TRX, the indigenous coin of the decentralized blockchain Tron, currently trades at its highest possible cost given that May 2021. The coin’s worth has actually increased by 27% in the previous 7 days.

Since this writing, the altcoin exchanges hands at $0.16.

Tron Sees Favorable Cost

TRX has actually seen an 11% cost walk in the previous 24-hour. Throughout that duration, its trading quantity has actually escalated by 139%. Completing $1.87 billion at press time, TRX’s everyday trading quantity goes to its highest degree given that November 7, 2022.

When a rise in trading quantity comes with a property’s cost rally, it recommends solid rate of interest from market individuals. This indicates that purchasing stress is high, and the marketplace belief is favorable.

TRX’s favorable heavy belief highlights the marketplace’s confident expectation on the altcoin. This statistics assesses the general state of mind bordering a property based upon social networks points out, newspaper article, and on the internet conversations.

When the belief declares, it shows that a lot of conversations are favorable. Presently, TRX’s heavy belief stands at 7.32, its highest degree given that November 2022.

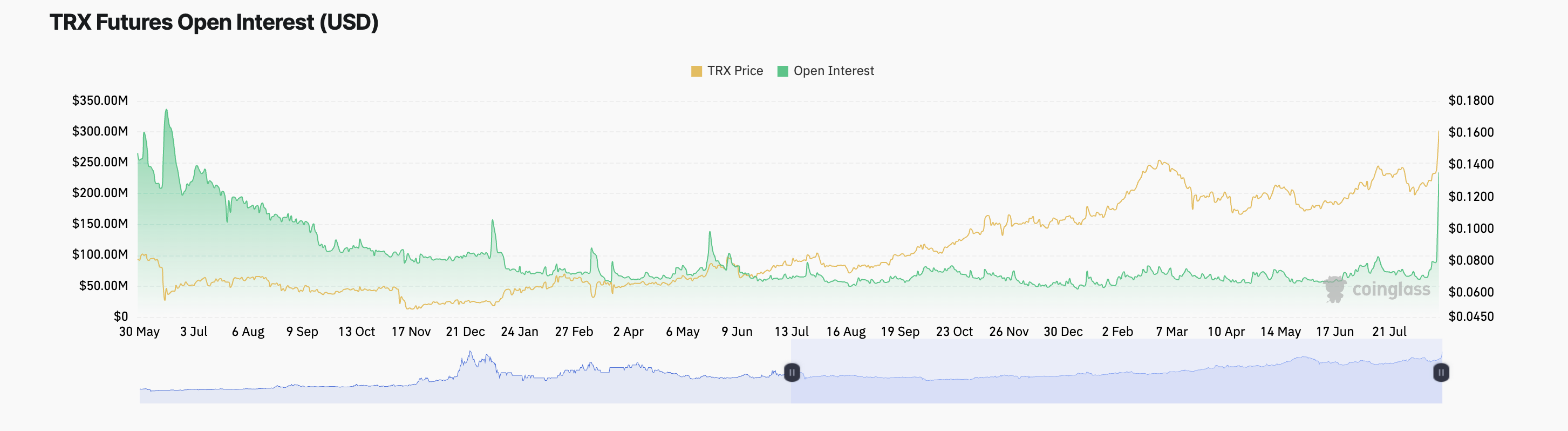

In addition, TRX’s current cost rise has actually been come with by a remarkable boost in futures open rate of interest. Information from Coinglass discloses that open rate of interest has actually leapt by 77% in the previous 24-hour, getting to a two-month high.

Find Out More: What Is TRON (TRX) and Just How Does It Function?

A property’s futures open rate of interest describes the complete variety of impressive futures agreements that have actually not been resolved. When it increases, it indicates that even more investors are becoming part of brand-new placements.

TRX Rate Forecast: The Rally May Be Shortlived

An evaluation of TRX’s vital energy signs recommends a prospective improvement might be on the perspective. Presently, its Loved One Stamina Index (RSI) is 84.76, while the cash Circulation Index (MFI) is 91.07.

Both signs evaluate whether a property is overbought or oversold. When the RSI surpasses 70, it indicates that the property is overbought and might be due for a pullback. In a similar way, an MFI analysis over 80 shows that the marketplace is overbought and an improvement might impend.

The raised RSI and MFI worths suggest that TRX’s market might be overheating, with indications of customer fatigue. As need winds down and marketing stress rises, TRX is most likely to get in a drop.

Find Out More: TRON (TRX) Rate Forecast 2024/2025/2030

If this circumstance unravels, TRX’s cost might pull away to $0.14, standing for a 13% decrease from existing degrees. Nonetheless, if the uptrend proceeds, TRX might recover its year-to-date high of $0.17.

Please Note

According to the Count on Task standards, this cost evaluation short article is for informative functions just and must not be thought about economic or financial investment guidance. BeInCrypto is devoted to exact, impartial coverage, yet market problems undergo alter without notification. Constantly perform your very own research study and talk to an expert prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.