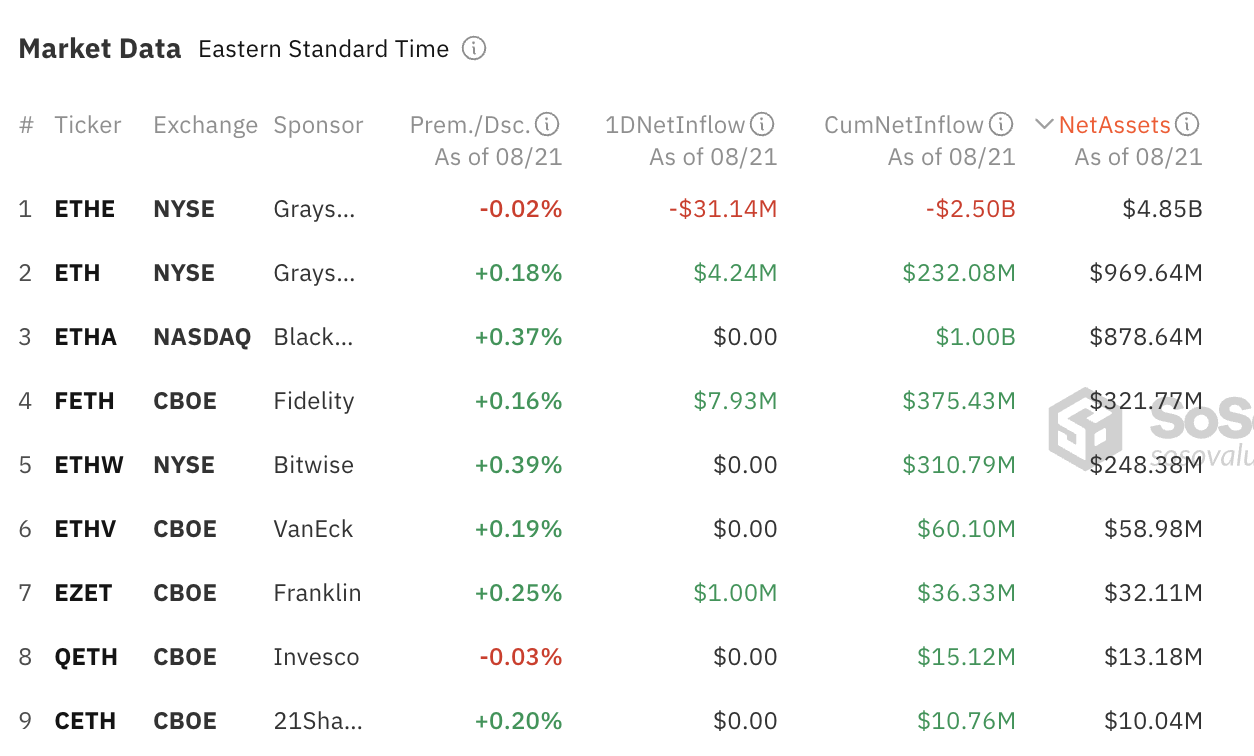

On Wednesday, BlackRock’s iShares Ethereum Count on (ETHA) exceeded $1 billion in collective internet inflows, making it the only fund to get to that landmark. According to SoSoValue information, this exceeds the consolidated inflows of the following 3 highest possible ETFs.

Learn More: Exactly how to Buy Ethereum ETFs?

Nevertheless, ETHA’s internet properties place 3rd, behind Grayscale’s mini Ether trust fund (ETH) and Ethereum trust fund (ETHE), which have overall properties of $4.85 billion and $969.64 million, specifically. ETHA holds overall properties of $878.64 million.

ETH Cost Forecast: Coin Flashes Acquire Signal

At press time, ETH is trading at $2,627, mirroring a 1% cost rise over the previous 1 day, while its trading quantity has actually risen by 9%.

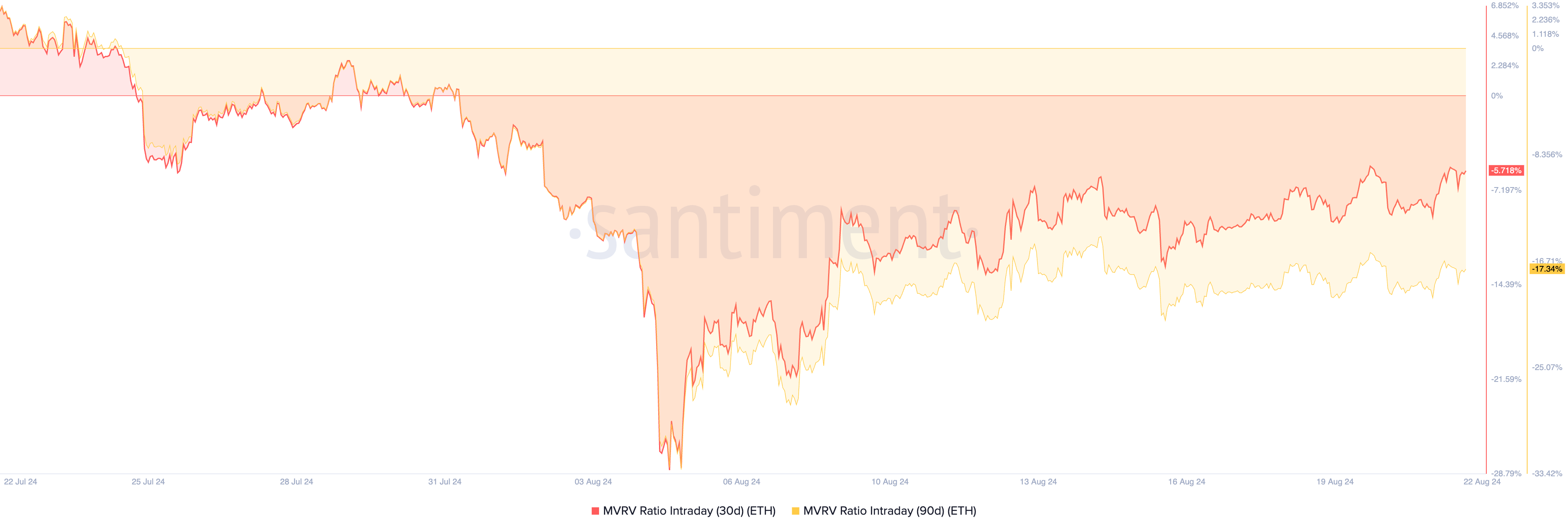

ETH’s battle to maintain over the $3,000 mark provides a possible acquiring possibility, shown by its adverse market price to understood worth (MVRV) proportion. According to Santiment, the token’s 30-day and 90-day MVRV proportions stand at -5.71% and -17.34%, specifically, recommending the possession might be underestimated.

The MVRV proportion steps whether a possession is miscalculated, underestimated, or rather valued. When the proportion is listed below one, it shows the possession’s market price is much less than its understood worth, recommending it might be underestimated. This produces an acquiring possibility for investors wanting to take advantage of the “dip.”

If ETH starts an uptrend, customers that go into at the existing market price might recognize gains as the cost climbs up towards $2,868.

Learn More: Ethereum (ETH) Cost Forecast 2024/2025/2030

Nevertheless, they run the risk of being placed “under the cash” if a drop happens and the cost goes down to $2,579. A capitalist is “under the cash” when the possession’s market price drops listed below the procurement cost, resulting in prospective losses.

Please Note

According to the Count on Task standards, this cost evaluation short article is for educational functions just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to exact, impartial coverage, yet market problems go through alter without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.