A couple of days back, Cardano’s (ADA) rate slid to $0.32, bringing the altcoin’s year-to-date efficiency reduced. Nevertheless, since this writing, an approximate 5% rise has actually assisted ADA review $0.35.

Regardless of the current rate rise, Cardano continues to be in 11th area in regards to market capitalization. This on-chain evaluation clarifies what need to occur for the job to have a shot at restoring its previous setting.

Cardano Requirements This to Jump Tron Off

On August 20, BeInCrypto reported that Cardano had actually befalled of the leading 10 cryptocurrencies as a result of a noteworthy rate rise in Tron (TRX) and increasing need for its indigenous token. ADA, on the various other hand, had not seen such development till the current more comprehensive market uptick.

Market capitalization is identified by rate and flowing supply, so for Cardano to reclaim its setting over Tron, its worth would certainly require to raise. Nevertheless, according to the In/Out of Cash Around Rate (IOMAP) indication, this might not be simple. The IOMAP tracks the ordinary on-chain expense of obtaining symbols contrasted to the present rate.

This device can determine the variety of addresses at break-even, in revenue, or holding muddle-headed. It additionally utilizes this information to find essential assistance and resistance degrees. Basically, the even more addresses gathered around a particular rate array, the more powerful the assistance or resistance at that degree.

As seen over, the variety of addresses that bought ADA in between $0.33 and $0.35 is unqualified the 155,800 addresses that built up 2.24 billion symbols at $0.38. These symbols, which run out the cash, deserve regarding $850 million.

As A Result, for ADA to have a shot at reclaiming the number 10 place, its rate needs to get to $0.38 or damage this resistance. At press time, Cardano’s market cap is $12.90 billion, while Tron’s is $13.84 billion.

If ADA’s rate strikes $0.38, its market capitalization will certainly deserve $14.11 billion, and Tron may be fixed back if the latter’s market value stalls.

Token Overvalued Ahead of Upcoming Upgrade

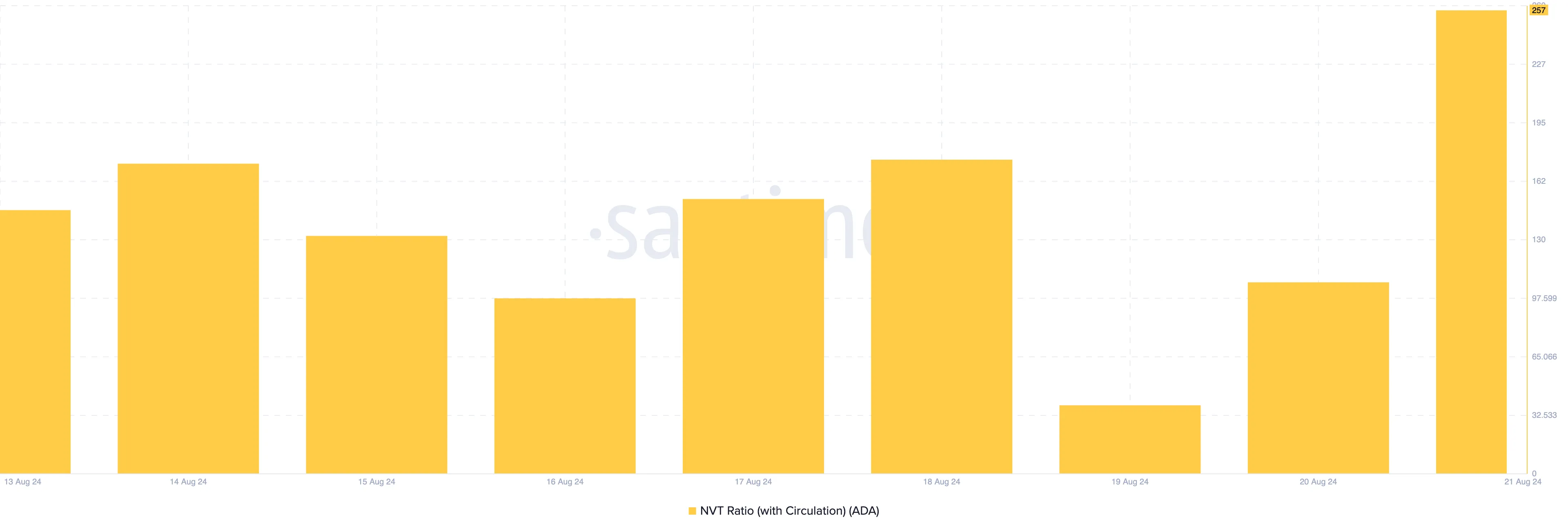

Regardless of the present ADA’s rate, on-chain information exposes that it may be unjustifiably blown up. This is because of the indicators from the Network Worth to Deal (NVT) proportion, which reveals whether a cryptocurrency’s market cap is outmatching the purchase quantity.

When the NVT proportion is high, it indicates that the marketplace cap outweighs purchase development. If this holds true, the token is called miscalculated, as the rate remains in an unsustainable bubble.

Alternatively, a reduced NVT proportion indicates purchases on the network are expanding at a quicker price than the marketplace cap. When this takes place, it suggests need for the token shows up and underestimated. For Cardano, it is the previous, as the photo listed below programs a noteworthy spike in the NVT proportion.

Learn More: Exactly How To Bet Cardano (ADA)

This strengthens the concept that ADA is miscalculated about the present market problem. If this proportion continues to be very high, maybe testing for the rate to get to $0.38 in the short-term.

Nevertheless, DiscoverCrypto, a YouTube Network committed to examining a number of altcoins, suggested that the Chang tough fork might drive a noteworthy rally for ADA. The upgrade, which is focused on progressing decentralization on the Cardano blockchain, is anticipated to happen prior to completion of August.

” All-time low is virtually, and I assume we will have an additional height for 2024 and 2025,” the network host said.

ADA Rate Forecast: a Transfer to $0.36 Likely

From a technological perspective, ADA still trades within an in proportion triangular. This pattern links a collection of low and high and is defined by 2 assembling trendlines. While it is neither favorable neither bearish, the rate’s following activity relies on various other indications.

For example, the Advancing Quantity Delta (CVD), which determines trading stress in the place market, declares. This favorable worth suggests that market individuals are acquiring even more ADA than the quantity offered. Presuming the CVD is unfavorable, it would certainly have shown greater marketing than acquiring

If continual, ADA’s rate might quickly get to $0.36. This overview is additionally sustained by the Relocating Ordinary Merging Aberration (MACD) indication, which tracks energy. Presently, the MACD analysis declares, showing that ADA is experiencing favorable energy.

Learn More: Cardano (ADA) Rate Forecast 2024/2025/2030

In an extremely favorable situation, the rate can get to $0.39, potentially taking Cardano back to the 10th market cap place. Nevertheless, denial at $0.36 might drive the rate back to $0.33.

Please Note

In accordance with the Depend on Job standards, this rate evaluation post is for educational objectives just and need to not be taken into consideration economic or financial investment recommendations. BeInCrypto is dedicated to exact, honest coverage, yet market problems go through transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.