2 weeks later on, Solana’s (SOL) cost relocated north, getting to an optimal of $163.60. The cost rise meant a go back to $200.

Nevertheless, since this writing, the worth of cryptocurrency has actually come by 15%. Trading at $140.39, SOL’s cost might run the risk of an additional decrease as a result of factors highlighted in this evaluation.

Solana Favorable Energy Fades

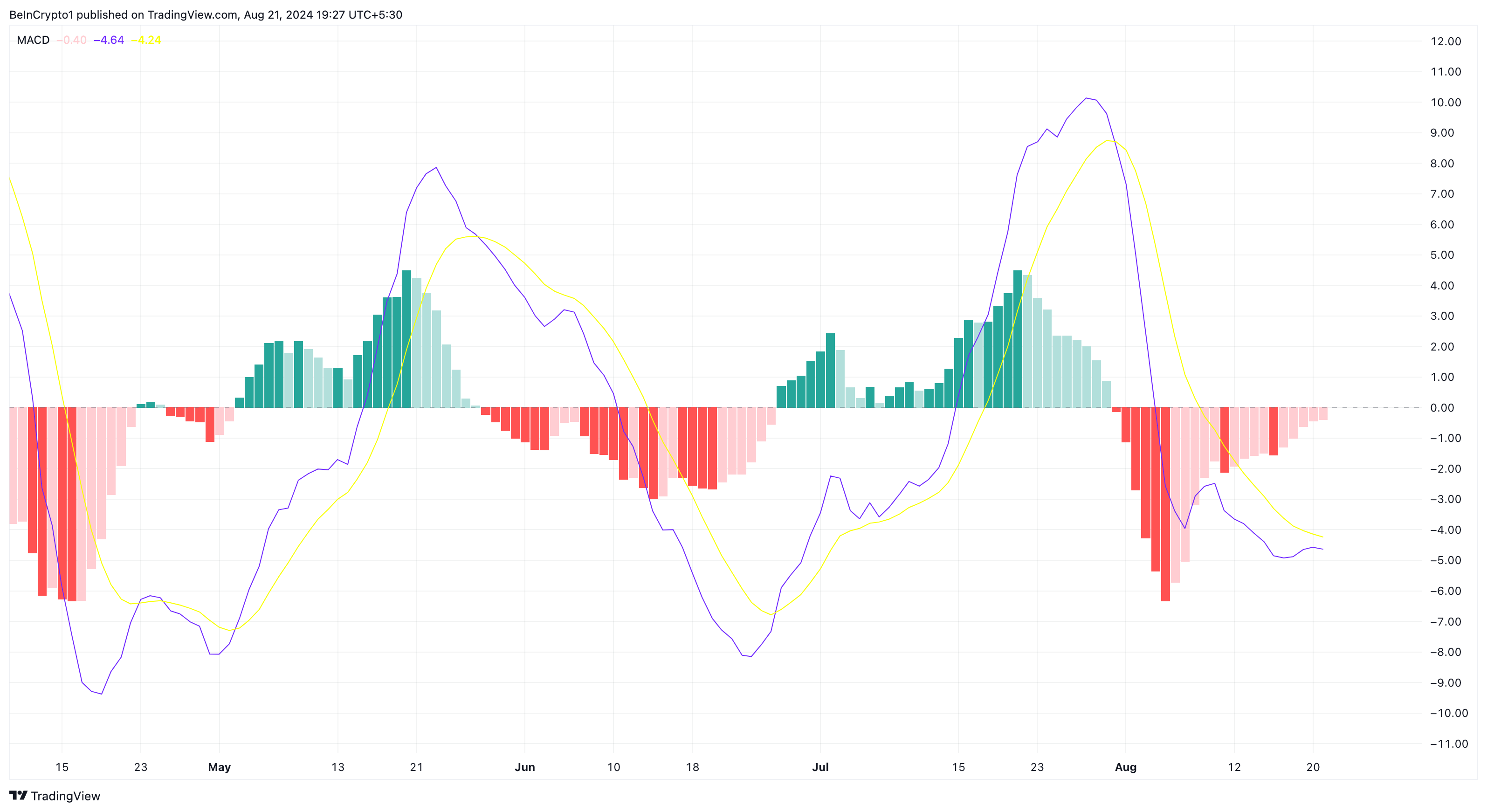

Since this writing, the Relocating typical merging aberration (MACD) is adverse on the SOL/USD everyday graph. The MACD gives solid indicators of pattern turnarounds and determines the energy of a cryptocurrency’s cost.

This sign likewise utilizes the Exponential Relocating Ordinary (EMA) in identifying the pattern. Especially, a favorable analysis of the MACD suggests favorable energy, raising the possibilities of a rate surge

Because it is adverse for Solana’s cost, it implies that energy is bearish, and the current decrease might proceed. Likewise, if the 12 EMA (blue) goes across over the 26 EMA (yellow), the pattern is favorable. In SOL’s instance, the longer EMA has gone across over the much shorter one, recommending that the pattern around the token is bearish

Learn More: What Is Solana (SOL)?

From the graph below, SOL’s cost tried a V-shaped recuperation in between July 31 and August 10. This technological pattern shows up when the cost of a possession drops from an optimal and turns around towards the very same area.

In many cases, raised acquiring stress backed by the pattern sends out the cost greater. Nevertheless, Solana’s cost was denied as quickly as it struck $163.60.

Ever Since, the cryptocurrency has actually battled to rebound. According to the graph, the SOL cost threats shedding vital assistance at $131.06. If bulls protect this degree, the cost can rebound. Nevertheless, if marketing stress boosts, the SOL cost might break down to $121.09.

SOL Cost Forecast: Can the Token Slip Listed Below $130?

A comprehensive evaluation of the everyday graph reveals the Incredible Oscillator (AO) setting in adverse area. The AO contrasts historic cost activities to current ones and utilizes it to determine market energy.

Comparable to the MACD, a favorable analysis of the sign shows raising up energy. An adverse ranking, on the various other hand, suggests or else. At press time, the AO is adverse, showing that SOL’s previous higher energy has actually been tested.

If this remains the very same, the token’s worth could glide even more down. Considering the Fibonacci retracement sign, SOL’s cost threats drawing back to $129.85 if bulls fall short to protect the assistance at $131.06.

Learn More: 13 Ideal Solana (SOL) Budgets To Take Into Consideration in August 2024

Nevertheless, a rebound to $142.09 or $151.98 could come true if the cryptocurrency jumps off the assistance or stands up to going down that reduced.

Please Note

In accordance with the Depend on Job standards, this cost evaluation short article is for educational functions just and need to not be taken into consideration economic or financial investment suggestions. BeInCrypto is dedicated to precise, impartial coverage, yet market problems go through alter without notification. Constantly perform your very own research study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.