Cookware and home products merchant Williams-Sonoma (NYSE: WSM) will certainly be revealing revenues outcomes tomorrow prior to market hours. Below’s what financiers need to recognize.

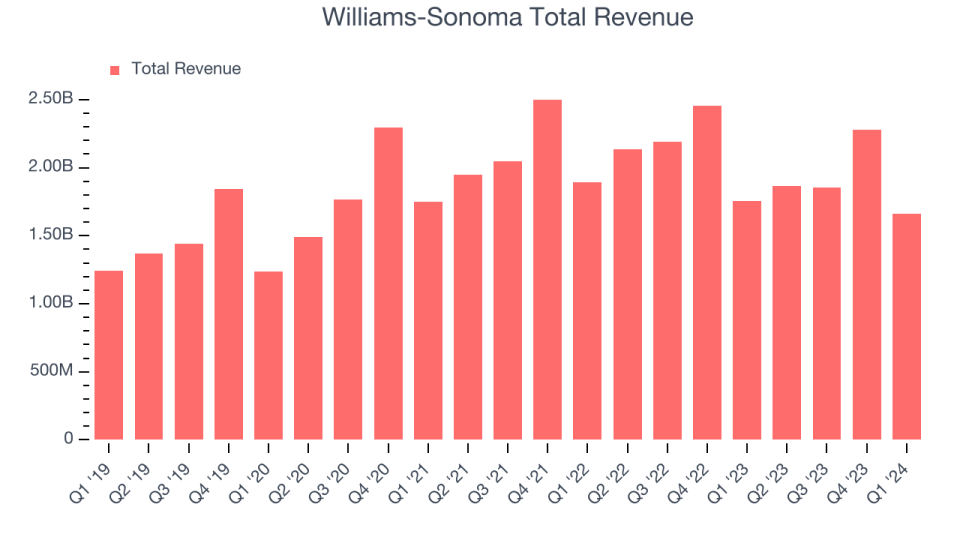

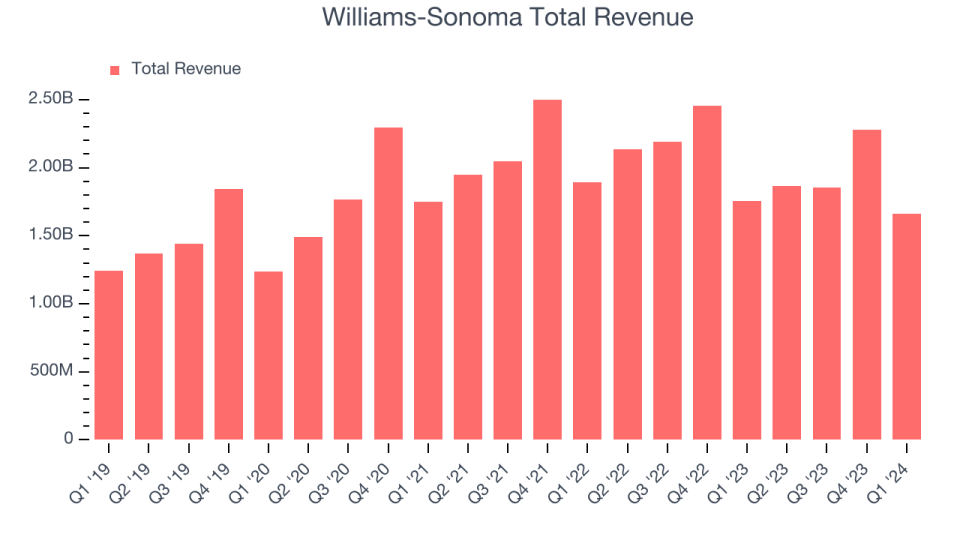

Williams-Sonoma fulfilled experts’ income assumptions last quarter, reporting profits of $1.66 billion, down 5.4% year on year. It was an outstanding quarter for the firm, with an outstanding beat of experts’ revenues quotes.

Is Williams-Sonoma a buy or market entering into revenues? Read our full analysis here, it’s free.

This quarter, experts are anticipating Williams-Sonoma’s income to decrease 2.8% year on year to $1.81 billion, enhancing from the 12.9% reduction it tape-recorded in the very same quarter in 2015. Changed revenues are anticipated ahead in at $1.61 per share.

Most of experts covering the firm have actually reconfirmed their quotes over the last 1 month, recommending they expect business to persevere heading right into revenues. Williams-Sonoma has actually missed out on Wall surface Road’s income approximates 4 times over the last 2 years.

Taking a look at Williams-Sonoma’s peers in the home equipping and enhancement retail sector, some have actually currently reported their Q2 results, providing us a tip regarding what we can anticipate. Rest Number’s profits reduced 11% year on year, missing out on experts’ assumptions by 1.9%, and Arhaus reported level income, disappointing quotes by 1.4%. Rest Number traded up 19.4% adhering to the outcomes while Arhaus was down 8.6%.

Review our complete evaluation of Sleep Number’s results here and Arhaus’s results here.

Capitalists in the home equipping and enhancement retail sector have actually had consistent hands entering into revenues, with share costs level over the last month. Williams-Sonoma is down 11.8% throughout the very same time and is heading right into revenues with a typical expert cost target of $148 (contrasted to the present share cost of $137.6).

When a business has even more money than it recognizes what to do with, redeeming its very own shares can make a great deal of feeling– as long as the cost is right. Fortunately, we have actually located one, a discounted supply that is spurting totally free capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.