Notcoin (NOT), the Telegram-based tap-to-earn task, has actually seen a decrease in whale task as the altcoin’s cost plummets.

Over the previous month, NOT huge owners have actually dispersed greater than they have actually gathered as a result of the altcoin’s double-digit cost decline throughout that duration.

Notcoin Whales Take Off the marketplace

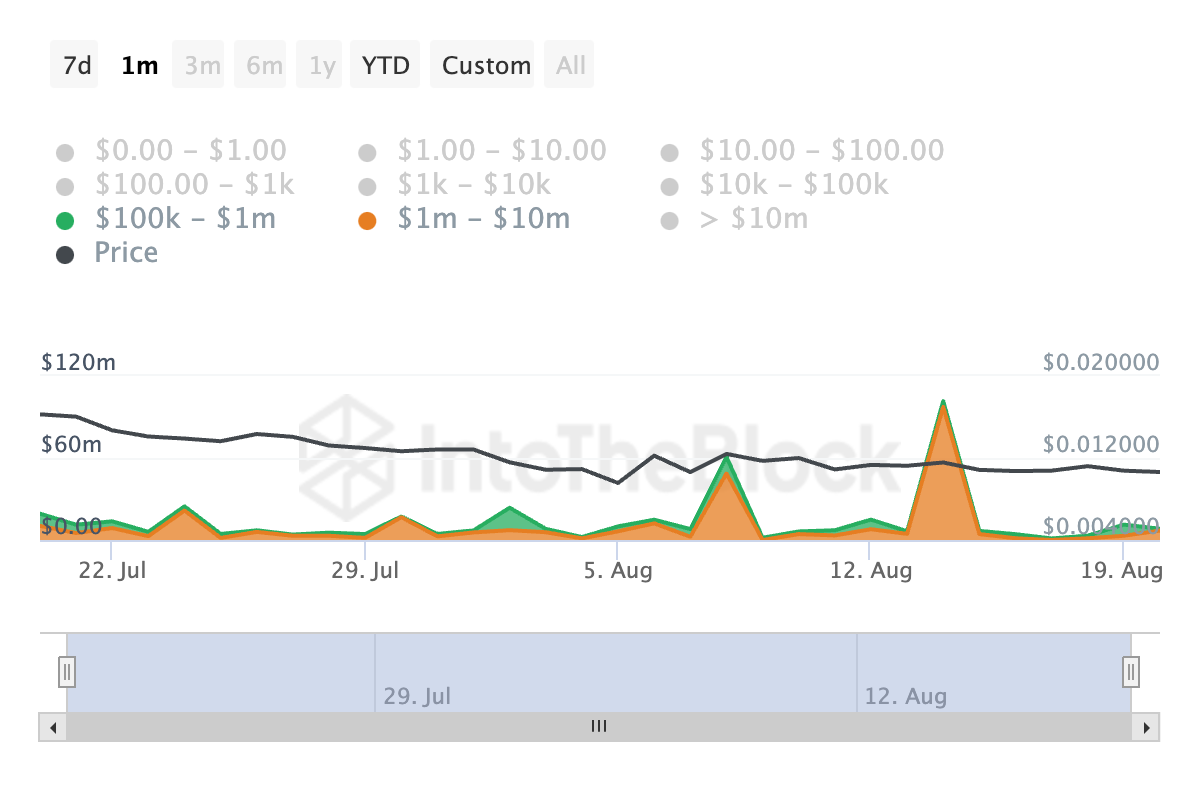

On-chain information suggests a sharp decrease in the day-to-day quantity of huge NOT deals. According to IntoTheBlock, the quantity of NOT deals valued in between $100,000 and $1 million has actually stopped by 74% over the previous month.

On the other hand, deals worth in between $1 million and $10 million have actually seen a 21% decrease in day-to-day quantity throughout the exact same duration.

A decrease in huge deal matters is commonly viewed as a bearish signal, as it adversely influences the general assumption of the possession. When retail capitalists discover whale capitalists minimizing their trading task, self-confidence in the possession has a tendency to compromise. This usually activates enhanced offering stress, resulting in continual cost decreases.

Verifying the rise in whale marketing stress, NOT’s huge owners’ netflow has actually stopped by 98% over the previous thirty days.

Find Out More: Exactly How To Get Notcoin (NOT) and Whatever You Required To Know

Huge owners are purse addresses that hold over 0.1% of a property’s flowing supply. The huge owners’ netflow determines the distinction in between the coins that whales acquire and the quantity they market over a details duration.

When this statistics decreases, it suggests that a property’s whales are offering their holdings. This is a bearish signal, recommending prospective marketing stress and an enhanced danger of a rate decrease.

NOT Cost Forecast: Altcoin Trends Laterally

NOT has actually been trading within a straight network given that August 6, identified by sideways cost motion. This happens when there’s a family member equilibrium in between buildup and circulation, protecting against the possession from trending highly in either instructions.

The technological arrangement reveals that the Loved one Stamina Index (RSI), a vital energy sign, has actually stayed level given that August 8. The RSI determines whether a property is overbought or oversold. NOT’s secure RSI recommends market uncertainty or combination, suggesting the possession is neither overbought neither oversold.

Additionally, NOT’s Typical Real Variety (ATR), which evaluates market volatility, has actually been trending downward given that August 8, strengthening the combination stage. A decreasing ATR suggests minimized market volatility, recommending the possession is much less vulnerable to cost swings. Already, NOT’s ATR is 0.0011.

Otherwise breaks out of its slim array to the advantage, it can rally towards $0.13. On the other hand, if it drops listed below the reduced limit of its straight network, the cost could go down better to $0.008.

Please Note

In accordance with the Depend on Task standards, this cost evaluation post is for informative functions just and ought to not be thought about economic or financial investment guidance. BeInCrypto is dedicated to exact, objective coverage, however market problems undergo alter without notification. Constantly perform your very own research study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.