Need for Bitcoin (BTC) cost to develop a brand-new all-time high has actually been maintaining financiers’ hopes to life.

Nevertheless, the real need for BTC is revealing an enormous decrease. Nevertheless, there is one friend of financiers that might avoid a drawdown in cost.

Bitcoin Need Decreases

Considering that the start of August, Bitcoin’s cost has actually had a hard time to increase over $60,000. This is postponing the recuperation of financiers’ losses from the July accident.

While the crypto possession’s motion specifies the framework of a widening rising wedge, the outbreak from this pattern takes a great deal of time. The factor behind this is the decrease popular for BTC amongst financiers.

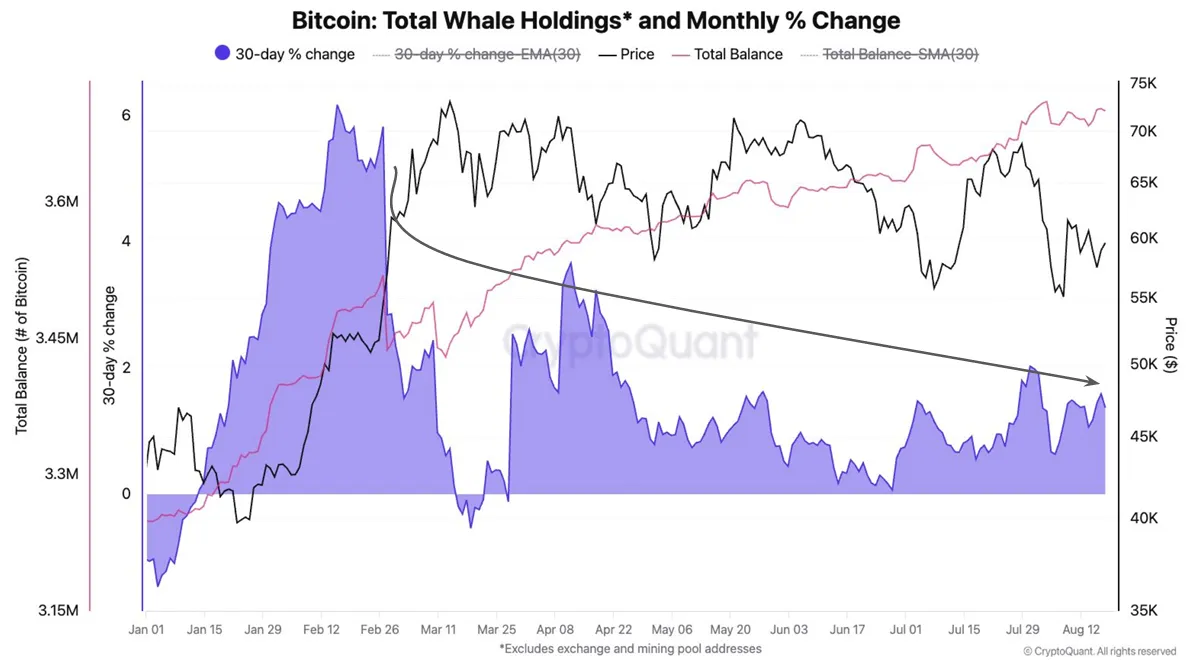

A special record from CryptoQuant shown BeInCrypto reveals that big BTC owners’ holdings have actually decreased substantially. As kept in mind in the record, the 30-day percent adjustment in whale holdings has actually reduced from 6% in February to simply 1% presently.

Find Out More: What Occurred at the Last Bitcoin Halving? Forecasts for 2024

Typically, a 3% surge in the holdings of addresses with 1,000 to 10,000 BTC in their budgets is a favorable indicator. This is a signal of Bitcoin’s cost boost, which does not appear to be the situation currently.

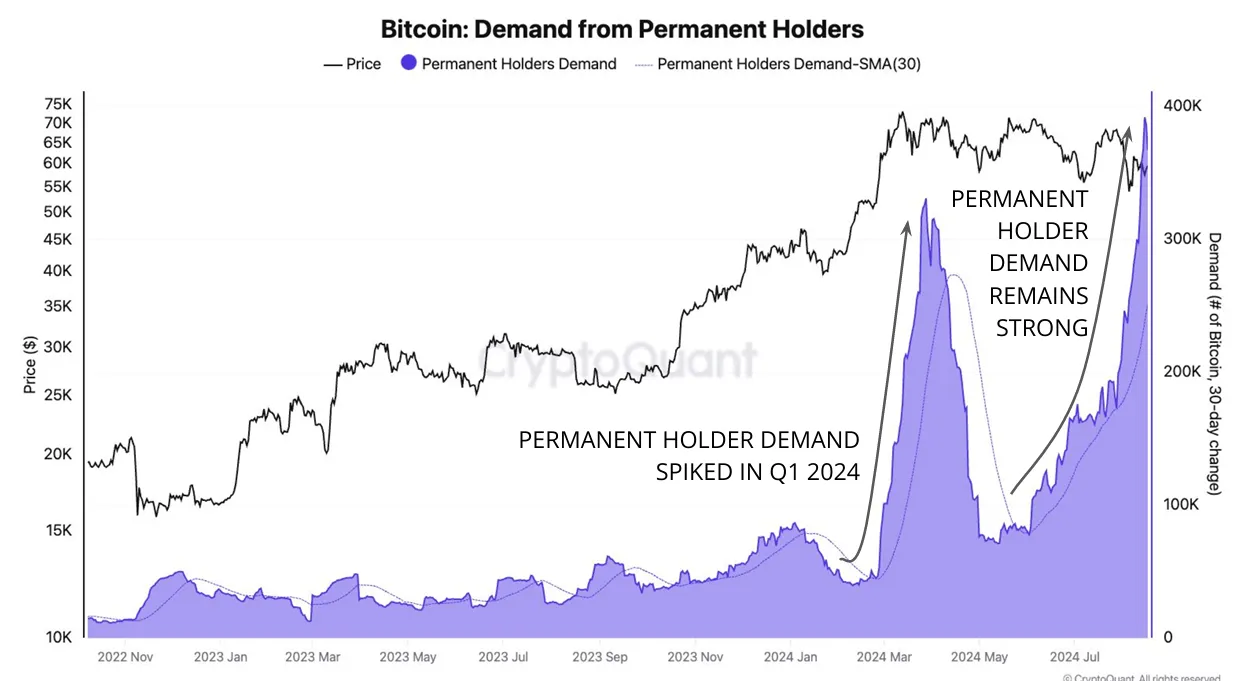

However, Bitcoin’s absence of continual cost development has actually not affected its most devoted owners. The long-term owners, i.e., those that just collect BTC and have actually never ever invested or marketed their holdings, are still purchasing.

The overall equilibrium of these long-term owners is climbing constantly each month at a price of 391,000 BTC. Remarkably, this surge in build-up followed the cost decrease started in the direction of completion of May.

Hence, these combined signs might maintain Bitcoin’s cost from dropping reduced yet may likewise postpone an increase.

BTC Rate Forecast: Time Under $65,000

Bitcoin’s cost, at $59,280 at the time of composing, will likely proceed its combination under $60,000. The recurring pattern given that very early March reveals BTC often tends to relocate sidewards in a set variety prior to substantially rallying or dropping.

If BTC locates favorable signs controling bearish signs, it might skyrocket to $65,000, yet breaching this degree might take a while. Hence, prior to completion of Q3, observing a break out of the pattern and a rally to $80,000 both appear somewhat not likely.

Find Out More: Bitcoin Halving Background: Every Little Thing You Required To Know

Nevertheless, if Bitcoin’s cost does handle to breach $65,000, it might burst out over $71,500. This would certainly make it possible for an increase for BTC, possibly rallying past the all-time high of $73,800, revoking the bearish-neutral thesis.

Please Note

In accordance with the Count on Job standards, this cost evaluation write-up is for educational functions just and ought to not be taken into consideration monetary or financial investment suggestions. BeInCrypto is dedicated to exact, objective coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.